Hong Kong Life | Retirement Planning

Do you have enough savings to achieve

a quality retirement?

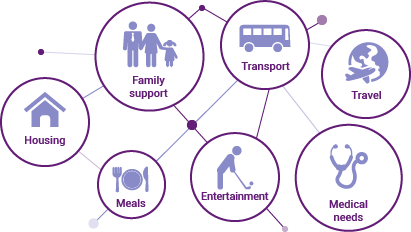

Travel around the world

Savor every moment of life

Build a harmonious family

Enjoy life’s pleasures

Life expectancy is rising, and the population is aging.

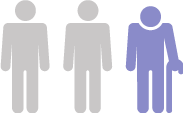

Male Age

around 86

Female Age

around 92

In 2046,

1 in every 3 people

Source: 1. Data.Gov.HK -Hong Kong Population - Hong Kong Population Projections (2021- 2046)

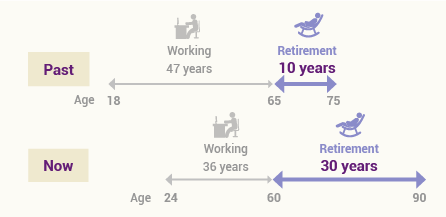

As life expectancy extends,

so does your retirement.

Start planning today to enjoy a fruitful retirement.

Start calculating your retirement expenses now

My current age :

My target

retirement age:

retirement age:

My target years of

retirement :

retirement :

Smart wealth management solutions

can bring steady growth to your wealth.

can bring steady growth to your wealth.

Hong Kong Life | Retirement Planning

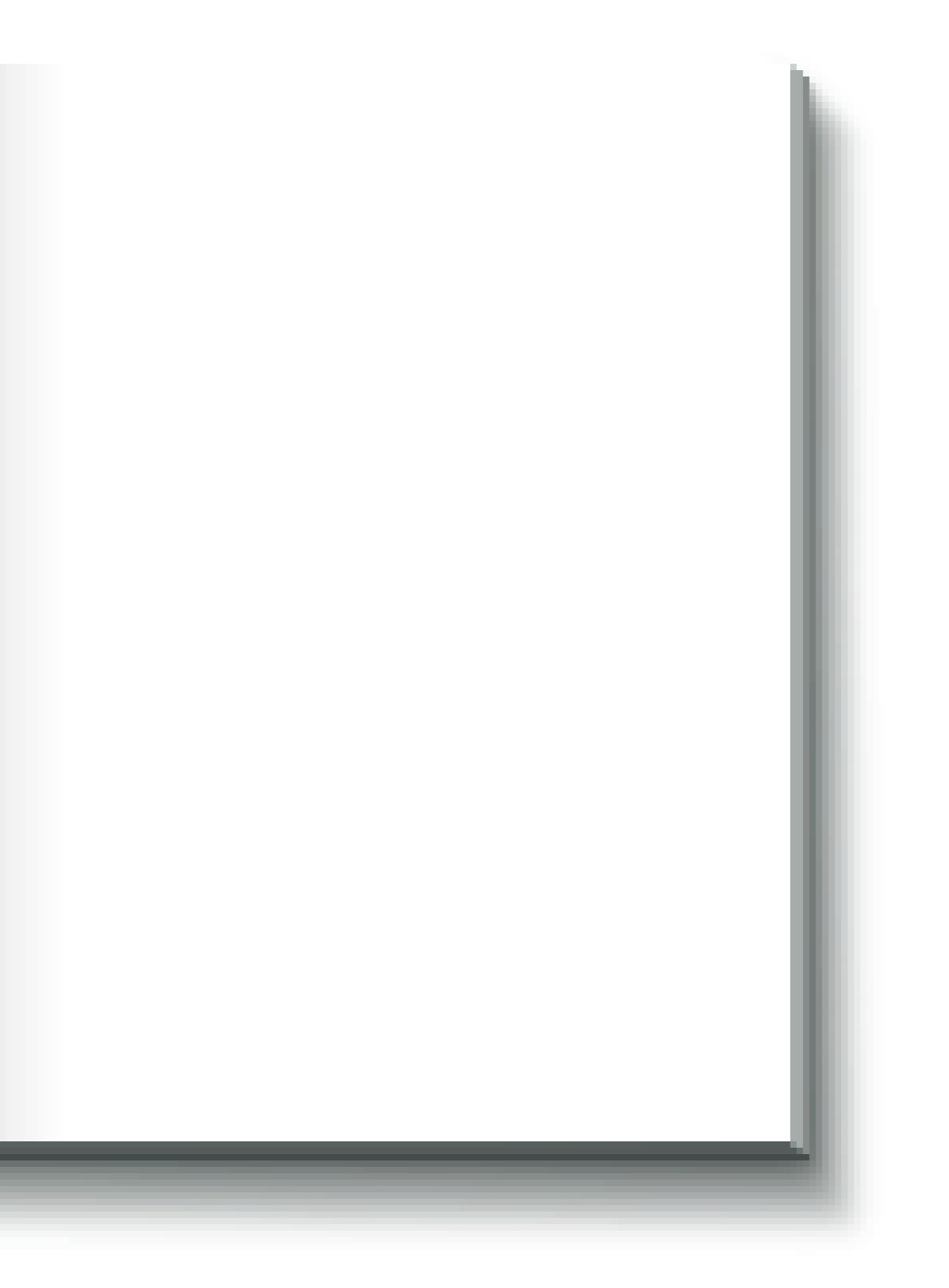

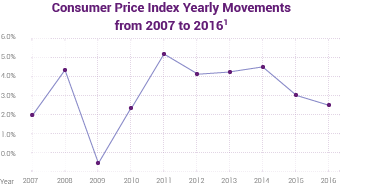

Price indices are soaring under inflation -

can your savings catch up?

Average

inflation rate

2.7%2

inflation rate

2.7%2

You need a comprehensive savings plan

to overtake inflation and achieve

a promising retirement.

to overtake inflation and achieve

a promising retirement.

Sources: 2. Data.Gov.HK -Consumer Price Index and Its Movements; 3. Data.Gov.HK -Consumer Price Index - Table E501 : Consumer Price Indices (October 2019 – September 2020 = 100) at Commodity/Service Section and Group level

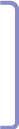

Are bank savings and government retirement policies

sufficient to give you a secure retirement?

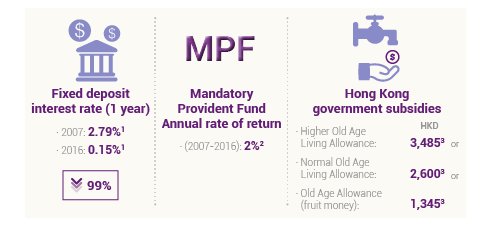

Start saving early - the effect of

compound interest allows you to achieve the

same goal with less capital.

compound interest allows you to achieve the

same goal with less capital.

Source: 4. Data.Gov.HK -Monthly Statistical Bulletin - Exchange rates and interest rates - Hong Kong dollar interest rates - Rates as at effective dates; 5. The major newspapers in Hong Kong;

6. Data.Gov.HK -Asset and income limits for Old Age Living Allowance, Level of Allowance and Supplement of the Social Security Allowance Scheme

Start calculating your retirement expenses now

Monthly MPF or Provident Fund contributions by me and my employer:

HKD

Current accumulated amount of my MPF or Provident Fund:

HKD

Average rate of return on MPF or Provident Fund per annum:

Average savings or investment return rate per annum before retirement:

Average savings or investment return rate per annum after retirement:

Expected average inflation rate per annum:

The total retirement

funds required

funds required

HKD

Your retirement gap

HKD

Statistics show that the MPF recorded an annualized rate of return of 3% from December 2000 to December 2024.

Annualized rates of return for other fund types from December 2000 to December 2023 are as follows:

Equity Fund:

4.3%

Mixed Asset Fund:

4.0%

Bond Fund:

1.9%

Guaranteed Fund:

1.2%

MPF Conservative Fund:

0.9%

Money Market Fund:

0.8%

Source: 7.MPFA releases the December 2024 Issue of the Mandatory Provident Fund Schemes Statistical

Hong Kong Life | Retirement Planning

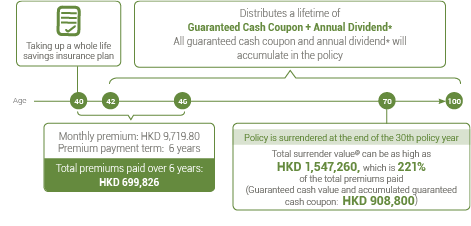

Case 1

Middle-aged Professional

Mr. Lee is the financial backbone of his family, always striving to provide the best quality of life for his loved ones. Early on, he set aside a substantial education fund for his two children. Now, he is also preparing for his own retirement.

Considering the basic living expenses he and his wife will face, along with inflation, Mr. Lee has done some preliminary calculations and anticipates needing an additional HKD 1.95 million by the age of 70 to support his retirement.

Considering the basic living expenses he and his wife will face, along with inflation, Mr. Lee has done some preliminary calculations and anticipates needing an additional HKD 1.95 million by the age of 70 to support his retirement.

Mr Lee’s whole life savings insurance plan helps him fill his HKD 1.5 million retirement savings gap.

Case 2

Retirees-to-be

Mr Wong has worked for years in the hopes of enjoying the fruits of his success once he retires. He expects

to leave HKD 2 million in assets to his daughter, who just landed her first job, as down-payment for her future

property. On top of his remaining assets, which will serve as his retirement savings, he will receive roughly

HKD 20,000 per month in rental income. Together, these should cover expenses for the couple to enjoy an

enriched retirement. However, rental income is not guaranteed, since it can be affected by the economic

environment; coupled with factors such as inflation, Mr. Wong is anxious that his retirement funds may be

insufficient. Therefore, he hopes to enhance his wealth through a steady savings plan. After consulting with

professionals for a financial needs analysis, he decides to take up a whole life annuity plan, which will give

him financial security through a monthly income of at least HKD 10,000 throughout his retirement years.

Mr Wong chooses the single premium option. The plan gives him financial

security through a steady stream of additional income, helping him achieve his retirement plans.

Hong Kong Life | Retirement Planning

Plan ahead

Start building your dream retirement today

Start building your dream retirement today

If you long for a secure retirement, you should start your savings plan early. Let our professional team conduct a financial needs analysis for you, and recommend the best retirement solution.

2290-2882

HongKongLifeCS@hklife.com.hk

Disclaimer