Underwritten by: Hong Kong Life Insurance Limited

Appointed Licensed Insurance Agency: OCBC Bank (Hong Kong) Limited

Prosperous Fortune to Realize Your Dreams

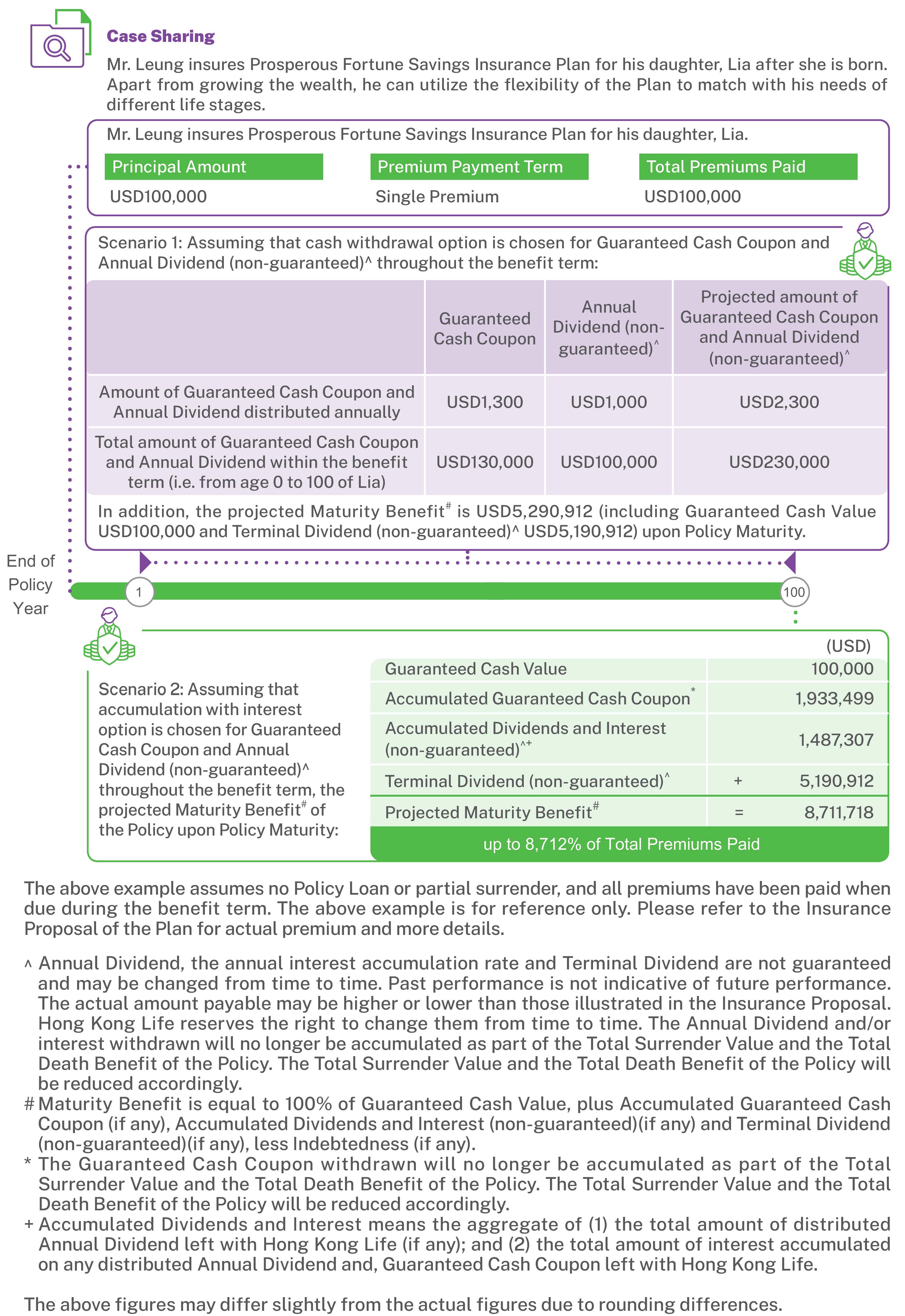

You are a visionary individual who embraces range of dreams at different life stages. Whether it is about owning a home with comfortable living, nurturing your children to achieve greatness, travelling the world or enjoying a fruitful retirement, realizing your dreams requires proactive actions. Achieving your dreams begins with taking the first step. Prosperous Fortune Savings Insurance Plan (the "Plan") offers you with a simple financial solution. By making a lump-sum premium payment, the Guaranteed Cash Coupon will be payable annually until the Policy Maturity starting from the end of 1st Policy Year, which helps you attain your long term wealth goal with ease and success.

Single Premium Simple Management

Simply pay a lump sum of premium and you can start your financial planning with life protection until age 100 of the Life Insured. The Plan starts with a relatively high Guaranteed Cash Value and helps to achieve potentially higher returns in long run.

Guaranteed Cash Coupon until Policy Maturity

Starting from the end of 1st Policy Year, Guaranteed Cash Coupon which is equal to 1.3% of the Principal Amount1 will be payable every year until the Policy Maturity. You can choose cash withdrawal or leaving it with the Policy for interest accumulation2,3.

Double Dividends Additional Return

The Plan not only provides Guaranteed Cash Value, Annual Dividend (non-guaranteed)4 may also be distributed annually in terms of cash starting from the end of 1st Policy Year. You can choose cash withdrawal or leaving it with the Policy for interest accumulation4 to meet your personal needs.

In addition, Terminal Dividend (non-guaranteed)4 may be payable at or after the end of 5th Policy Year when the Policy is fully surrendered by the Policyowner, upon the death of the Life Insured or upon Policy Maturity, whichever is earlier.

When the Policy is partially surrendered by the Policyowner, Terminal Dividend (non-guaranteed)4 may be payable at or after the end of 5th Policy Year. The payable amount is equal to the Terminal Dividend (non-guaranteed)4 attributable to the reduced portion of Principal Amount. Terminal Dividend (non-guaranteed)4 will not accumulate in the Policy.

Flexible Wealth Management to Plan for the Future

The Policyowner may make a one-off or regular withdrawal from the cash value of the Policy (including the Guaranteed Cash Value (if any), Accumulated Guaranteed Cash Coupon (if any)3, Accumulated Dividends and Interest (non-guaranteed)4,5(if any) and Terminal Dividend (non-guaranteed)4(if any)) according to his/ her needs in order to fulfill the dreams like children's education and fruitful retirement, etc. However, the future cash value of the Policy will be reduced accordingly.

After the Policy has acquired a Guaranteed Cash Value, the Policyowner can opt for Partial Surrender6 to withdraw the Guaranteed Cash Value and Terminal Dividend (non-guaranteed)4(if any) attributable to the reduced portion of Principal Amount of the Policy.

Life Protection for Peace of Mind

If the Life Insured dies while the Plan is in force, the Total Death Benefit which is equal to 101% of Net Premiums Paid7 or 100% of Guaranteed Cash Value as at the date of death of the Life Insured (whichever is greater), plus Accumulated Guaranteed Cash Coupon3 (if any),Accumulated Dividends and Interest (non-guaranteed)4,5 (if any) and Terminal Dividend (non-guaranteed)4(if any), less Indebtedness (if any) will be paid to the Policy Beneficiary.

In case of Partial Surrender, the Principal Amount shall be reduced proportionally based on the percentage of Guaranteed Cash Value and Terminal Dividend (non-guaranteed)4(if any) being withdrawn for the Partial Surrender. Upon the reduction of Principal Amount, the Guaranteed Cash Value, Guaranteed Cash Coupon (if any), Annual Dividend (non-guaranteed)4(if any), Terminal Dividend (non-guaranteed)4(if any), Total Premiums Paid and Net Premium Paid7 of the Plan shall be reduced proportionately. Total Death Benefit shall also be adjusted accordingly.

Simple Application

Application procedure is simple and no medical examination is required.

| Premium Payment Term | 2 Years |

|---|---|

| Issue Age* | Age 0 (15 days after birth) to 75 |

| Policy Currency | HKD / USD |

| Benefit Term | Until age 100 of the Life Insured |

| Minimum Principal Amount1 |

HKD500,000 or USD62,500 |

| Maximum Principal Amount1 |

HKD10,000,000 or USD1,250,000 (Per Life Insured per Plan) |

* Age means age of the Life Insured at the last birthday

- Principal Amount is used to calculate Initial Premium, any subsequent premium, benefits and policy values (if any) of the respective Basic Plan and any Supplementary Benefit. Any subsequent change of the Principal Amount will result in corresponding change in premium, benefits and policy values (if any) of the respective Basic Plan and any Supplementary Benefit. The Principal Amount does not represent the amount of death benefit of the respective Basic Plan and any Supplementary Benefit.

- The annual interest accumulation rate is not guaranteed and may be changed from time to time. Past performance is not indicative of future performance. The actual amount payable may be higher or lower than those illustrated in the Insurance Proposal. Hong Kong Life reserves the right to change it from time to time.

- The Guaranteed Cash Coupon withdrawn will no longer be accumulated as part of the Total Surrender Value and the Total Death Benefit of the Policy. The Total Surrender Value and the Total Death Benefit of the Policy will be reduced accordingly.

- Annual Dividend, the annual interest accumulation rate and Terminal Dividend are not guaranteed and may be changed from time to time. Past performance is not indicative of future performance. The actual amount payable may be higher or lower than those illustrated in the Insurance Proposal. Hong Kong Life reserves the right to change them from time to time. The Annual Dividend and/or interest withdrawn will no longer be accumulated as part of the Total Surrender Value and the Total Death Benefit of the Policy. The Total Surrender Value and the Total Death Benefit of the Policy will be reduced accordingly.

- Accumulated Dividends and Interest means the aggregate of (1) the total amount of distributed Annual Dividend left with Hong Kong Life (if any); and (2) the total amount of interest accumulated on any distributed Annual Dividend and Guaranteed Cash Coupon left with Hong Kong Life.

- If Partial Surrender is exercised in the Policy, the Principal Amount shall be reduced proportionally based on the percentage of Guaranteed Cash Value and Terminal Dividend (if any) being withdrawn for the Partial Surrender. Upon the reduction of Principal Amount, the Guaranteed Cash Value, Guaranteed Cash Coupon (if any), Annual Dividend (if any), Terminal Dividend (if any), Total Premiums Paid and Net Premiums Paid of the Plan shall be reduced proportionately. Total Death Benefit and Maturity Benefit shall also be adjusted accordingly. Partial Surrender is subject to the terms and conditions, and the then administrative rules as determined by Hong Kong Life from time to time. For detailed terms and conditions, please refer to the policy document issued by Hong Kong Life.

- Net Premiums Paid means the Total Premiums Paid less the aggregate amount of Guaranteed Cash Coupon distributed by Hong Kong Life from the Policy Date up to the date of termination of the Plan. In case of Partial Surrender, the Net Premiums Paid shall be adjusted and reduced proportionally as specified in the Partial Surrender provisions. Total Premiums Paid means the total amount of due and payable premiums from the Policy Date up to the date of termination of the Plan, paid to the Plan and received by Hong Kong Life. Any payment in excess of such amount of due and payable premiums will not be included in the Total Premiums Paid. In case of Partial Surrender, the Total Premiums Paid under the Policy shall be adjusted and reduced proportionally as specified in the Partial Surrender provisions.

-

Basic Plan

Risk

Exchange Rate Risk

You are subject to exchange rate risks for the Policy denominated in currencies other than the local currency. Exchange rates fluctuate from time to time. You may suffer a loss of your benefit values and the subsequent premium payments (if any) may be higher than your initial premium payment as a result of exchange rate fluctuations.

Liquidity Risk / Long Term Commitment

The Plan is designed to be held until the Maturity / Expiry Date. If you partially surrender or terminate the Policy prior to the Maturity / Expiry Date, a loss of the premium paid may be resulted.

The premium of the Plan should be paid in full for the whole payment term. If you discontinue the payment, the Policy may lapse and a loss of the premium paid may be resulted.

Credit Risk of Issuer

The life insurance product is issued and underwritten by Hong Kong Life. The premium to be paid by you would become part of the assets of Hong Kong Life and that you and your Policy are subject to the credit risk of Hong Kong Life. In the worst case, you may lose all the premium paid and benefit amount.

Market Risk

The amount of dividends (if any) of the Plan depends principally on the factors including investment returns, claim payments, policy persistency rates, operation expenses and tax; while the annual interest accumulation rate principally depends on the factors including investment performance and market conditions. Hence the amount of dividends (if any) and annual interest accumulation rate are not guaranteed and may be changed over time. The actual dividends payable and annual interest accumulation rate may be higher or lower than the expected amount and value at the time when the Policy was issued.

Inflation Risk

When reviewing the values shown in the Insurance Proposal, please note that the cost of living in the future is likely to be higher than it is today due to inflation.

Important Policy Provisions

Suicide

If the Life Insured commits suicide, while sane or insane, within one (1) year from the Issue Date or the date of any reinstatement, whichever is later, the liability of Hong Kong Life shall be limited to a refund of paid premiums to the Beneficiary without interest less any existing Indebtedness. In the case of reinstatement, such refund of premium shall be calculated from the date of reinstatement.

Incontestability

The validity of the Policy shall not be contestable except for (i) the non-payment of premiums, (ii) fraud or (iii) misstatement of age and/or sex as specified in the Misstatement of Age and/or Sex provisions, after it has been in force during the lifetime of the Life Insured for two (2) years from the Issue Date or the date of any reinstatement, whichever is later. Premiums paid will not be refunded should the Policy be voided by Hong Kong Life.

Automatic Termination

The Plan shall terminate automatically:

- upon the death of the Life Insured; or

- if and when the Plan matures or is fully surrendered; or

- if and when the Indebtedness of this Policy equals to or exceeds the Guaranteed Cash Value.

Others

Insurance Costs

The Plan is an insurance plan with a savings element. Part of the premium pays for the insurance and related costs (if any).

Cooling-off Period

If you are not satisfied with your Policy, you have a right to cancel it within the cooling-off period and obtain a refund of any premium(s) and levy(ies) paid (in the original payment currency) to Hong Kong Life without any interest. A written notice signed by you should be received directly by Hong Kong Life Insurance Limited at 15/F Cosco Tower, 183 Queen's Road Central, Hong Kong within the cooling-off period (that is, the period of 21 calendar days immediately following either the day of delivery of the Policy or the Cooling-off Notice to you or your nominated representative (whichever is the earlier)). After the expiration of the cooling-off period, if you cancel the Policy before the end of the term, the projected Total Surrender Value (if applicable) may be less than the Total Premiums Paid.

Dividends

Hong Kong Life determines the amount of divisible surplus that will be distributed in the form of dividends. Dividends will be determined and distributed according to the Policy's terms and conditions and in compliance with the relevant legislative and regulatory requirements as well as relevant actuarial standards, whereas Terminal Dividend is available for certain types of policies and payable at the termination of the policies.

The amount of divisible surplus depends principally on the factors including investment returns, claim payments, policy persistency rates, operation expenses and tax. Hence the amount of dividends is not guaranteed and may be changed over time. The actual dividends payable may be higher or lower than the expected amount at the time when the policies were issued. The withdrawal of dividends will decrease the Total Surrender Value and Total Death Benefit of the Policy.

Withdrawal of Cash Payments

The withdrawal of cash payments (including but not limited to guaranteed cash coupon (if any) and monthly incomes (if any) etc.) will decrease the Total Surrender Value and Total Death Benefit of the Policy.

Partial Surrender

In case of Partial Surrender, the Guaranteed Cash Value and Terminal Dividend of the Policy will be decreased accordingly. This will also decrease the Principal Amount, Total Surrender Value, Total Death Benefit, Guaranteed Cash Coupon, Annual Dividend and other benefits (if applicable) of the Policy.

Policy Loan

After the Plan has acquired a Guaranteed Cash Value and while the Policy is in force, the Policyowner may, upon the sole security and satisfactory assignment of the Policy to Hong Kong Life, apply for a Policy Loan from the Plan. Any loan on the Policy shall bear interest at a rate declared by Hong Kong Life from time to time. Interest on the loan shall accrue and compound daily from the date of loan. The Policy Loan Interest Rate is not guaranteed and will be changed from time to time. The loan and the interest accrued thereon shall constitute Indebtedness against the Policy. Interest shall be due on each Policy Anniversary subsequent to the date of loan. In the event that the Indebtedness of the Policy equals to or exceeds the Guaranteed Cash Value, the Policy will terminate. Any Policy Loan and accrued loan interest may reduce the Total Surrender Value and Total Death Benefit of the Policy.

Non-Protected Deposit

The Plan is not equivalent to, nor should it be treated as a substitute for, time deposit. The Plan is not a protected deposit and is not protected by the Deposit Protection Scheme in Hong Kong.

Dispute on Selling Process and Product

Chong Hing Bank Limited, CMB Wing Lung Bank Limited, OCBC Bank (Hong Kong) Limited and Shanghai Commercial Bank Limited (collectively "Appointed Licensed Insurance Agencies" and each individually "Appointed Licensed Insurance Agency") are the Appointed Licensed Insurance Agency of Hong Kong Life, and the life insurance product is a product of Hong Kong Life but not the Appointed Licensed Insurance Agencies. In respect of an eligible dispute (as defined in the Terms of Reference for the Financial Dispute Resolution Centre in relation to the Financial Dispute Resolution Scheme) arising between the Appointed Licensed Insurance Agency and the customer out of the selling process or processing of the related transaction, Appointed Licensed Insurance Agency is required to enter into a Financial Dispute Resolution Scheme process with the customer; however any dispute over the contractual terms of the life insurance product should be resolved between Hong Kong Life and the customer directly.

The above information is for reference and is applicable within Hong Kong only. Unless otherwise specified, the defined terms used in the above information should have the same meanings as given to them in the policy document. The information of the above information does not contain the full terms of the policy document. For full terms and conditions, please refer to the policy document. If there is any conflict between the above information and the policy document, the latter shall prevail. The copy of the policy document is available upon request. Before applying for the insurance plan, you may refer to the contents and terms of the policy document. You may also seek independent and professional advice before making any decision.