Underwritten by: Hong Kong Life Insurance Limited

Appointed Licensed Insurance Agency: Chong Hing Bank Limited, CMB Wing Lung Bank Limited and OCBC Bank (Hong Kong) Limited

Your Prime Guardian for Health

The below information does not contain the full terms of the policy document. For full terms and conditions, please refer to the policy document.

Good health is the most important asset in our life. As a successful and prosperous individual, you would well prepare for the uncertainty and protect the invaluable asset for you and your family. Hong Kong Life understands the needs of quality medical protection for privileged customers and cordially introduces Vantage Medical Plan (the "Plan"). With lifetime medical protection and full cover for major medical expenses1, you are assured of a comprehensive support to face any challenge and enjoy your life!

Comprehensive Lifetime Medical Protection

The Plan offers comprehensive lifetime medical protection until age 100 of the Life Insured. Full reimbursement1 will be provided for major medical items including Hospital Room and Board Benefit, Physician's Visit, Specialist's Fee, Miscellaneous Hospital Expenses Benefit, Intensive Care Benefit and Surgery Benefit, etc. The Plan offers an Overall Lifetime Limit of up to HKD50,000,000/ USD6,250,000, and a Policy Year Limit of up to HKD20,000,000/ USD2,500,000.

Guaranteed Renewal for Peace of Mind

Regardless of the Life Insured's health conditions or claim records, you are guaranteed to renew2 the Plan every year up to age 100 of the Life Insured, allowing you to enjoy total peace of mind.

Flexible Plan Options to Fit Your Personal Budget

The Plan provides 3 choices of Geographical Area of Cover including worldwide, worldwide excluding United States, and Asia. Also, it offers 3 options of Policy Year Deductible3 which are HKD0/ USD0, HKD40,000/ USD5,000, and HKD80,000/ USD10,000. You can flexibly choose the best plan option to fit your personal needs.

In addition, to better gear up the medical protection for your retirement, the Policyowner can exercise his/her right once during the lifetime of the Life Insured to reduce the existing Policy Year Deductible3 (if any) without evidence of insurability at the relevant Policy Anniversary of the Life Insured's 45th, 50th, 55th, 60th or 65th birthday4.

Health Check-up Allowance for Prevention of Serious Illness

The Life Insured can enjoy one Health Check-up Allowance5 up to HKD3,000/ USD375 every two consecutive Policy Years while the Policy Year Deductible3 (if any) is not applicable to this coverage item. This helps you closely monitor your health condition.

Various Cash Benefits for Different Medical Needs

The Plan offers various cash benefits to cater to different medical needs while the Policy Year Deductible3 (if any) is not applicable to these coverage items6:

- If the Life Insured is Confined in a general ward of a government Hospital, or in a Hospital without charge, Daily Government Hospital Cash Benefit will be paid.

- If the Life Insured is Confined in a room of class lower than the covered room class under the Plan of a private Hospital in Hong Kong, Daily Lower Room Class Cash Benefit will be paid.

- If the Life Insured adopts designated Day Case Surgery, Day Case Surgery Cash Benefit7 will be paid.

Female Extended Benefits for Attentive Care

The Plan provides Pregnancy Complications Benefit8 and Hormone Replacement Therapy for Menopause Benefit9 for female Life Insured, allowing you to enjoy attentive protection at different life stages.

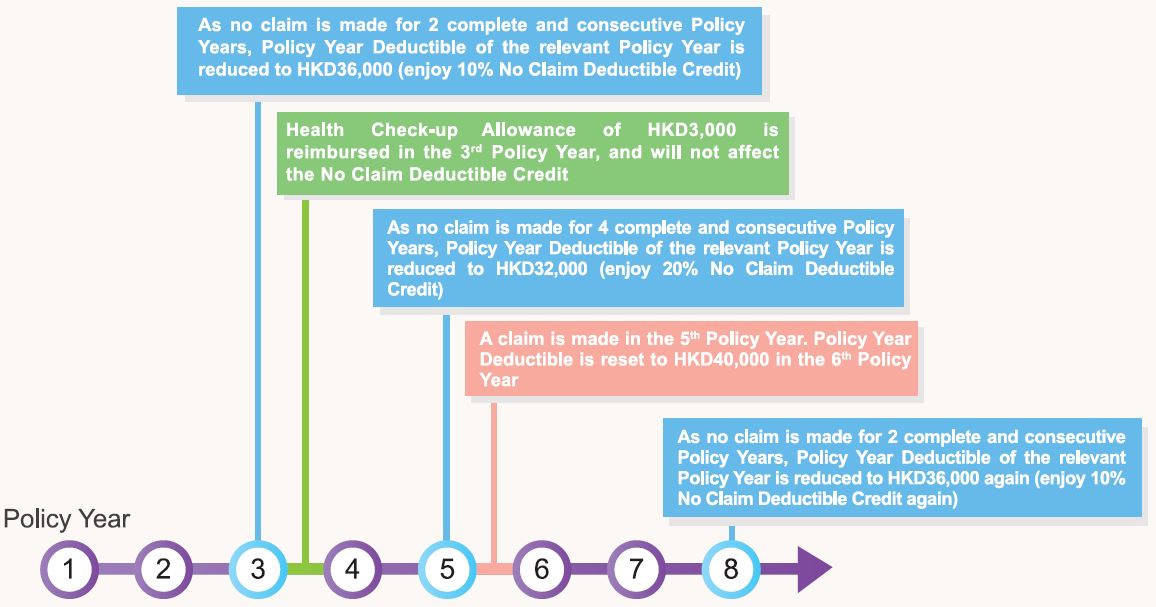

Up to 100% No Claim Deductible Credit10

The Plan specially offers No Claim Deductible Credit10. If no claim has been made for two complete and consecutive Policy Years, the Plan offers a credit equals 10% of the Policy Year Deductible3 (if any) in the following Policy Year in order to reduce the Policy Year Deductible3 of the relevant Policy Year. The relevant credits can be accumulated every two Policy Years up to 100%, and thus the Policy Year Deductible3 of the relevant Policy Year will reduce to zero. The No Claim Deductible Credit10 will be reset to 0% in the next Policy Year upon claim is made and will restart to operate.

More importantly, the No Claim Deductible Credit10 will not be affected by any claim on Daily Government Hospital Cash Benefit, Daily Lower Room Class Cash Benefit, Day Case Surgery Cash Benefit, Health Check-up Allowance or any items under Extra Services.

Example: Assuming the Life Insured is age 40 and the Policy Year Deductible option is HKD40,000

Extra Services for a Continuum of Health Care

- Cashless Arrangement Service for Hospitalization11,12

If the Life Insured receives in-patient treatment in the private hospital in Hong Kong, by completing simple registration and approval procedures before hospitalization to ensure you understand and are fully informed of the terms and coverage, the eligible medical expenses incurred during the hospital stay will be settled on the behalf of you when discharge. This helps alleviate your burden to deal with medical expenses.

- Healthcare Service12

(applicable to the Policy with first-year annual premium of HKD 15,000 / USD 1,875 or above while the policy is issued)

Healthcare Service provides comprehensive medical support service to the Life Insured in mainland China. This service includes 1. Online Services, 2. Medical Supports and 3. Rehabilitation Care. Online Services can provide you with online family doctor consultation services and health assessment. Medical Supports include hospitalization/surgery appointments, escort service in hospital, second medical opinion from mainland Chinese medical experts and overseas drug search services etc. Rehabilitation Care can provide discharge transportation arrangements, door-to-door care by nurses and other related services. - Critical Illness Assistance Service12

(applicable to the Policy with first-year annual premium below HKD 15,000 / USD 1,875 while the policy is issued)

Internet Based Medical Consulting Service in mainland China is provided to the Life Insured. Moreover, if the Life Insured is diagnosed with a specified critical illness, Second Medical Opinion from Mainland Chinese Medical Expert Service helps you get independent advice on the medical condition and alternative treatment plan, while Medical Guidance Service would arrange a service assistant to assist you in appointment registration and accompany you throughout the process of medical consultation. Areas for medical consultation are limited to Beijing, Shanghai and Guangzhou.

- Subject to maximum benefit limits, sub-limits and/or amount of relevant benefits, Policy Year Limit, Overall Lifetime Limit and the Policy Year Deductible (if any).

- The Policyowner can renew the Policy every year until aged 100 of the Life Insured provided the Plan is then available for renewal. Renewal premium is not guaranteed and Hong Kong Life reserves the right to revise or adjust the premium according to the Life Insured's attained age and the premium rates upon renewal.

- "Policy Year Deductible" means the amount which shall be borne by the Life Insured and is to be deducted from any amount of benefits under Medical Benefit in any one Policy Year.

- Upon reduction of the Policy Year Deductible at the relevant Policy Anniversary, the premium shall be adjusted according to Hong Kong Life's applicable premium rate for the risk class and the then attained Age of the Life Insured, and any special terms imposed on the Policy.

- This benefit is only payable for one health check-up every two consecutive Policy Years commencing from the second Policy Anniversary provided that the Life Insured had attained Age 30 at the beginning of the relevant two consecutive Policy Years.

- For Daily Government Hospital Cash Benefit, Policy Year Deductible does not apply if the Life Insured with (i) a Hong Kong identity card is Confined as a bed patient in a general ward of a government Hospital in Hong Kong; or (ii) a Macau resident identity card is Confined as a bed patient in a general ward of a government Hospital in Macau.

- Only applicable to gastroscopy (with or without excision biopsy/removal of lesion), colonoscopy (with or without excision biopsy/removal of lesion) or cataract surgical procedure.

- The date of diagnosis of such covered pregnancy complications must be more than 10 consecutive months after the Issue Date, date of endorsement or date of any reinstatement of the Plan, whichever is later.

- The treatments must be received by the Life Insured between age 45 to 55.

- No Claim Deductible Credit is not applicable if the Policy Year Deductible of the relevant Policy Year is zero.

- The Cashless Arrangement Service for Hospitalization is an administrative arrangement for hospitalization expenses. The service is only applicable to private hospitals in Hong Kong. Cashless Arrangement Service for Hospitalization is not an admission of claim eligibility and the actual reimbursement entitlement is subject to the terms and conditions of the Policy, medical information finally received by Hong Kong Life and the eligible medical expenses incurred. Hong Kong Life reserves the rights to recover any shortfall from the Policyowner in the event when any non-eligible expenses that are not covered under the Policy.

- Cashless Arrangement Service for Hospitalization, Healthcare Service and Critical Illness Assistance Service are provided by third party service providers. Such services are included in the Plan but not part of the coverage. The availability of these services is not guaranteed. The details of the services will be provided along with the policy document or please refer to the company website of Hong Kong Life. Hong Kong Life reserves the right to cancel or amend the said services at its sole discretion. In addition, Hong Kong Life will not be responsible for any services or opinions provided by the third party service providers. Hong Kong Life reserves the right of final decision in case of any dispute.

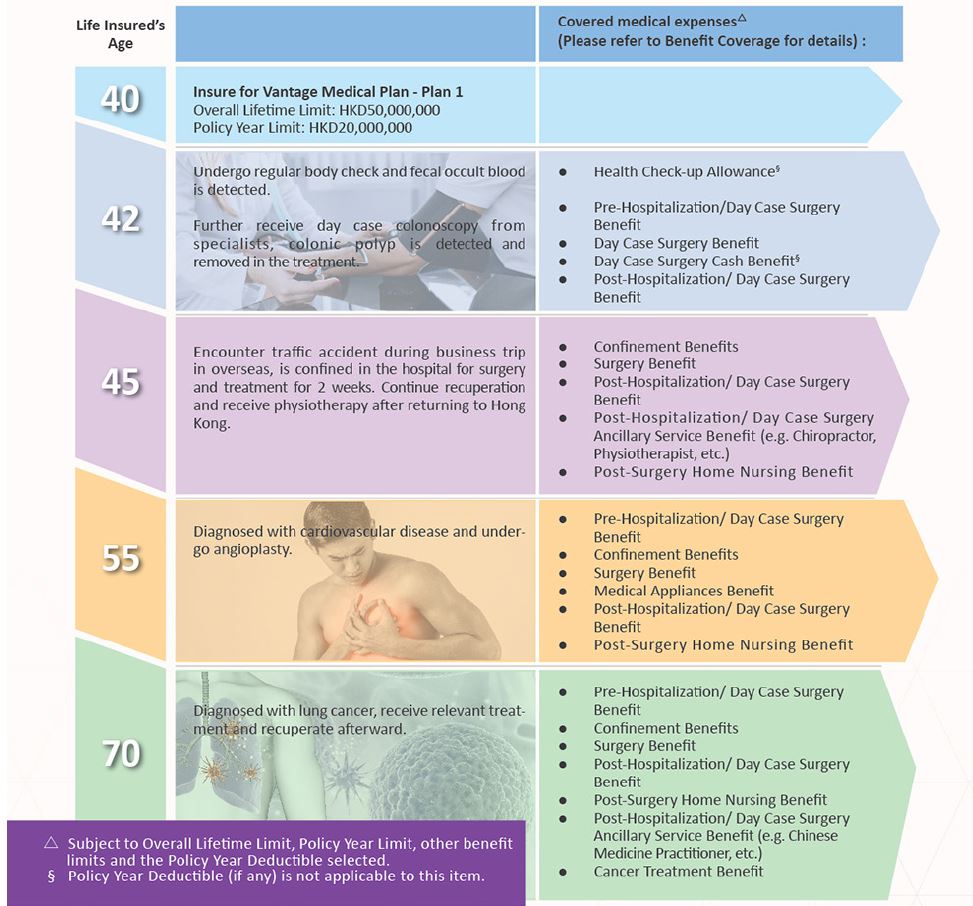

How does "Vantage Medical Plan" provide comprehensive medical support to you?

Policyowner and Life Insured: Andy (Age 40)

Occupation: Business director

Family Status: Married, with a pair of son and daughter

Andy is the bread winner of the family and has to frequently travel overseas for business trip. He is always busy at work and does not have regular schedule for diet and rest. He understands that having a broad and high quality medical coverage is important for him and his family. Thus, he insures for Vantage Medical Plan – Plan 1 to enjoy the worldwide medical protection with an Overall Lifetime Limit of HKD50,000,000. With strong medical backup from the Plan, he can be assured of a comprehensive protection whenever receiving medical treatment due to illness or accident. This also helps alleviate his family's financial burden.

Benefit Schedule

-

Medical Benefit

| Overview | Plan 1 | Plan 2 | Plan 3 |

|---|---|---|---|

| Overall Lifetime Limit | HKD50,000,000/ USD6,250,000 | HKD50,000,000/ USD6,250,000 | HKD25,000,000/ USD3,125,000 |

| Policy Year Limit | HKD20,000,000/ USD2,500,000 | HKD20,000,000/ USD2,500,000 | HKD10,000,000/ USD1,250,000 |

| Policy Year Deductible~ | HKD0/ USD0 OR HKD40,000/ USD5,000 OR HKD80,000/ USD10,000 | ||

Geographic Area of Cover

|

Worldwide |

Worldwide |

Worldwide |

| Covered Room Class | Standard Private Room | Standard Private Room |

Semi-Private Room Standard Private Room |

Coverage items 1.1-1.8, 2.1-2.2, 2.4-4.7, 5.1-5.2 are reimbursed on Medically Necessary and Reasonable and Customary basis. Please refer to point 1 of the Product Limitation section for more information.

| Coverage Items | Maximum Benefit Limit/ Amount | ||

|---|---|---|---|

| Plan 1 | Plan 2 | Plan 3 | |

| 1. Confinement Benefits | |||

| 1.1 Hospital Room and Board Benefit | Full Cover | ||

| 1.2 Physician's Visit | Full Cover | ||

| 1.3 Specialist's Fee | Full Cover | ||

| 1.4 Miscellaneous Hospital Expenses Benefit | Full Cover | ||

| 1.5 Intensive Care Benefit | Full Cover | ||

| 1.6 Private Nurse's Fee | Full Cover (max 1 visit per day) (max 90 days per Policy Year) |

||

| 1.7 Computed Tomography (CT), Magnetic Resonance Imaging (MRI) and Positron Emission Tomography (PET) Benefit | Full Cover | ||

| 1.8 Hospital Companion Bed Benefit | Full Cover | ||

| 1.9 Daily Government Hospital Cash Benefit@ | HKD1,800/ USD225 per day |

HKD1,500/ USD187.5 per day |

HKD1,200/ USD150 per day |

| (max 120 days per Policy Year) | |||

| 1.10 Daily Lower Room Class Cash Benefit# | HKD1,800/ USD225 per day |

HKD1,500/ USD187.5 per day |

HKD1,200/ USD150 per day |

| (max 120 days per Policy Year) | |||

| 2. Surgical Benefits | |||

| 2.1 Surgery Benefit (including Surgeon's fee, Anaesthetist's fee and operating theatre fee) | |||

| (1) All Surgeries | Full Cover | ||

| (2) Surgery of the Donor∫ | 30% of the total transplantation surgical cost of both donor and recipient | ||

| 2.2 Day Case Surgery Benefit (including consultation, medication, Surgeon's fee, Anaesthetist's fee, operating theatre fee and/ or room charge) | Full Cover | ||

| 2.3 Day Case Surgery Cash Benefit+ | HKD1,800/ USD 225 per surgical procedure |

HKD1,500/ USD187.5 per surgical procedure |

HKD1,200/ USD150 per surgical procedure |

| (max 1 payment per surgical procedure and max 1 surgical procedure per Policy Year) | |||

| 2.4 Medical Appliances Benefit | |||

| (1) Designated Medical Appliances* | Full Cover | ||

| (2) Non-designated Medical Appliances (3) Reconstructive Devices or Materials |

HKD100,000/ USD12,500 each item per lifetime | ||

| 3. Pre- and Post-Hospitalization Benefits | |||

| 3.1 Pre-Hospitalization/ Day Case Surgery Out-Patient Benefit (1) Out-Patient consultation (2) Medication (3) Diagnostic tests |

Full Cover (max 1 visit per day) (within 30 days immediately preceding the Confinement in Hospital or Day Case Surgery) |

||

| 3.1 Post-Hospitalization/ Day Case Surgery Out-Patient Benefit (1) Out-Patient consultation (2) Medication (3) Wound Care (4) Diagnostic tests |

Full Cover (max 1 visit per day) (within 60 days immediately preceding the Confinement in Hospital or Day Case Surgery) |

||

| 3.3 Post-Surgery Home Nursing Benefit | Full Cover (max 1 visit per day and max 120 days per Policy Year) (within 120 days immediately after Discharge from Hospital following surgery/ admission to Intensive Care Unit) |

||

| 3.4 Post-Hospitalization/ Day Case Surgery Ancillary Service Benefit | HKD30,000/ USD3,750 per Confinement/ Day Case Surgery (max 1 visit per day) (within 90 days immediately after Discharge from Hospital or Day Case Surgery) |

||

| (1) Chiropractor/ Physiotherapist/ Speech Therapist/ Occupational Therapist | HKD1,000/ USD125 per visit | ||

| (2) Chinese Medicine Practitioner | HKD600/ USD75 per visit (max 15 visits per Confinement/ Day Case Surgery) |

||

| 3.5 Rehabilitation Benefit | HKD80,000 / USD10,000 per Policy Year (max 60 days per Policy Year) |

||

| 3.6 Hospice Care Benefit | HKD80,000 / USD10,000 per lifetime (within 90 days immediately after Discharge from Hospital) |

||

| 4. Extended Benefits | |||

| 4.1 Cancer Treatment Benefit^^ | Full Cover | ||

| 4.2 Kidney Dialysis Benefit | Full Cover | ||

| 4.3 Reconstructive Surgery Benefit | Full Cover | ||

| 4.4 Pregnancy Complications Benefitπ | Full Cover | ||

| 4.5 Hormone Replacement Therapy for Menopause Benefit** | Full Cover (within 1 year immediately after Discharge from Hospital) |

||

| 4.6 Psychiatric Treatment Benefit▲ | HKD40,000/ USD5,000 per Policy Year (max 30 days per Policy Year) |

||

| 4.7 HIV/ AIDS Treatment Benefit& | HKD800,000/ USD100,000 per lifetime |

HKD600,000/ USD75,000 per lifetime |

HKD400,000/ USD50,000 per lifetime |

| 4.8 Health Check-up Allowance▽ | HKD3,000/ USD375 per health check-up (1 health check-up per 2 consecutive Policy Years) |

||

| 5. Emergency Treatment Benefits | |||

| 5.1 Emergency Out-Patient Benefit (Accident)ɤ | Full Cover | ||

| 5.2 Emergency Dental Benefit (Accident) | Full Cover | ||

-

Death Benefit

| 6.1 Compassionate Death Benefit | HKD80,000/ USD10,000 | ||

Extra Services^

| Cashless Arrangement Service for Hospitalization≈ | Applicable | ||

|

Healthcare Service |

|||

| Critical Illness Assistance Service (applicable to the Policy with first-year annual premium below HKD 15,000 / USD 1,875 ) |

|||

|

~ |

"Policy Year Deductible" means the amount which shall be borne by the Life Insured and is to be deducted from any amount of benefits under Medical Benefit in any one Policy Year. Policy Year Deductible is applicable to all items under Confinement Benefits, Surgical Benefits, Pre- and Post-Hospitalization Benefits, Extended Benefits and Emergency Treatment Benefits, while excluding Daily Government Hospital Cash Benefit if the Life Insured with (i) a Hong Kong identity card is Confined as a bed patient in a general ward of a government Hospital in Hong Kong; or (ii) a Macau resident identity card is Confined as a bed patient in a general ward of a government Hospital in Macau, Daily Lower Room Class Cash Benefit, Day Case Surgery Cash Benefit and Health Check-up Allowance. |

|

@ |

Only applicable if the Life Insured is Confined in a general ward of a government Hospital, or in a Hospital without charge. |

|

# |

Only applicable if the Life Insured is Confined in a room of class lower than the covered room class under the Plan of a private Hospital in Hong Kong. |

|

∫ |

Only applicable to organ transplantation of heart, kidney, liver, lung or bone marrow on the Life Insured as recipient. |

|

+ |

Only applicable to gastroscopy (with or without excision biopsy/removal of lesion), colonoscopy (with or without excision biopsy/removal of lesion) or cataract surgical procedure. |

|

* |

Designated Medical Appliances include pace maker, stents for Percutaneous Transluminal Coronary Angioplasty, intraocular lens, artificial cardiac valve, metallic or artificial joints for joint replacement, prosthetic ligaments for replacement or implantation between bones, and prosthetic intervertebral disc. |

|

^^ |

Including In-Patient or Out-Patient treatment for radiotherapy, chemotherapy, targeted therapy, hormonal therapy, immunotherapy and proton therapy; and targeted therapy and chemotherapy for usage and consumption at home. |

|

π |

The date of diagnosis of such covered pregnancy complications must be more than 10 consecutive months after the Issue Date, date of endorsement or date of any reinstatement of the Plan, whichever is later. |

|

** |

The treatment must be received by the Life Insured between Age 45 to 55. |

|

▲ |

Applicable if the Life Insured is Confined in a Mental or Psychiatric Hospital, or the mental or psychiatric unit or department of a Hospital. |

|

& |

Only applicable to the signs or symptoms of such illness first occurred after 5 years from the Issue Date, date of endorsement or date of any reinstatement of the Plan, whichever is later. |

|

▽ |

This benefit is only payable for one health check-up every two consecutive Policy Years commencing from the second Policy Anniversary provided that the Life Insured had attained Age 30 at the beginning of the relevant two consecutive Policy Years. |

|

ɤ |

The Injury is caused by Accident and the Life Insured must receive Medically Necessary emergency treatment in the out-patient department or emergency treatment room of a Hospital as an Out-Patient within 24 hours of the said Accident. |

|

^ |

Cashless Arrangement Service for Hospitalization, Healthcare Service and Critical Illness Assistance Service are provided by third party service providers. Such services are included in the Plan but not part of the coverage. The availability of these services is not guaranteed. The details of the services will be provided along with the policy document or please refer to the company website of Hong Kong Life. Hong Kong Life reserves the right to cancel or amend the said services at its sole discretion. In addition, Hong Kong Life will not be responsible for any services or opinions provided by the third party service providers. Hong Kong Life reserves the right of final decision in case of any dispute. |

|

≈ |

The Cashless Arrangement Service for Hospitalization is an administrative arrangement for hospitalization expenses. The service is only applicable to private hospitals in Hong Kong. Cashless Arrangement Service for Hospitalization is not an admission of claim eligibility and the actual reimbursement entitlement is subject to the terms and conditions of the Policy, medical information finally received by Hong Kong Life and the eligible medical expenses incurred. Hong Kong Life reserves the rights to recover any shortfall from the Policyowner in the event when any non-eligible expenses that are not covered under the Policy. |

-

Hong Kong Life covers the charges and/ or expenses of the Life Insured on Medical Necessary and Reasonable and Customary basis.

"Medically Necessary" means necessary for having or the necessity to have a medical service, procedure or supply, when in Hong Kong Life's opinion:

- is consistent with generally accepted professional standards of medical practice;

- is required to establish a diagnosis and to provide treatment;

- cannot be safely delivered in a lower level of medical care; and

- is not for the convenience of the Policyowner, Life Insured or Registered Medical Practitioner.

"Reasonable and Customary" means any fee, charge, or expense which:- is charged for treatment, supplies (inclusive of medication) or medical services that are Medically Necessary and in accordance with standards of good medical practice for the care of an injured or ill person under the care, supervision or order of a Registered Medical Practitioner;

-

does not exceed the usual level of charges for similar treatment, supplies (inclusive of medication) or medical services in the locality where the expense is incurred, which for the avoidance of doubt, shall not exceed the level of such charges applicable to the covered room class under the Plan for treatment, supplies (inclusive of medication) or medical services provided during a covered Confinement; and

- does not include charges that would have only been made if insurance existed.

Hong Kong Life reserves the right to determine whether any particular Hospital or medical charge is Reasonable and Customary with reference including but not limited to any relevant publication or information made available, such as schedule of fees by the government, relevant authorities, recognized medical association in the locality where the expense is incurred. Hong Kong Life also reserves the right to adjust any and all benefits payable in relation to any Hospital or medical charges which in the opinion of Hong Kong Life's medical examiner is not Reasonable and Customary.

-

If the Life Insured in Confined in Hospital in a room of the class upper than the covered room class under the Plan, whether voluntarily or involuntarily, on any days of a Confinement, any Reasonable and Customary charges actually incurred under Medical Benefit during such days of Confinement shall be reduced by multiplying an adjustment ["Room Class Adjustment"].

Room Class Adjustment = Daily room charge of the covered room class under the Plan in the Hospital admitted by the Life Insured ÷ Daily actual room charge of each such days of Confinement

-

"Asia" means Afghanistan, Australia, Bangladesh, Bhutan, Brunei, Cambodia, China, Hong Kong, India, Indonesia, Japan, Kazakhstan, Kyrgyzstan, Laos, Macau, Malaysia, Maldives, Mongolia, Myanmar, Nepal, New Zealand, North Korea, Pakistan, Philippines, Singapore, South Korea, Sri Lanka, Taiwan, Tajikistan, Thailand, Timor-Leste, Turkmenistan, Uzbekistan, and Vietnam.

-

If the Life Insured has been present for a period of 365 or more consecutive days in one of the following regions, any Reasonable and Customary charges actually incurred under Medical Benefit [with the exception of Daily Government Hospital Cash Benefit, Daily Lower Room Class Cash Benefit, Day Case Surgery Cash Benefit and Health Check-up Allowance] in such region will be permanently reduced to 60% with respect to any covered Confinement, stay in hospice, surgical procedure, medical treatment/ service and/or emergency treatment.

For Plan 1 and Plan 2

Regions Countries North America United States and Canada Western Europe Austria, Belgium, Denmark, Finland, France, Germany, Greece, Iceland, Ireland, Italy, Luxembourg, Monaco, Netherlands, Norway, Portugal, Spain, Sweden, Switzerland, United Kingdom and Vatican City For Plan 3

Regions Countries Australia Australia New Zealand New Zealand North America

(for covered events under Coverage Items 1-4 due to Emergency and under Coverage Item 5 only)United States and Canada Western Europe

(for covered events under Coverage Items 1-4 due to Emergency and under Coverage Item 5 only)Austria, Belgium, Denmark, Finland, France, Germany, Greece, Iceland, Ireland, Italy, Luxembourg, Monaco, Netherlands, Norway, Portugal, Spain, Sweden, Switzerland, United Kingdom and Vatican City

| Premium Payment Term | 1 Year (Renewable up to aged 100 of the Life Insured) |

|---|---|

| Issue Age* | Age 0 (15 days after birth) to 70 |

| Policy Currency | HKD/USD |

| Benefit Term | 1 Year (Renewable up to age 100 of the Life Insured) |

| Premium Payment Mode | Annual / Semi-annual / Quarterly / Monthly |

*Age means age of the Life Insured at the last birthday

The Medical Benefit under the Plan does not cover the Life Insured for any Confinement, stay in hospice, surgical procedure, medical treatment/ service, emergency treatment or charges relating to or caused directly or indirectly, wholly or partly, as a result of any of the following:

- any Pre-existing Condition;

- self-destruction or intentional self-inflicted injuries or any attempted self-destruction while sane or insane;

- war, hostilities, invasion, acts of foreign enemies, or warlike operations (whether war be declared or not), civil war, insurrection, riot, rebellion, revolution, civil commotion assuming the proportions of or amounting to an uprising, military or usurped power;

- service in the armed forces in time of declared or undeclared war or while under orders for warlike operations or restoration of public order;

- any violation or attempted violation of the law or resistance to lawful arrest;

- the Life Insured's participation in any Act of Terrorism where the Life Insured was involved as a terrorist; the use of atomic, nuclear, biological or chemical weapons and radioactive, nuclear, biological or chemical contamination due to any Act of Terrorism, unless the Life Insured is injured during a Trip outside his permanent residence country or place and is not involved as a terrorist ("Act of Terrorism" and "Trip" are defined herein below);

- the Life Insured's travelling to a country where there is a war (whether declared or not), warlike operation, hostilities, mutiny, riot, civil commotion, civil war, rebellion, revolution, insurrection, military or usurped power, martial law or state of siege, or a war zone as recognized by the United Nations;

- pregnancy, miscarriage, childbirth, termination of pregnancy, pre-natal or postnatal care, or complications of them [unless such occurrence are covered by Pregnancy Complications Benefit under the Plan];

- investigations, treatment or any procedures related to birth control, fertility, genetic testing or counselling, sexual dysfunction or inadequacies, contraception, sterilization of either sexes, and all kinds of human assisted reproduction procedures;

-

any mental disorder, behavioural problems, psychiatric or psychological conditions or personality disorder, including but not limited to anxiety, anorexia, depression, stress, fatigue, or psychiatric complications of physical disorders, cognitive impairment, sleep disorders, nicotine or alcohol or drugs or substance abuse/dependency or any complications therefrom [unless such occurrence are covered by Psychiatric Treatment Benefit under the Plan];

-

cosmetic or plastic surgery (unless such treatment is covered by Reconstructive Surgery Benefit under the Plan), prophylactic surgery or treatment, any kind of weight control programmes and treatment of obesity (including morbid obesity), organ donation as the donor, or treatment of an optional nature; or any form of dental care or surgery (unless such occurrence are covered by Emergency Dental Benefit (Accident) under the Plan) but in all circumstances shall not cover restoration or replacement of natural teeth, any denture and prosthetic services including bridges and crowns and their replacement and related expenses;

- any congenital or inherited disorder or developmental conditions that give rise to signs or symptoms, or was diagnosed before the Life Insured reaches Age 17;

-

treatment or procedures directly or indirectly associated with sex changes;

- corrective aids and treatment of refractive errors, vision therapy or hearing aids unless necessitated by Injury caused by an Accident;

- routine health checks, whether with or without any positive finding(s) (except for Health Check-up Allowance under the Plan), screening and preventive care/checking, or investigations on the Life Insured not directly related to illness or conditions which the Life Insured is admitted for;

- convalescence, custodial or rest care, or any admission that is not Medically Necessary; or any treatment, investigation, service or supplies which is not Medically Necessary;

- investigation, treatment or surgery for tonsils, adenoids, hernia or a disease peculiar to the female generative organs until the Life Insured has been continuously covered under the Plan for a period of 120 days immediately preceding such investigation, treatment or surgery;

- AIDS or any complications associated with HIV Infection (except for HIV/AIDS Treatment Benefit under the Plan);

-

any of the following traditional Chinese medicines: (a) cordyceps; (b) ganoderma; (c) antler; (d) cubilose; (e) donkey-hide gelatin; (f) hippocampus; (g) ginseng; (h) red ginseng; (i) American Ginseng; (j) Radix Ginseng Silvestris; (k) antelope horn powder; (l) placenta hominis; (m) agaricus blazei murill; (n) musk; and (o) pearl powder (except for item (2) of Post-Hospitalization/ Day Case Surgery Ancillary Service Benefit under the Plan).

"Act of Terrorism" shall mean the use or threat of action (including but not limited to the use of force or violence and/or the threat thereof) by any person or group of persons, whether acting alone or on behalf of or in connection with any organization or government, which is directed at or causing damage, injury, harm or disruption, or endangering human life or property; and the use or threat is intended to influence any government and/or intimidate the public or any section of the public, and made for the purpose of pursuing political, religious, ideological, ethnic, racial or economic interests (whether such interests are declared or not).

"Trip" shall mean a journey taken by the Life Insured and commences upon the Life Insured leaving the country or place of which he was a permanent resident at the time of leaving or 2 hours before the Life Insured's arrival at any immigration counter for the purpose of leaving such country or place (whichever is later). The journey ceases when the Life Insured's return directly to the country or place of which he was a permanent resident at the time of leaving or 2 hours immediately following the Life Insured's arrival at any immigration counter for the purpose of returning to such country or place after the journey (whichever is earlier).

Risk

-

Basic Plan

Exchange Rate Risk

If the Policy Value and premium of the Plan are calculated in USD, all benefit amount will be presented in USD. If the benefit amount is received in terms of HKD, it is subject to the exchange rate between USD and HKD as determined by Hong Kong Life at the time of payment. Due to the potential fluctuation of the exchange rate, if USD depreciates substantially against HKD, there is a risk that you may lose a substantial portion of the benefit value (calculated in HKD) of your Policy; if USD appreciates substantially against HKD, there is a risk that the premium (calculated in HKD) of the Policy may be substantially increased.

Credit Risk of Issuer

The Plan is issued and underwritten by Hong Kong Life. Your Policy is subject to the credit risk of Hong Kong Life. In the worst case, you may lose all the premium paid and benefit amount.

Inflation Risk

When reviewing the values shown in the Insurance Proposal, please note that the cost of living in the future is likely to be higher than it is today due to inflation.

Important Policy Provisions

Guarantee Renewal

Subject to the terms and conditions of the Policy, the Plan is guaranteed for renewal on each Policy Anniversary for a further twelve (12) months period, provided always that Hong Kong Life reserves the right to qualify the terms and conditions and/or to adjust the premiums of the renewal. The Plan may be renewed by continuing payment of the appropriate required premiums on each Policy Anniversary during the lifetime of the Life Insured and before the Life Insured's one hundredth (100th) birthday, provided that the Plan is then available for renewal. Unless otherwise specified, the premium is not guaranteed, and at the time of any renewal, Hong Kong Life reserves the right to revise or adjust the premium according to its applicable premium rate for the attained Age of the Life Insured at the time of such renewal.

Revision of Benefit Structure

At any Policy Anniversary or renewal, Hong Kong Life reserves the right to revise the benefit structure, premium, terms and conditions (including but not limited to the Benefit Schedule, maximum benefit limits and any other benefit items as determined by Hong Kong Life) under the Plan. Hong Kong Life shall notify the Policyowner in writing at least thirty (30) days prior to the Policy Anniversary or renewal specifying such revision. Any such revision shall take effect on the Policy Anniversary or date of the renewal unless the Policyowner declines in writing in which case the Plan shall terminate automatically on the next premium due date following the date of such notification.

Automatic Termination

The Plan shall terminate automatically:

- upon the death of the Life Insured;

- if and when the Plan expires;

- if and when a premium remains unpaid at the end of the Grace Period as specified in the General Provisions;

- on the Policy Anniversary immediately following the Life Insured's one hundredth (100th) birthday;

- upon receipt of the written notification from the Policyowner declining any revision of benefits under Revision of Benefit Structure; or

- when the aggregate amount of benefits paid under Medical Benefit of all relevant insurance policies in respect of the Life Insured reaches the Overall Lifetime Limit.

Others

Premium Adjustment

Hong Kong Life has the right to review and adjust the Plan's premium rates for particular risk classes upon renewal, but not for any individual customer. Hong Kong Life may adjust premium rates because of several factors, such as Hong Kong Life's claims and persistency experience, expenses directly related to and indirect expenses allocated to the Plan, medical price inflation, projected future medical costs and any applicable changes in benefit.

Insurance Costs

Part of the premium pays for the insurance and related costs (if any).

Cooling-off Period

If you are not satisfied with your Policy, you have a right to cancel it within the cooling-off period and obtain a refund of any premium(s) and levy(ies) paid (in the original payment currency) to Hong Kong Life without any interest. A written notice signed by you should be received directly by Hong Kong Life Insurance Limited at 15/F Cosco Tower, 183 Queen's Road Central, Hong Kong within the cooling-off period (that is, the period of 21 calendar days immediately following either the day of delivery of the Policy or the Cooling-off Notice to you or your nominated representative (whichever is the earlier)).After the expiration of the cooling-off period, if you cancel the Policy before the end of the term, the projected Total Surrender Value (if applicable) may be less than the Total Premiums Paid.

Cancellation

After the cooling-off period, the Policyowner can request cancellation of the Policy by giving thirty (30) days prior written notice to Hong Kong Life, provided that there has been no benefit payment under the Policy during the relevant Policy Year.

Dispute on Selling Process and Product

Chong Hing Bank Limited, CMB Wing Lung Bank Limited, OCBC Bank (Hong Kong) Limited and Shanghai Commercial Bank Limited (collectively "Appointed Licensed Insurance Agencies" and each individually "Appointed Licensed Insurance Agency") are the Appointed Licensed Insurance Agencies of Hong Kong Life, and the life insurance product is a product of Hong Kong Life but not the Appointed Licensed Insurance Agencies. In respect of an eligible dispute (as defined in the Terms of Reference for the Financial Dispute Resolution Centre in relation to the Financial Dispute Resolution Scheme) arising between the Appointed Licensed Insurance Agency and the customer out of the selling process or processing of the related transaction, Appointed Licensed Insurance Agency is required to enter into a Financial Dispute Resolution Scheme process with the customer; however any dispute over the contractual terms of the life insurance product should be resolved between Hong Kong Life and the customer directly.

The above information is for reference and is applicable within Hong Kong only. The above information does not contain the full terms of the policy document. For full terms and conditions, please refer to the policy document. If there is any conflict between the above information and the policy document, the latter shall prevail. The copy of the policy document is available upon request. Before applying for the insurance plan, you may refer to the contents and terms of the policy document. You may also seek independent and professional advice before making any decision.