Underwritten by: Hong Kong Life Insurance Limited

Appointed Licensed Insurance Agency: Chong Hing Bank Limited, CMB Wing Lung Bank Limited, OCBC Bank (Hong Kong) Limited and Shanghai Commercial Bank Limited

Caring Health Protection for Your Loved Ones

The below information does not contain the full terms of the policy document. For full terms and conditions, please refer to the policy document.

When a dread disease strikes, not only will you lose your health, but also your wealth. With sophisticated planning ahead to safeguard the health for you and your loved ones, you will have confidence to face any challenges.

Family Care Dread Disease Protection Plan (The "Plan") is an insurance solution includes dread disease and life protection with savings element. The Plan provides coverage for up to 118 illnesses including common dread diseases such as Cancer, Stroke and Heart Attack. Also, if the Covered Family Members are diagnosed with Cancer, the Family Cancer Benefit of the Plan will offer additional benefit to give you and your family members extra peace of mind.

Flexible Premium Payment Term1 with Whole Life Protection

The Plan provides 2 choices of Premium Payment Term1, i.e. 10 years1 and 20 years1, with whole life protection until age 100 of the Life Insured.

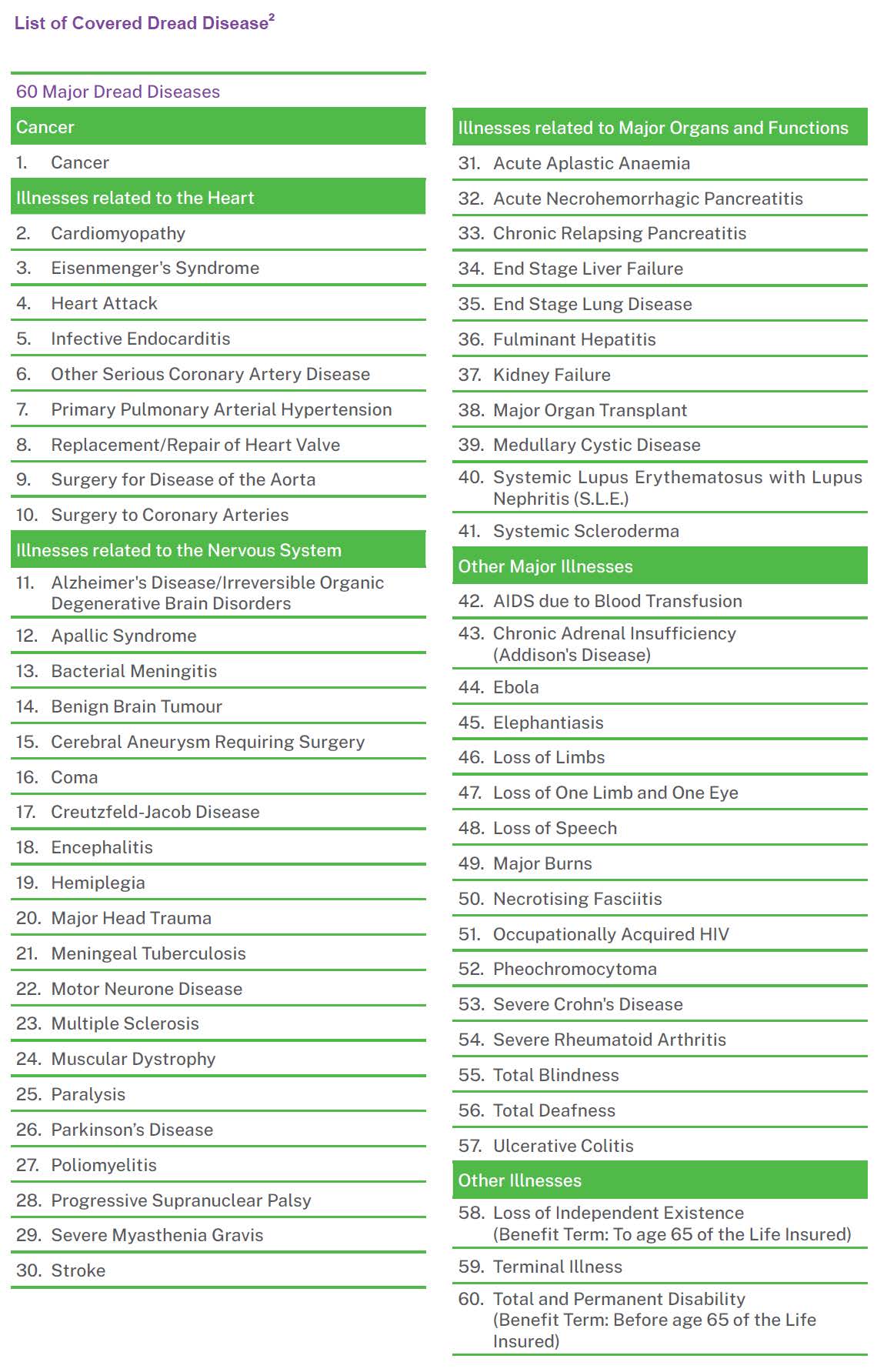

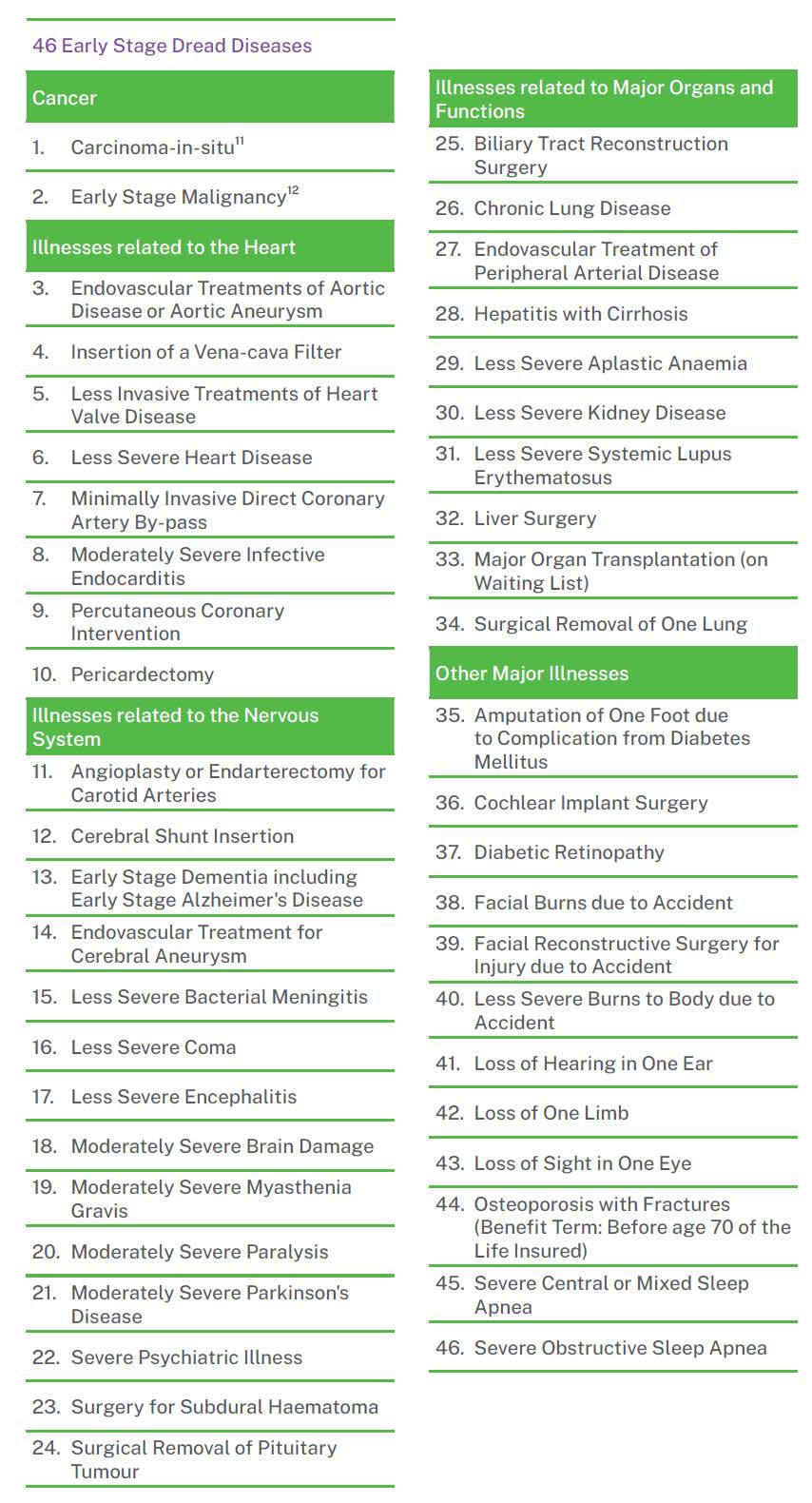

Broad Cover for 118 Illnesses2 without Worries

The Plan covers 60 Major Dread Diseases2 and 46 Early Stage Dread Diseases2, as well as 12 Severe Juvenile Diseases2 to safeguard your health comprehensively. If the Life Insured is diagnosed with covered Dread Diseases, the Dread Disease Benefit of the Plan will be paid. For details of covered Dread Diseases and benefit, please refer to List of Covered Dread Disease and Dread Disease Benefit Schedule.

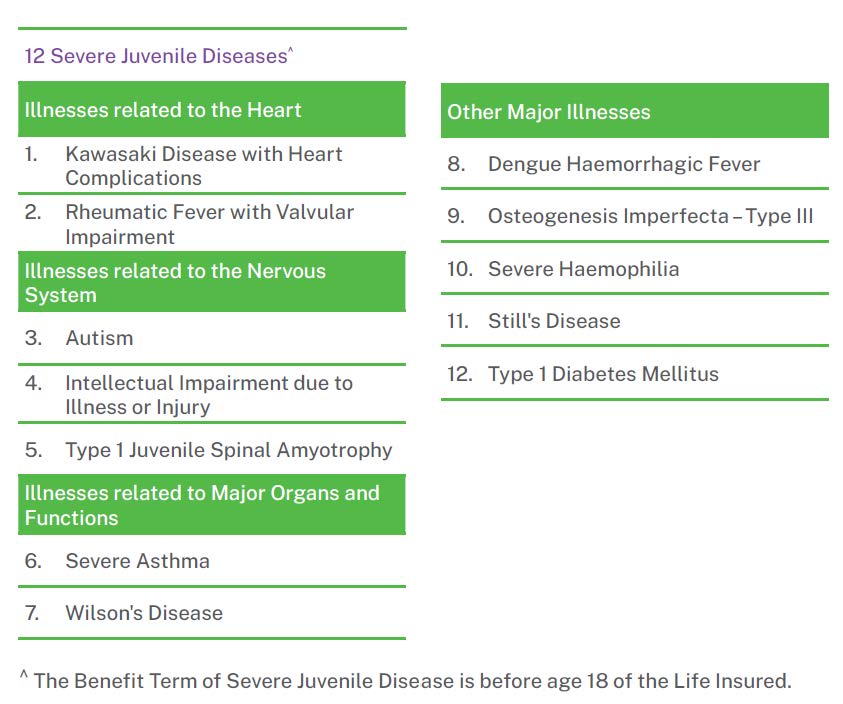

ICU Benefit3 to Extend Protection

The Plan provides ICU Benefit3 which extends its coverage to health issues beyond dread diseases. If the Life Insured is required for a Qualified ICU Stay4 for a total of consecutive 3 days or more due to Sickness or Accident, a payment which is equal to 20% of Sum Assured, less Indebtedness (if any) will be paid as ICU Benefit3. Such benefit will only be paid once.

Family Cancer Benefit5 for Extra Peace of Mind

The Plan specially offers Family Cancer Benefit5 to the Policyowner's parents, spouse and children (except the Life Insured). No medical examination and health questions are required for the Covered Family Members. If the parents, spouse or children is diagnosed with Cancer during the benefit term of the Family Cancer Benefit5, for each Covered Family Member, the Family Cancer Benefit5 of the Plan which is equal to up to 20% (applicable for 10 Years Premium Payment Term) or 40% (applicable for 20 Years Premium Payment Term) of Total Initial Annual Premium will be payable to the Policyowner. Family Cancer Benefit5 could be claimed a maximum of 4 times and in which a maximum of 1 time for each of the Covered Family Member, and limited to one payment for one spouse only. The policy value and coverage of the Life Insured will not be changed due to the claim of Family Cancer Benefit5.

| Family Cancer Benefit5 | Parents | Spouse | Children |

|---|---|---|---|

| Maximum no. of Covered Family Members | 2 | 1 | No Limit |

| Benefit Term* | Before age 85 of Parents/Spouse | Before age 18 of Children | |

| Benefit Amount |

Covered Family Members who are under age 66 on the date of endorsement: 20% (applicable for 10 Years Premium Payment Term) / 40% (applicable for 20 Years Premium Payment Term) of the Total Initial Annual Premium

Covered Family Members who are at or above age 66 on the date of endorsement: 10% (applicable for 10 Years Premium Payment Term) / 20% (applicable for 20 Years Premium Payment Term) of the Total Initial Annual Premium

(maximum of 4 times and in which a maximum of 1 time for each of the Covered Family Member, and limited to one payment for one spouse only) |

||

*The Family Cancer Benefit for each Covered Family Member will be effective 2 years after (i) the endorsement date of such Covered Family Member or (ii) date of any reinstatement, whichever is later.

Also, the Family Cancer Benefit5 provides conversion privilege to the Policyowner's children to suit their needs. Within 30 days of the Covered Family Member reaches age 18, if no Family Cancer Benefit5 has ever been paid for such Covered Family Member, such Covered Family Member may apply for a new permanent life plan as defined by Hong Kong Life from time to time for an amount up to 100% of Sum Assured of the Plan without further evidence of insurability, subject to the specific terms and conditions, and the then administrative rules as determined by Hong Kong Life from time to time.

Life Protection and Flexible Settlement Option

Apart from Dread Disease Benefit, the Plan also offers whole life protection. If the Life Insured dies while the Plan is in force, the Total Death Benefit which is equal to 100% of Sum Assured, less Dread Disease Benefit6 already paid, plus Terminal Dividend (non-guaranteed)7 (if any), less Indebtedness (if any) will be paid to the Policy Beneficiary.

In addition, the Plan provides flexible Death Benefit Settlement Options8 instead of receiving the Death Benefit in a lump sum payment, Policyowner can designate other settlement options including Installment Payments (Fixed Amount) or Installment Payments (Fixed Period) while the Plan is in force and the Life Insured is alive to settle the Death Benefit to the Policy Beneficiary.

Additional Return

The Plan not only provides Guaranteed Cash Value, a Terminal Dividend (non-guaranteed)7 may be payable on or after the end of 12th Policy Year upon the death of the Life Insured, when the Policy is surrendered by the Policyowner, the Major Dread Disease Benefit is fully paid or upon Policy Maturity, whichever is the earliest.

Extra Service for a Continuum of Health Care

- Health Checkup Service9

During the first 10 Policy Years, the Plan provides one time of health checkup service to the Life Insured or Covered Family Members to enjoy every two consecutive Policy Years starting from the 2nd Policy Anniversary.

Simple Application

Application procedure is simple and no medical examination is required.

| Premium Payment Term1 | 10 Years | 20 Years | ||

|---|---|---|---|---|

| Issue Age* | Age 0 (15 days after birth) to 65 | Age 0 (15 days after birth) to 55 | ||

| Policy Currency | HKD / USD | |||

| Benefit Term | Until age 100 of the Life Insured | |||

| Minimum Sum Assured | HKD100,000 / USD12,500 | |||

| Maximum Sum Assured | Issue Age* | HKD | USD | |

| 0-17 | 1,200,000 | 150,000 | ||

| 18-40 | 2,400,000 | 300,000 | ||

| 41-45 | 2,000,000 | 250,000 | ||

| 46-55 | 1,200,000 | 150,000 | ||

| 56-60 | 400,000 | 50,000 | ||

| 61-65 | 200,000 | 25,000 | ||

| (Calculated based on all in-force policies and pending applications regarding simplified underwritten dread disease plan per Life Insured in Hong Kong Life ) | ||||

| Premium Payment Mode | Annual / Semi-annual / Quarterly / Monthly | |||

*Age means age of the Life Insured at the last birthday

- The Policy will be terminated if the Policyowner cannot settle the premium payment before the end of the Grace Period during the Premium Payment Term, subject to the Automatic Premium Loan, Non-forfeiture Option and other relevant provisions of the Policy. For detailed terms and conditions, please refer to the policy document issued by Hong Kong Life. If the Policy is terminated before the Policy Maturity, the Total Surrender Value (if applicable) received by the Policyowner may be less than the Total Premiums Paid.

- For the definition of covered Dread Disease, please refer to the policy document.

- The aggregate amount of the ICU Benefit paid under the Plan and payable under other policies issued by Hong Kong Life in respect of the Life Insured's confinement in ICU within the meaning of the Qualified ICU Stay shall not exceed HKD400,000/ USD50,000 under any circumstances.

- "Qualified ICU Stay" means a stay in an ICU of a Hospital where all of the following criteria must be met: (i) the stay in ICU of a Hospital must be a confinement in the ICU for a total of consecutive 3 days or more in one Hospital admission; (ii) the stay in ICU of a Hospital must be a confinement for Medically Necessary treatment or service as recommended and certified by a Registered Medical Practitioner; (iii) the Company will not consider the stay in ICU of a Hospital as Medically Necessary if the Life Insured can be safely and adequately treated in any other medical facility; and (iv) the stay in ICU of a Hospital must not be caused directly, or indirectly, wholly or partly, by any one of the following occurrences: (a) cosmetic treatment performed on the Life Insured unless necessitated by Injury caused by an Accident and the Life Insured sustains the Injury and the cosmetic treatment is approved by Hong Kong Life in advance within 90 days of the Accident; or (b) the Life Insured's pregnancy, surrogacy, childbirth or termination of pregnancy, birth control, infertility or human assisted reproduction, or sterilisation of either sexes; or (c) mental disorder, psychological or psychiatric conditions, behavioral problems or personality disorder of the Life Insured; or (d) stay in ICU of a Hospital primarily for physiotherapy or for the investigation of signs and/or symptoms with diagnostic imaging, laboratory investigation or other diagnostic procedures; or (e) experimental and/or unconventional medical technology /procedure /therapy performed on the Life Insured; or novel drugs/ medicines /stem cell therapy not yet approved by the government, relevant authorities and recognised medical association in the locality.

- Family Cancer Benefit for each Policyowner's natural parents, spouse or natural children, except the Life Insured [Covered Family Members] is only available if such parents, spouse or children is accepted and approved by Hong Kong Life. The Family Cancer Benefit for each Covered Family Member will be effective 2 years after (i) the endorsement date of such Covered Family Member or (ii) date of any reinstatement, whichever is later. The aggregate amount of the Family Cancer Benefit paid under the Plan and the same benefits paid under other policies issued with Hong Kong Life in respect of each Covered Family Member shall not exceed HKD200,000/ USD25,000 (if the Covered Family Member is under the age of 66 on the date of endorsement) or HKD100,000/ USD12,500 (if the Covered Family Member is at or above the age of 66 on the date of endorsement). In addition, the payment of Family Cancer Benefit should be payable in the event of the Covered Family Member's survival of 14 days following the Diagnosis of a Cancer. For detailed terms and conditions, please refer to relevant form and the policy document issued by Hong Kong Life.

- Dread Disease Benefit includes Major Dread Disease Benefit, Early Stage Dread Disease Benefit, Severe Juvenile Disease Benefit and ICU Benefit.

- Terminal Dividend is not guaranteed and may be changed from time to time. Past performance is not indicative of future performance. The actual amount payable may be higher or lower than those illustrated in the Insurance Proposal. Hong Kong Life reserves the right to change it from time to time.

- Death Benefit Settlement Options are only applicable in the event of the death of the Life Insured after the Premium Payment Term and all premiums due have been paid, and subject to the terms and conditions, and the then administrative rules as determined by Hong Kong Life from time to time. For detailed terms and conditions, please refer to the policy document issued by Hong Kong Life.

- Health Checkup Service is provided by the third party service provider designated by Hong Kong Life. Such service is not part of the product features. The terms and conditions of the service will be issued together with the relevant service document. The availability of the service is not guaranteed. Hong Kong Life reserves the right to cancel or amend the said service at its sole discretion. In addition, Hong Kong Life will not be responsible for any services or opinions provided by the third party service provider. Hong Kong Life reserves the right of final decision in case of any dispute.

- Cover of Carcinoma-in-situ under Early Stage Dread Disease Benefit includes Carcinoma-in-situ in any one of the following covered organ groups: (a) breast; (b) uterus or cervix uteri; (c) ovary and / or fallopian tube; (d) vagina or vulva; (e) colon and rectum; (f) penis; (g) testis; (h) lung; (i) liver; (j) stomach and esophagus; (k) urinary tract or bladder; or (l) nasopharynx. Please refer to the policy document for the definitions of Carcinoma-in-situ.

- Early Stage Malignancy under Early Stage Dread Disease Benefit shall mean the presence of one of the following early malignant conditions: [a] tumour of the thyroid histologically classified as T1N0M0 according to the TNM classification; [b] tumour of the prostate histologically classified as T1a, T1b and T1c according to the TNM classification system; [c] Chronic lymphocytic leukemia classified as RAI Stage I or II; or [d] non melanoma skin cancer. Please refer to the policy document for the definitions of Early Stage Malignancy.

- If two (2) or more of covered Dread Disease and/or Qualified ICU Stay are diagnosed or required arising from a single and same incident, only the larger of the corresponding benefits or, if they are equal, only one benefit is payable. For the avoidance of doubt, the priority of payment for Major Dread Disease Benefit, Early Stage Dread Disease Benefit or Severe Juvenile Disease Benefit will be higher than ICU Benefit and no ICU Benefit will be paid if other benefit amount is paid.

- Under any circumstances,

- The aggregate amount of all benefits paid under ICU Benefit shall not exceed twenty percent (20%) of Sum Assured for the Plan.

- The aggregate amount of all benefits paid under Early Stage Dread Disease Benefit and Severe Juvenile Disease Benefit shall not exceed forty percent (40%) of Sum Assured for the Plan.

- The aggregate amount of all benefits paid under Major Dread Disease Benefit, Early Stage Dread Disease Benefit, Severe Juvenile Disease Benefit and ICU Benefit shall not exceed one hundred percent (100%) of Sum Assured for the Plan.

- Premiums shall continue to be paying without any reduction when the aggregate amount of all benefits paid or payable under Dread Disease Benefit is less than one hundred percent (100%) of the Sum Assured for the Plan.

- Any Indebtedness on the Policy shall be deducted from the Dread Disease Benefit payable under the Policy.

- The coverage of these benefits under the Dread Disease Benefit shall be automatically terminated, as follows:

- Major Dread Disease Benefit and Early Stage Dread Disease Benefit shall be automatically terminated on the Policy Anniversary on or immediately following the Life Insured's one hundredth (100th) birthday.

- Severe Juvenile Disease Benefit shall be automatically terminated when the Life Insured attains the Age of eighteen (18).

- Upon payment of one hundred percent (100%) of Sum Assured for the Plan, Hong Kong Life shall have no further liability under this Dread Disease Benefit.

- The Covered Family Member has survived for no less than fourteen (14) days following the Diagnosis of a Cancer.

- For a Covered Family Member who is the Parent or Spouse, Family Cancer Benefit is only payable if such Covered Member is diagnosed of a Cancer before the age of eighty-five (85), and shall cease after reaching the age of eighty-five (85).

- For a Covered Family Member who is the Child, Family Cancer Benefit is only payable if such Covered Member is diagnosed of a Cancer before the age of eighteen [18], and shall cease after reaching the age of eighteen [18].

- Family Cancer Benefit is only payable for a Covered Family Member if such Covered Family Member still meets the eligibility of Family Member upon a claim is made.

- The Sum Assured, Death Benefit, Maturity Benefit and Dread Disease Benefit for the Plan shall not be affected by any amount paid under the Family Cancer Benefit.

- Family Cancer Benefit for all Covered Family Member will cease automatically upon the termination of the Plan.

- Upon a transfer of the ownership of the Policy pursuant to the "Ownership" clause of the General Provisions of the Policy, Family Cancer Benefit of the Plan will be terminated automatically and cannot be restored.

- Upon the death of the Policyowner, Family Cancer Benefit of the Plan will be terminated automatically and cannot be restored.

- Any Indebtedness on the Policy shall be deducted from the Family Cancer Benefit otherwise payable under the Plan.

- Policyowner may submit a written request in the form prescribed by Hong Kong Life at any time to remove a Covered Family Member. Upon the request for removal of a Covered Family Member is accepted and approved by Hong Kong Life, the Plan shall cease to provide the Family Cancer Benefit for such Family Member commencing on the date of such request is recorded and endorsed by Hong Kong Life.

The Dread Disease Benefit and Family Cancer Benefit of the Plan shall not cover any claims caused directly, or indirectly, wholly or partly, by any one of the following occurrences:

- Pre-existing Condition; or

- For Dread Disease Benefit, any signs or symptoms of any Dread Disease, sickness, illness or injury first occurred prior to the Issue Date of the Plan, or within ninety (90) days following the Issue Date, date of endorsement or date of reinstatement of the Plan, whichever is later; or

- For Family Cancer Benefit, any signs or symptoms of Cancer, sickness, illness or injury first occurred prior to the date of endorsement (the date of such endorsement issued by Hong Kong Life for the acceptance of a Covered Family Member to be covered under the Family Cancer Benefit of the Plan), or within two (2) years following such date of endorsement or date of reinstatement of the Plan, whichever is later; or

- Acquired Immunodeficiency Syndrome (AIDS), AIDS Related Complex (ARC), or HIV Infection, except for "AIDS due to Blood Transfusion" and "Occupationally Acquired HIV" as stated under the definition of Major Dread Disease of the Dread Disease Benefit; or

- Suicide, attempted suicide or intentionally self-inflicted injury, whether the Life Insured or Covered Family Member is sane or insane; or

- Taking of drugs (except under the direction and prescription of a Registered Medical Practitioner), or any poison or alcohol; or

- War, declared or undeclared, riots, insurrection or civil commotion; or

- Any congenital or inherited disorder or developmental conditions that give rise to signs or symptoms, or was diagnosed before the Life Insured or Covered Family Member reaches the age of sixteen (16); or

- Travelling in any aircraft, except as a fare paying passenger in a regular scheduled commercial aircraft or cabin crew working on a scheduled public air service; or

- The commitment of or attempt to commit a criminal offense.

-

Basic Plan

Risk

Exchange Rate Risk

You are subject to exchange rate risks for the Policy denominated in currencies other than the local currency. Exchange rates fluctuate from time to time. You may suffer a loss of your benefit values and the subsequent premium payments (if any) may be higher than your initial premium payment as a result of exchange rate fluctuations.

Liquidity Risk / Long Term Commitment

The Plan is designed to be held until the Maturity / Expiry Date. If you terminate the Policy prior to the Maturity / Expiry Date, a loss of the premium paid may be resulted.

The premium of the Plan should be paid in full for the whole payment term. If you discontinue the payment, the Policy may lapse and a loss of the premium paid may be resulted.

Credit Risk of Issuer

The life insurance product is issued and underwritten by Hong Kong Life. The premium to be paid by you would become part of the assets of Hong Kong Life and that you and your Policy are subject to the credit risk of Hong Kong Life. In the worst case, you may lose all the premium paid and benefit amount.

Market Risk

The amount of dividends [if any] of the Plan depends principally on the factors including investment returns, claim payments, policy persistency rates, operation expenses and tax. Hence the amount of dividends [if any] is not guaranteed and may be changed over time. The actual dividends payable may be higher or lower than the expected amount and value at the time when the Policy was issued.

Inflation Risk

When reviewing the values shown in the Insurance Proposal, please note that the cost of living in the future is likely to be higher than it is today due to inflation.

Important Policy Provisions

Non-guaranteed Premium

The premium is not guaranteed and Hong Kong Life reserves the right to adjust it on a risk class basis.

Suicide

If the Life Insured commits suicide, while sane or insane, within one (1) year from the Issue Date or the date of any reinstatement, whichever is later, the liability of Hong Kong Life shall be limited to a refund of paid premiums to the Beneficiary without interest less any existing Indebtedness. In the case of reinstatement, such refund of premium shall be calculated from the date of reinstatement.

Incontestability

The validity of the Policy shall not be contestable except for [i] the non-payment of premiums, [ii] fraud or [iii] misstatement of age and/or sex as specified in the Misstatement of Age and/or Sex provisions, after it has been in force during the lifetime of the Life Insured for two (2) years from the Issue Date or the date of any reinstatement, whichever is later. Premiums paid will not be refunded should the Policy be voided by Hong Kong Life.

Automatic Termination

The Plan shall terminate automatically:

- upon the death of the Life Insured; or

- if and when Dread Disease Benefit has been fully paid under the Plan; or

- if and when the Plan matures or is surrendered; or

- if and when a premium remains unpaid at the end of the Grace Period as specified in the General Provisions of the Policy unless Automatic Premium Loan applies; or

- if and when the Indebtedness of the Policy equals to or exceeds the Adjusted Guaranteed Cash Value; or

- if and when the Adjusted Guaranteed Cash Value less Indebtedness [if any] is less than the premium required to maintain the Policy up to the next premium due date as specified in the Automatic Premium Loan provisions.

The Adjusted Guaranteed Cash Value is calculated as the Guaranteed Cash Value multiplied by one minus the ratio of the Dread Disease Benefit already paid to the Sum Assured.

Others

Premium Adjustment

Hong Kong Life has the right to review and adjust the Plan's premium rates for particular risk classes on Policy Anniversary, but not for any individual customer. Hong Kong Life may adjust premium rates because of several factors, such as Hong Kong Life's claims and persistency experience, historical performance and the future outlook of investment returns, and expenses directly related to and indirect expenses allocated to the Plan.

Insurance Costs

The Plan is an insurance plan with a savings element. Part of the premium pays for the insurance and related costs (if any).

Cooling-off Period

If you are not satisfied with your Policy, you have a right to cancel it within the cooling-off period and obtain a refund of any premium(s) and levy(ies) paid (in the original payment currency) to Hong Kong Life without any interest. A written notice signed by you should be received directly by Hong Kong Life Insurance Limited at 15/F Cosco Tower, 183 Queen's Road Central, Hong Kong within the cooling-off period (that is, the period of 21 calendar days immediately following either the day of delivery of the Policy or the Cooling-off Notice to you or your nominated representative (whichever is the earlier)). After the expiration of the cooling-off period, if you cancel the Policy before the end of the term, the projected Total Surrender Value [if applicable] may be less than the Total Premiums Paid.

Cancellation

After the cooling-off period, the Policyowner can request cancellation of the Policy by giving thirty (30) days prior written notice to Hong Kong Life.

Dividends

Hong Kong Life determines the amount of divisible surplus that will be distributed in the form of Terminal Dividend. Terminal Dividend will be determined according to the Policy's terms and conditions and in compliance with the relevant legislative and regulatory requirements as well as relevant actuarial standards. Terminal Dividend is available at the termination of the policies.

The amount of divisible surplus depends principally on the factors including investment returns, claim payments, policy persistency rates, operation expenses and tax. Hence the amount of Terminal Dividend is not guaranteed and may be changed over time. The actual Terminal Dividend payable may be higher or lower than the expected amount at the time when the policies were issued.

Policy Loan

After the Plan has acquired a Guaranteed Cash Value and while the Policy is in force, the Policyowner may, upon the sole security and satisfactory assignment of the Policy to Hong Kong Life, apply for a Policy Loan from the Plan. Any loan on the Policy shall bear interest at a rate declared by Hong Kong Life from time to time. Interest on the loan shall accrue and compound daily from the date of loan. The Policy Loan Interest Rate is not guaranteed and will be changed from time to time. The loan and the interest accrued thereon shall constitute Indebtedness against the Policy. Interest shall be due on each Policy Anniversary subsequent to the date of loan. In the event that the Indebtedness of the Policy equals to or exceeds the Adjusted Guaranteed Cash Value, the Policy will terminate. Any Policy Loan and accrued loan interest may reduce the Total Surrender Value and the Total Death Benefit of the Policy.

The Adjusted Guaranteed Cash Value is calculated as the Guaranteed Cash Value multiplied by one minus the ratio of the Dread Disease Benefit already paid to the Sum Assured.

Non-Protected Deposit

The Plan is not equivalent to, nor should it be treated as a substitute for, time deposit. The Plan is not a protected deposit and is not protected by the Deposit Protection Scheme in Hong Kong.

Dispute on Selling Process and Product

Chong Hing Bank Limited, CMB Wing Lung Bank Limited, OCBC Bank (Hong Kong) Limited and Shanghai Commercial Bank Limited (collectively "Appointed Licensed Insurance Agencies" and each individually "Appointed Licensed Insurance Agency") are the Appointed Licensed Insurance Agencies of Hong Kong Life, and the life insurance product is a product of Hong Kong Life but not the Appointed Licensed Insurance Agencies. In respect of an eligible dispute [as defined in the Terms of Reference for the Financial Dispute Resolution Centre in relation to the Financial Dispute Resolution Scheme] arising between the Appointed Licensed Insurance Agency and the customer out of the selling process or processing of the related transaction, Appointed Licensed Insurance Agency is required to enter into a Financial Dispute Resolution Scheme process with the customer; however any dispute over the contractual terms of the life insurance product should be resolved between Hong Kong Life and the customer directly.

The above information is for reference and is applicable within Hong Kong only. The above information does not contain the full terms of the policy document. For full terms and conditions, please refer to the policy document. If there is any conflict between the above information and the policy document, the latter shall prevail. The copy of the policy document is available upon request. Before applying for the insurance plan, you may refer to the contents and terms of the policy document. You may also seek independent and professional advice before making any decision.