Underwritten by: Hong Kong Life Insurance Limited

Appointed Licensed Insurance Agency: Chong Hing Bank Limited, CMB Wing Lung Bank Limited and Shanghai Commercial Bank Limited

Safeguard Your Family with Timely Support

The below information does not contain the full terms of the policy document. For full terms and conditions, please refer to the policy document.

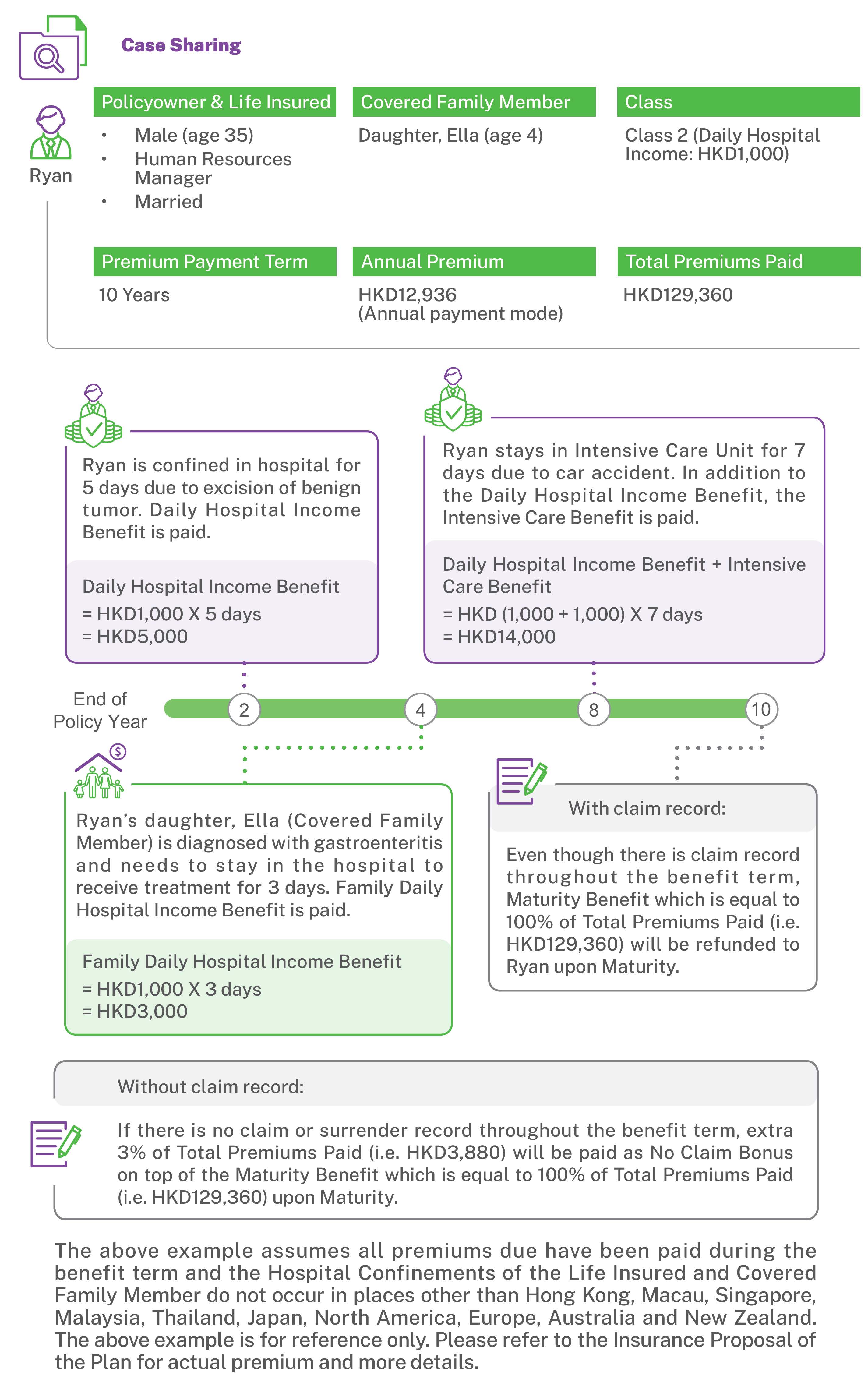

Accidents and illnesses are unpredictable and will cause you unexpected financial burden. Family Guardian Refundable Hospital Income Protection Plan (The "Plan") provides you the solution to be well prepared for the rainy days. If the Life Insured needs to stay in the hospital due to Injury or Sickness, the Plan will provide the Daily Hospital Income Benefit as financial support, allowing you to recover well with peace of mind.

Daily Hospital Income for Flexible Use

If the Life Insured is confined in hospital due to Injury or Sickness while the Plan is in force and prior to the Maturity Date, the Daily Hospital Income Benefit1 will be paid for each day of Hospital Confinement2, with a maximum number of days of Hospital Confinement2 up to 1,000 days per Disability.

Intensive Care Benefit

If the Life Insured is confined in Intensive Care Unit due to Injury or Sickness while the Plan is in force and prior to the Maturity Date, in addition to the Daily Hospital Income Benefit, the Intensive Care Benefit1 will be paid for each day of Hospital Confinement2 only when the Daily Hospital Income Benefit is also payable for the same Disability, with a maximum number of days of Hospital Confinement2 up to 90 days per Disability.

3 Classes of Daily Hospital Income

The Plan provides 3 classes of Daily Hospital Income for selection, i.e. HKD600, HKD1,000 and HKD1,500 in order to meet your need.

10-Year Protection with Premium Refund

The Plan offers 10 years of protection to the Life Insured. Also, the Plan provides premium refund. Maturity Benefit which is equal to 100% of Total Premiums Paid will be paid if the Life Insured is then alive on the Maturity Date. Provided that no death claim is made in the benefit term of the Plan, if you surrender the Policy prior to the Maturity Date, the Surrender Benefit will be paid to the Policyowner. The Surrender Benefit equals to a percentage of Total Premiums Paid for the Plan by referring to the Schedule of Surrender Benefit in "Benefit Coverage" at the time of surrender.

No Claim Bonus

If the Life Insured is then alive on the Maturity Date, provided that no surrender and no claim has been made under Daily Hospital Income Benefit1 (or Family Daily Hospital Income Benefit1,3, where applicable), Intensive Care Benefit1 or Surrender Benefit, an extra 3% of Total Premiums Paid will be paid as No Claim Bonus.

Life Protection for Peace of Mind

Apart from Daily Hospital Income Benefit, the Plan also offers life protection. If the Life Insured dies while the Plan is in force and prior to the Maturity Date, the Guaranteed Death Benefit which is equal to 105% of Total Premiums Paid will be paid to the Beneficiary.

Additional Protection to Meet the Needs of You and Your Family

First-in-Market# Family Daily Hospital Income Benefit1,3

The Plan specially offers Family Daily Hospital Income Benefit1,3 to one of the Policyowner's spouse or children (except the Life Insured). No medical examination and health questions are required for the Covered Family Member. If the Covered Family Member is confined in hospital due to Injury or Sickness while the Plan is in force and prior to the Maturity Date, the Family Daily Hospital Income Benefit1,3 will be paid to the Policyowner for each day of Hospital Confinement2. Throughout the benefit term of the Plan, the maximum number of days of Hospital Confinement2 for Family Daily Hospital Income Benefit1,3 is 10 days.

Fixed Premium for Your Better Planning

The premium will remain unchanged throughout the Premium Payment Term5, allowing you to have a better plan for your future.

Simple Application

Application procedure is simple and no medical examination is required.

| Daily Hospital Income Benefit, Intensive Care Benefit and Family Daily Hospital Income Benefit1,3(HKD) [Amount per each day of Hospital Confinement2] |

Hospitalization Benefit Schedule:

|

|||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Benefit Term |

10 Years |

|||||||||||||||||||||||||||

| Death Benefit |

105% of Total Premiums Paid |

|||||||||||||||||||||||||||

| Maturity Benefit |

|

|||||||||||||||||||||||||||

| No Claim Bonus |

|

|||||||||||||||||||||||||||

| Surrender Benefit |

Schedule of Surrender Benefit:

|

|||||||||||||||||||||||||||

Premium Table

| HKD | ||||||

|---|---|---|---|---|---|---|

| Class 1 | Class 2 | Class 3 | ||||

| Daily Hospital Income Benefit | 600 | 1,000 | 1,500 | |||

| Age* | Monthly | Annual | Monthly | Annual | Monthly | Annual |

| 0-6 | 704 | 8,448 | 994 | 11,928 | 1,427 | 17,124 |

| 7-17 | 698 | 8,376 | 984 | 11,808 | 1,410 | 16,920 |

| 18-30 | 737 | 8,844 | 1,011 | 12,132 | 1,456 | 17,472 |

| 31-35 | 761 | 9,132 | 1,078 | 12,936 | 1,548 | 18,576 |

| 36-40 | 861 | 10,332 | 1,238 | 14,856 | 1,768 | 21,216 |

| 41-45 | 992 | 11,904 | 1,428 | 17,136 | 2,039 | 24,468 |

| 46-50 | 1,088 | 13,056 | 1,558 | 18,696 | 2,256 | 27,072 |

| 51-55 | 1,334 | 16,008 | 1,905 | 22,860 | 2,792 | 33,504 |

| 56-60 | 1,606 | 19,272 | 2,295 | 27,540 | 3,363 | 40,356 |

* Age means age of the Life Insured at the last birthday

| Premium Payment Term5 | 10 Years |

|---|---|

| Issue Age* | Age 0 [15 days after birth] to 60 |

| Policy Currency | HKD |

| Benefit Term | 10 Years |

| Premium Payment Mode | Annual / Monthly |

* Age means age of the Life Insured at the last birthday

1. The Daily Hospital Income Benefit [or Family Daily Hospital Income Benefit, where applicable] or Intensive Care Benefit is only payable once for any one day of Hospital Confinement, regardless of the number of Disability per Hospital Confinement. If more than one Hospital Confinement are caused by the same or related Disability, Hong Kong Life will regard such multiple Hospital Confinements as being caused by the same Disability. In the case where Hospital Confinement occurs in places other than Hong Kong, Macau, Singapore, Malaysia, Thailand, Japan, North America, Europe, Australia and New Zealand, the amount of the benefit payable for each day of Hospital Confinement will be limited to 50% of the amount of Daily Hospital Income Benefit [and Family Daily Hospital Income Benefit, where applicable] and Intensive Care Benefit as shown on the Hospitalization Benefit Schedule, and subject to a maximum of 90 days for any one Disability [applicable for Daily Hospital Income Benefit and Intensive Care Benefit) or a maximum of 10 days for the Plan [applicable for Family Daily Hospital Income Benefit, where applicable]. The Daily Hospital Income Benefit [and Family Daily Hospital Income Benefit, where applicable] and Intensive Care Benefit are payable on Medically Necessary Hospital Confinement basis. "Medically Necessary" means in respect of Hospital Confinement, treatment, procedure, supplies or other medical services, such Hospital Confinement, treatment, procedure, supplies or other medical services which are, in the Hong Kong Life's opinion:

- required for, appropriate and consistent with the symptoms and findings or diagnosis and treatment of the Disability;

- in accordance with generally accepted medical practice and not of an experimental or investigative nature;

- not for the convenience of the Policyowner, Life Insured [or the Covered Family Member, where applicable], or Registered Medical Practitioner or any other person; and

- not able to be omitted without adversely affecting the medical condition of the Life Insured [or the Covered Family Member, where applicable].

2. "Hospital Confinement" means the admission and confinement of the Life Insured [or the Covered Family Member, where applicable] as an in-patient in a Hospital upon recommendation of a Registered Medical Practitioner for the treatment of a Disability provided that the Life Insured [or the Covered Family Member, where applicable] must be admitted in the Hospital as an in-patient for a minimum of 6 hours and continuously Stay in the Hospital thereafter prior to the Discharge of the Life Insured [or the Covered Family Member, where applicable], which incurs a charge for daily room and board of Hospital room or Intensive Care Unit. Hospital Confinement must be Medically Necessary.

3. Family Daily Hospital Income Benefit for Policyowner's legally married spouse or natural child, except the Life Insured [Covered Family Member] is only available if such spouse or child is accepted and approved by Hong Kong Life. Only one Covered Family Member can be covered under Family Daily Hospital Income Benefit. Spouse shall be

- under the age of 60 at the time of application for Family Daily Hospital Income Benefit and

- under the age of 70 throughout the benefit term of the Plan. Child shall be attained the age of 15 days and is under the age of 18. Family Daily Hospital Income Benefit could be claimed a maximum of 10 days throughout the benefit term of the Plan. In no event shall the aggregate amount of benefit payable under the Family Daily Hospital Income Benefit of the Policy and all other insurance policies covering the Covered Family Member issued by Hong Kong Life from time to time, exceed an maximum aggregate amount of HKD1,500 for each day of Hospital Confinement. For detailed terms and conditions, please refer to relevant form and the policy document issued by Hong Kong Life.

5. The Policy will be terminated if the Policyowner cannot settle the premium payment before the end of the Grace Period during the Premium Payment Term, subject to the Non-forfeiture Option and other relevant provisions of the Policy. For detailed terms and conditions, please refer to the policy document issued by Hong Kong Life. If the Policy is terminated before the Maturity, the Guaranteed Surrender Value received by the Policyowner may be less than the Total Premiums Paid.

While the Plan is in force and the Life Insured is alive, the Policyowner may apply for the Family Daily Hospital Income Benefit of the Plan to cover one [1] Family Member of the Policyowner provided that the following conditions are met:

- One [1] Family Member of the Policyowner who meets the eligibility of Family Member can be applied to be covered under the Family Daily Hospital Income Benefit of the Plan, subject to the specific terms and conditions, and the administrative rules and requirements as determined by Hong Kong Life at the time of application; and

- Submission of evidence of the relationship with the Policyowner satisfactory to Hong Kong Life; and

- The age of Spouse of the Policyowner must be under the age of sixty [60] or the age of Child of the Policyowner must attain fifteen [15] days and under the age of eighteen [18] at the time of application, and satisfactory proof of age to Hong Kong Life is required; and

- A written request in the form prescribed by Hong Kong Life must be submitted by the Policyowner.

Hong Kong Life reserves the right not to accept any application for the Family Daily Hospital Income Benefit and has the absolute discretion to determine the administrative rules and requirements in respect of the application for the Family Daily Hospital Income Benefit from time to time.

Once the application for the Family Daily Hospital Income Benefit to cover a Family Member is accepted and approved by Hong Kong Life, such Family Member will become a Covered Family Member, who will be covered under the Family Daily Hospital Income Benefit of the Plan and the coverage of insurance benefit will take effect on the date the application was endorsed by Hong Kong Life by way of a written endorsement to be issued by Hong Kong Life during the lifetime of the Policyowner, Life Insured and the Family Member. Hong Kong Life shall not be responsible for any payment made or other action taken before the date of such endorsement.

- Only one [1] Covered Family Member of the Policyowner who meets the eligibility of Family Member can be covered as the Covered Family Member under Family Daily Hospital Income Benefit.

- Provided that no claim is made under Family Daily Hospital Income Benefit, the Policyowner may request for a change of Covered Family Member while the Policy is in force and the Life Insured is alive, subject to the specific terms and conditions, and the then administrative rules as determined by Hong Kong Life from time to time.

- Family Daily Hospital Income Benefit for the Covered Family Member who is the Spouse shall terminate on the Policy Anniversary on or immediately following such Covered Family Member's seventieth [70th] birthday.

- Family Daily Hospital Income Benefit for the Covered Family Member who is the Child shall terminate on the Policy Anniversary on or immediately following such Covered Family Member's eighteenth [18th] birthday.

- Family Daily Hospital Income Benefit is only payable for the Covered Family Member if such Covered Family Member still meets the eligibility of Family Member upon a claim is made.

- Family Daily Hospital Income Benefit for the Covered Family Member will cease automatically upon the termination of the Plan.

- Upon a transfer of the ownership of the Policy pursuant to the "Ownership" clause of the General Provisions of the Policy, Family Daily Hospital Income Benefit of the Plan will be terminated automatically and cannot be restored.

- Upon the death of the Policyowner, Family Daily Hospital Income Benefit of the Plan will be terminated automatically and cannot be restored.

- Policyowner may submit a written request in the form prescribed by Hong Kong Life at any time to remove a Covered Family Member. Upon the request for removal of a Covered Family Member is accepted and approved by Hong Kong Life, the Plan shall cease to provide the Family Daily Hospital Income Benefit for such Family Member commencing on the date of such request is recorded and endorsed by Hong Kong Life.

The Daily Hospital Income Benefit [and Family Daily Hospital Income Benefit, where applicable] and Intensive Care Benefit of the Plan shall not cover any claims caused directly or indirectly, wholly or partly, by any one of the following occurrences:

- any hospitalization or charges incurred as a result of any pre-existing condition or illness the symptoms of which first occurred in the five [5] years prior to or within thirty [30] days following the Issue Date, date of endorsement or date of any reinstatement of the Plan, whichever is later;

- suicide or self-inflicted injuries while sane or insane;

- war whether declared or undeclared or any act thereof, invasion, civil commotion, riots or any warlike operations;

- service in the armed forces in time of declared or undeclared war or while under orders for warlike operations or restoration of public order; or violation or attempted violation of the law or resisting arrest or participation in any brawl or affray;

- engaging in or taking part in [a] driving or riding in any kind of race; [b] professional sports; [c] underwater activities involving the use of breathing apparatus; [d] flying or other aerial activity except as a fare-paying passenger in a commercial aircraft;

- Injury or Sickness sustained whilst the Life Insured [or the Covered Family Member, where applicable] is under the influence of alcohol or drugs and treatment in connection with addiction to drugs or alcohol;

- routine physical examinations, health check-ups or tests, rest cure, sanatorium care, vaccinations, immunization injections, preventive medication or any treatment which is not Medically Necessary;

- dental treatment or eye examinations, dentures, glasses or hearing aids or the fitting of any thereof, cosmetic surgery or plastic surgery, except and to the extent that any of such treatment is necessary for the cure or alleviation of Injury to the Life Insured [or the Covered Family Member, where applicable];

- Human Immunodeficiency Virus [HIV] infection, except and to the extent that such infection occurs through an accidental cut or wound, and/or any HIV-related illness including AIDS and/or any mutations, derivations or variations thereof; venereal diseases, sexually transmitted diseases, infertility, sterilization or psychiatric treatment; mental or nervous diseases or disorder including but not restricted to anorexia nervosa, anxiety, depression, mania, neurosis, paranoid, psychosis and schizophrenia; congenital deformities and anomalies that gives rise to signs or symptoms, or is diagnosed before the Life Insured [or the Covered Family Member, where applicable) reaches age fourteen [14];

- childbirth, pregnancy, miscarriage or abortion;

- treatment or surgery for tonsils, adenoids or hernia until the Life Insured [or the Covered Family Member, where applicable] has been continuously covered under the Plan for a period of one hundred and twenty [120] days immediately preceding such treatment or surgery.

-

Basic Plan

Risk

Exchange Rate Risk

You are subject to exchange rate risks for the Policy denominated in currencies other than the local currency. Exchange rates fluctuate from time to time. You may suffer a loss of your benefit values and the subsequent premium payments [if any] may be higher than your initial premium payment as a result of exchange rate fluctuations.

Liquidity Risk / Long Term Commitment

The Plan is designed to be held until the Maturity / Expiry Date. If you terminate the Policy prior to the Maturity / Expiry Date, a loss of the premium paid may be resulted.

The premium of the Plan should be paid in full for the whole payment term. If you discontinue the payment, the Policy may lapse and a loss of the premium paid may be resulted.

Credit Risk of Issuer

The life insurance product is issued and underwritten by Hong Kong Life. The premium to be paid by you would become part of the assets of Hong Kong Life and that you and your Policy are subject to the credit risk of Hong Kong Life. In the worst case, you may lose all the premium paid and benefit amount.

Inflation Risk

When reviewing the values shown in the Insurance Proposal, please note that future medical costs / cost of living in the future is likely to be higher than it is today due to inflation.

Important Policy Provisions

Suicide

If the Life Insured commits suicide, while sane or insane, within one [1] year from the Issue Date or date of any reinstatement, whichever is later, the liability of Hong Kong Life shall be limited to a refund of paid premiums to the Beneficiary without interest less any existing Indebtedness. In the case of reinstatement, such refund of premium shall be calculated from the date of reinstatement.

Incontestability

The validity of the Policy shall not be contestable except for [i] the non-payment of premiums, [ii] fraud or [iii] misstatement of age and/or sex as specified in the Misstatement of Age and/or Sex provisions, after it has been in force during the lifetime of the Life Insured for two [2] years from the Issue Date or the date of any reinstatement, whichever is later. Premiums paid will not be refunded should the Policy be voided by Hong Kong Life.

Automatic Termination

The Plan shall terminate automatically:

- upon the death of the Life Insured; or

- if and when the Plan matures or is surrendered; or

- if and when a premium remains unpaid at the end of the Grace Period as specified in the General Provisions; or

- on the Policy Anniversary on or immediately following the Life Insured's seventieth [70th] birthday.

Others

Insurance Costs

Part of the premium pays for the insurance and related costs [if any].

Cooling-off Period

If you are not satisfied with your Policy, you have a right to cancel it within the cooling-off period and obtain a refund of any premium[s] and levy[ies] paid [in the original payment currency] to Hong Kong Life without any interest. A written notice signed by you should be received directly by Hong Kong Life Insurance Limited at 15/F Cosco Tower, 183 Queen's Road Central, Hong Kong within the cooling-off period [that is, the period of 21 calendar days immediately following either the day of delivery of the Policy or the Cooling-off Notice to you or your nominated representative [whichever is the earlier]]. After the expiration of the cooling-off period, if you cancel the Policy before the end of the term, the Surrender Value [if applicable] may be less than the Total Premiums Paid.

Cancellation

While the Plan is in force and the Life Insured is alive, the Policyowner may surrender the Policy prior to the Maturity Date for the Surrender Benefit as specified in "Surrender Benefit" clause of the Benefit Provisions of the Policy, provided that no Death Benefit has been paid or become payable under the Policy by submitting Hong Kong Life a written request with the return of the Policy, subject to the specific terms and conditions, and the then administrative rules as determined by Hong Kong Life from time to time.

Once surrendered, the Policy shall terminate. Hong Kong Life shall have no further liability under the Policy.

Non-Protected Deposit

The Plan is not equivalent to, nor should it be treated as a substitute for, time deposit. The Plan is not a protected deposit and is not protected by the Deposit Protection Scheme in Hong Kong.

Dispute on Selling Process and Product

Chong Hing Bank Limited, CMB Wing Lung Bank Limited, OCBC Bank [Hong Kong] Limited and Shanghai Commercial Bank Limited [collectively "Appointed Licensed Insurance Agencies" and each individually "Appointed Licensed Insurance Agency"] are the Appointed Licensed Insurance Agencies of Hong Kong Life, and the life insurance product is a product of Hong Kong Life but not the Appointed Licensed Insurance Agencies. In respect of an eligible dispute [as defined in the Terms of Reference for the Financial Dispute Resolution Centre in relation to the Financial Dispute Resolution Scheme] arising between the Appointed Licensed Insurance Agency and the customer out of the selling process or processing of the related transaction, Appointed Licensed Insurance Agency is required to enter into a Financial Dispute Resolution Scheme process with the customer; however any dispute over the contractual terms of the life insurance product should be resolved between Hong Kong Life and the customer directly.

The above information is for reference and is applicable within Hong Kong only. Unless otherwise specified, the defined terms used in the above information should have the same meanings as given to them in the policy document. If there is any conflict between the above information and the policy document, the latter shall prevail. The copy of the policy document is available upon request. Before applying for the insurance plan, you may refer to the contents and terms of the policy document. You may also seek independent and professional advice before making any decision.