Underwritten by: Hong Kong Life Insurance Limited

Appointed Licensed Insurance Agency: Chong Hing Bank Limited, CMB Wing Lung Bank Limited, OCBC Bank (Hong Kong) Limited and Shanghai Commercial Bank Limited

A Multi-Currency Wealth Solution to Flourish Perpetual Legacy

In a global landscape teeming with boundless potential, your visionary mindset empowers you to transcend the constraints of the ordinary and forge a path towards your aspirations without limits. We comprehend that cultivating an agile financial solution integrated with a prospective wealth succession plan is pivotal in catering to the needs for you and your beloved ones.

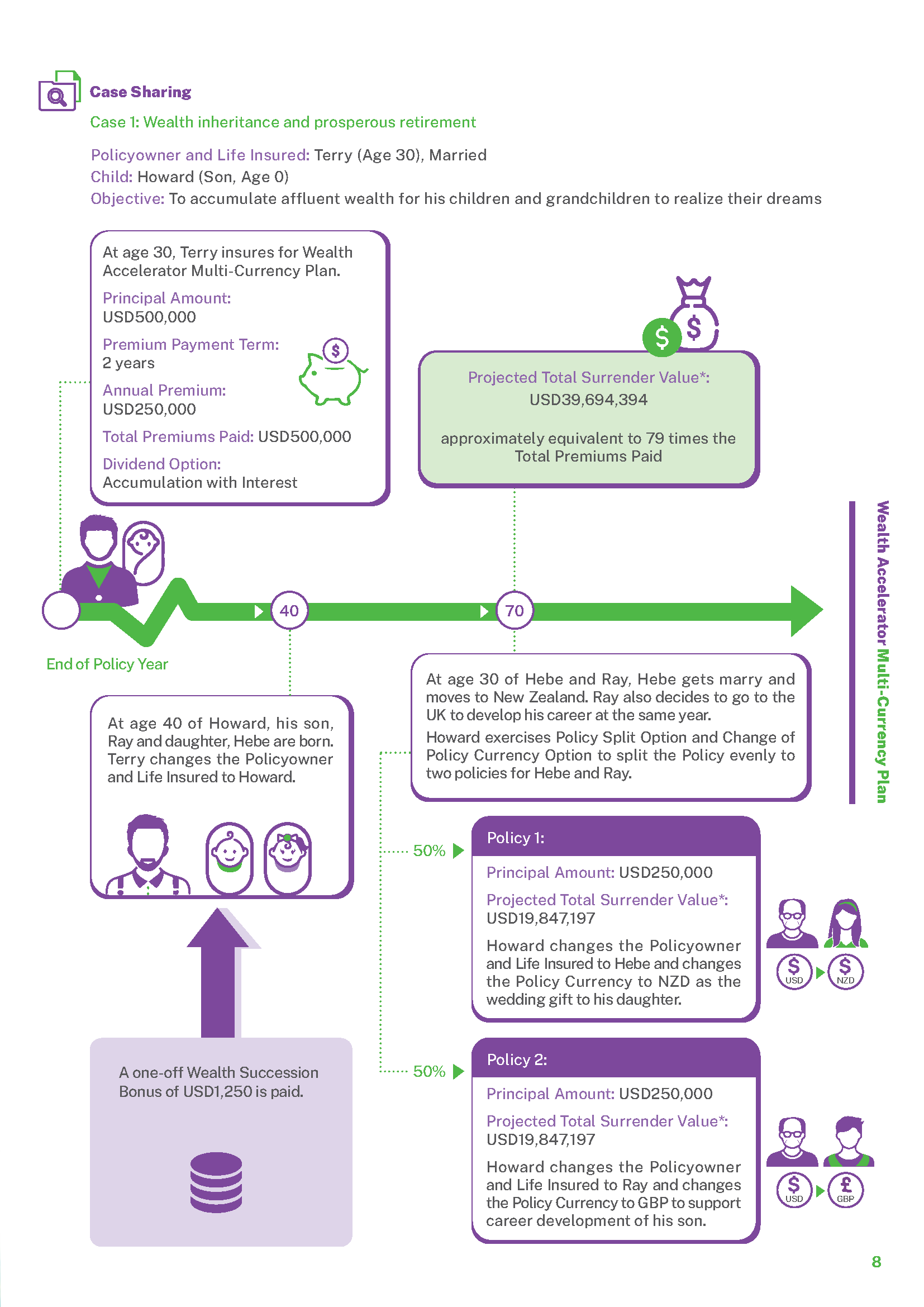

Wealth Accelerator Multi-Currency Plan (The "Plan") is a life protection plan which caters to long term savings target and aims to accumulate your capital with potentially higher returns. The Plan offers Change of Policy Currency Option and Policy Split Option to help you navigate financial risks and seize emerging opportunities in global market. In addition, the Plan is further equipped with features including Wealth Succession Bonus and flexible Contingent Life Insured Arrangement, enables you to architect a comprehensive and sustainable legacy plan.

Multiple Premium Payment Term1 for selection with Extended Life Protection

The Plan provides 3 choices of Premium Payment Term1, i.e. 2 years1, 5 years1 and 10 years1, with extended life protection until age 130 of the Life Insured. If the Policyowner chooses for a change of Life Insured2, life protection will be extended to age 130 of the New Life Insured.

Additional Return

The Plan not only provides Guaranteed Cash Value, Annual Dividend (non-guaranteed)3 may also be distributed annually in terms of cash starting from the end of 2nd Policy Year. You can choose cash withdrawal or leaving it with the Policy for interest accumulation3 to meet your personal needs.

In addition, Terminal Dividend (non-guaranteed)3 may be payable at or after the end of 4th Policy Year when the Policy is fully surrendered by the Policyowner, upon the death of the Life Insured (provided that there is no named and surviving Contingent Life Insured who will become the new Life Insured) or upon Policy Maturity, whichever is earlier.

When the Policy is partially surrendered4 (including the partial surrender4 automatically triggered for the Incapacity Benefit5), Terminal Dividend (non-guaranteed)3 may be payable at or after the end of 4th Policy Year. The payable amount is equal to the Terminal Dividend (non-guaranteed)3 attributable to the reduced portion of Principal Amount6. Terminal Dividend (non-guaranteed)3 will not accumulate in the Policy.

Flexible Wealth Management to Seize Opportunities across Global Markets

- Change of Policy Currency Option7

Starting from the 3rd Policy Anniversary while the Plan is in force and the Life Insured is alive, the Policyowner can apply for a change of policy currency7 to change the current Policy Currency of the Policy to a different currency ("New Policy Currency"), including HKD, USD, RMB, AUD, CAD, EUR, GBP, NZD or SGD (subject to availability as determined by Hong Kong Life at the time of applying the change of policy currency7). This allows you to flexibly allocate your currency mix in line with market trends and to meet your personal needs, enhancing the potential for wealth growth. The Change of Policy Currency Option7 has a maximum limit of 1 time per Policy Year.

- Policy Split Option8

Starting from the 1st Policy Anniversary while the Plan is in force and the Life Insured is alive, the Policyowner can apply for a policy split8 to split the Policy to one separate new policy or multiple separate new policies ("Split Policy(ies)"), by transferring a designated portion of the Principal Amount6 of the Basic Plan of the Policy to each of the Split Policy(ies). This option can be used in conjunction with the Change of Policy Currency Option7 to appropriately address changes in your life planning. It can also be used in conjunction with the Change of Life Insured Option2 to meet your wealth succession arrangement. The Policy Split Option8 has a maximum limit of 1 time per Policy Year.

- Withdrawal Arrangement

The Policyowner may make a one-off or regular withdrawal from the cash value of the Policy (including the Guaranteed Cash Value (if any), Accumulated Dividends and Interest (non-guaranteed)3,9(if any) and Terminal Dividend (non-guaranteed)3(if any)) according to his/ her needs in order to fulfill the dreams like children's education and fruitful retirement, etc. However, the future cash value of the Policy will be reduced accordingly.

After the Policy has acquired a Guaranteed Cash Value, the Policyowner can opt for Partial Surrender4 after the 1st Policy Anniversary (applicable to 2-year Premium Payment Term) / 2nd Policy Anniversary (applicable to 5/10-year Premium Payment Term) to withdraw the Guaranteed Cash Value and Terminal Dividend (non-guaranteed)3(if any) attributable to the reduced portion of Principal Amount6 of the Policy.

Comprehensive Wealth Succession Plan to Cultivate Wealth across Generations

- Change of Life Insured Option2

While the Plan is in force and the Life Insured is alive, the Policyowner may change the Life Insured2 for unlimited times starting from the 1st Policy Anniversary.

- Wealth Succession Bonus10

To encourage you to outline your wealth succession planning, the Plan offers Wealth Succession Bonus10. In the event of change of Life Insured2 be accepted and approved by Hong Kong Life while the Plan is in force, Policyowner will receive a one-off Wealth Succession Bonus10 which the amount equals to 1% of the Total Premiums Paid (subject to the maximum amount of HKD10,000 (or its equivalent in a currency other than HKD)). You can enjoy the joy of passing on your wealth as the policy can be continued while the Policyowner can also be rewarded.

- Contingent Policyowner Arrangement11

To safeguard the wealth management planning, during the lifetime of the Life Insured and while the Plan is in force, the Policyowner can designate up to 3 Contingent Policyowner(s) and designate the sequence of Contingent Policyowner to become the new Policyowner of the Policy in the event of death of the Policyowner. The ownership of the Policy will be transferred to the Contingent Policyowner according to the specified sequence in the event of death of the Policyowner. If the Policyowner requests to designate a split of the Policy under Contingent Life Insured arrangement by allocating a designated portion of the Principal Amount6 of the Policy to multiple separate new policy(ies) ("Designated Policy(ies)") in the event of death of the Life Insured, for each Designated Policy, the Policyowner can designate up to 3 Contingent Policyowner(s) and designate the sequence of Contingent Policyowner(s) to become the new Policyowner of such Designated Policy in the event of death of the Policyowner.

In the event of the death of the Policyowner, the Contingent Policyowner of first in sequence will become the new Policyowner. If the Contingent Policyowner of first in sequence cannot become the new Policyowner, the Contingent Policyowner of second in sequence will be arranged to become the new Policyowner, and so on.

- Contingent Life Insured Arrangement12

To lower the impacts of any sudden events and ensure that your wealth can be passed on through generations according to your wishes, the Policyowner can designate up to 3 Contingent Life Insured(s) while the Plan is in force and the Life Insured is alive and designate the sequence of Contingent Life Insured(s) to become the new Life Insured of the Policy in the event of death of the Life Insured. Policyowner may also request to designate a split of the Policy by allocating a designated portion of the Principal Amount6 of the Policy to multiple separate new policy(ies). For each Designated Policy, the Policyowner can designate up to 3 Contingent Life Insured(s) and designate the sequence of Contingent Life Insured(s) to become the new Life Insured of such Designated Policy in the event of death of the Life Insured. The designated portion of the Principal Amount6 to be allocated from the Policy to each of Designated Policy must be specified by the Policyowner and is subject to the minimum amount or any other relevant requirements as determined by Hong Kong Life from time to time.

In the event of the death of the Life Insured on or after the 1st Policy Anniversary, the Contingent Life Insured of first in sequence will become the new Life Insured. If the Contingent Life Insured of first in sequence cannot become the new Life Insured, the Contingent Life Insured of second in sequence will be arranged to become the new Life Insured, and so on. This ensures the Policy continues and avoids termination in the sudden event of the death of the Life Insured.

Extensive Life Protection for Peace of Mind

- Life Protection

When the Life Insured dies and provided that there is no named and surviving Contingent Life Insured who will become the new Life Insured, the Total Death Benefit will be paid to the Beneficiary as below:

| Policy Year | Total Death Benefit | |

|---|---|---|

|

|

100% of Total Premiums Paid | less Indebtedness (if any) |

|

3 and onwards |

101% of Total Premiums Paid OR 100% of Guaranteed Cash Value as at the date of death of the Life Insured |

plus Accumulated Dividends and Interest (non-guaranteed)3,9 (if any) and Terminal Dividend (non-guaranteed)3(if any), less Indebtedness (if any) |

In case of Partial Surrender4, the Principal Amount6 shall be reduced proportionally based on the percentage of Guaranteed Cash Value and Terminal Dividend (non-guaranteed)3(if any) being withdrawn for the Partial Surrender4. Upon the reduction of Principal Amount6, the Guaranteed Cash Value, Annual Dividend (non-guaranteed)3(if any), Terminal Dividend(non-guaranteed)3(if any), premium (if any) and Total Premiums Paid of the Plan shall be reduced proportionately. Total Death Benefit shall also be adjusted accordingly.

- Flexible Death Benefit Settlement Options13

The Plan provides flexible Death Benefit Settlement Options13. Instead of receiving the Death Benefit in a lump sum payment, Policyowner can designate one of the following settlement options while the Plan is in force and the Life Insured is alive to settle the Death Benefit to the Beneficiary. If there is more than one Beneficiary named in the Policy, different settlement options can be specified for different Beneficiaries. For more flexibility of estate planning, the date to start the first installment payment can also be chosen.

- Installment Payments (Fixed Amount)

Death Benefit will be paid in fixed amount at regular intervals (monthly, quarterly, semi-annually or annually), and the date of first installment payment can also be specified. - Installment Payments (Fixed Period)

Death Benefit will be paid in installments (monthly, quarterly, semi-annually or annually) for an agreed fixed payment period, and the date of first installment payment can also be specified. - Partial Installment Payments (Fixed Amount)

A designated percentage of Death Benefit will be paid in a lump sum. The unpaid balance of Death Benefit will be paid in fixed amount at regular intervals (monthly, quarterly, semi-annually or annually), and the date of first installment payment can also be specified. - Partial Installment Payments (Fixed Period)

A designated percentage of Death Benefit will be paid in a lump sum. The unpaid balance of Death Benefit to be paid in installments (monthly, quarterly, semi-annually or annually) for an agreed fixed payment period, and the date of first installment payment can also be specified. - Partial Installment Payments until the Designated Age of the Beneficiary

Death Benefit will be paid in fixed amount at regular intervals (monthly, quarterly, semi-annually or annually) before the Designated Age of the Beneficiary, and the date of first installment payment can also be specified. The unpaid balance of Death Benefit (if any) will be paid in a lump sum at the Designated Age of the Beneficiary. - Increasing Installment Payments

Death Benefit will be paid by increasing installments (monthly, quarterly, semi-annually or annually), and the date of first installment payment can also be specified. Death Benefit will be paid in a specified amount for the first installment. The subsequent installments will be increased by 3% each year starting from the second year until Death Benefit is fully settled.

Other Benefits and Items

- Incapacity Benefit5

In the face of uncertainties of life, apart from planning for your loved one, you also need to be thoughtful to yourself in order to ensure everything is taken care of. The Plan provides Incapacity Benefit5, which the Policyowner can designate one person ("Incapacity Benefit Recipient") to receive the Incapacity Benefit5 and the percentage ("Incapacity Benefit Percentage") for the amount of Incapacity Benefit5 while the Plan is in force and the Life Insured is alive. In the event that the Policyowner is diagnosed of a Covered Illness while the Policy is in force, the Incapacity Benefit5 will be paid to the Incapacity Benefit Recipient during the lifetime of the Policyowner. This provides immediate financial supporting to your family to cope with the medical and rehabilitation expenses. Incapacity Benefit5 can only be paid once for each Policy.

- Accidental Death Benefit14

The Plan provides Accidental Death Benefit14 for the first 5 Policy Years. Regardless of the presence of named and surviving Contingent Life Insured, if the Life Insured dies because of accident, an extra benefit equals to 30% of the first year premium of the Plan will be paid to the Beneficiary.

- Accidental Waiver of Premium15

If the Life Insured becomes totally and permanently disabled due to accident and loses his/her working ability before the Life Insured's 60th birthday for 6 consecutive months or above, premiums payable of the Plan will be waived within the period of disability.

- Accidental Payor Benefit16

Regardless of the presence of named and surviving Contingent Policyowner, if the Policyowner dies due to accident or becomes totally and permanently disabled due to accident and loses his/her working ability before the Policyowner's 60th birthday or the Life Insured's 25th birthday (whichever is earlier) for 6 consecutive months or above, premiums payable of the Plan will be waived upon the death of the Policyowner or within the period of disability.

- Insurance Standby Trust Allowance / Tax or Legal Advisory Allowance for Legacy Planning / Health Check-up Allowance (collectively called the "Allowance") 17

Subject to the Principal Amount requirement of the Allowance while the Policy is issued, the Policyowner can enjoy one of the following Allowances17 of up to HKD8,000 after the expiry of cooling off period and during the first 3 Policy Year while the Policy is in force.17

- Insurance Standby Trust Allowance17

- Tax or Legal Advisory Allowance for Legacy Planning17

- Health Check-up Allowance17

Fixed Premium for Your Better Planning

The premium will remain unchanged throughout the Premium Payment Term1, allowing you to have a better plan for your future.

Simple Application

The Life Insured will not have to go through any medical examination, up to a certain Principal Amount6 subject to the prevailing administrative rules as determined by Hong Kong Life.

| Premium Payment Term1 | 2 Years | 5 Years | 10 Years |

|---|---|---|---|

| Issue Age* | Age 0 (15 days after birth) to 80 | Age 0 (15 days after birth) to 75 | Age 0 (15 days after birth) to 70 |

| Policy Currency | HKD / USD / RMB / AUD / CAD / EUR / GBP / NZD / SGD | ||

| Benefit Term | Until age 130 of the New Life Insured | ||

| Minimum Principal Amount6 | HKD240,000 / USD30,000 / RMB216,000 / AUD48,000 / CAD48,000 / EUR30,000 / GBP24,000 / NZD48,000 / SGD48,000 | ||

| Premium Payment Mode | Annual / Semi-annual / Quarterly / Monthly+ | ||

*Age means age of the Life Insured at the last birthday

+Monthly mode is only applicable to HKD and USD policies

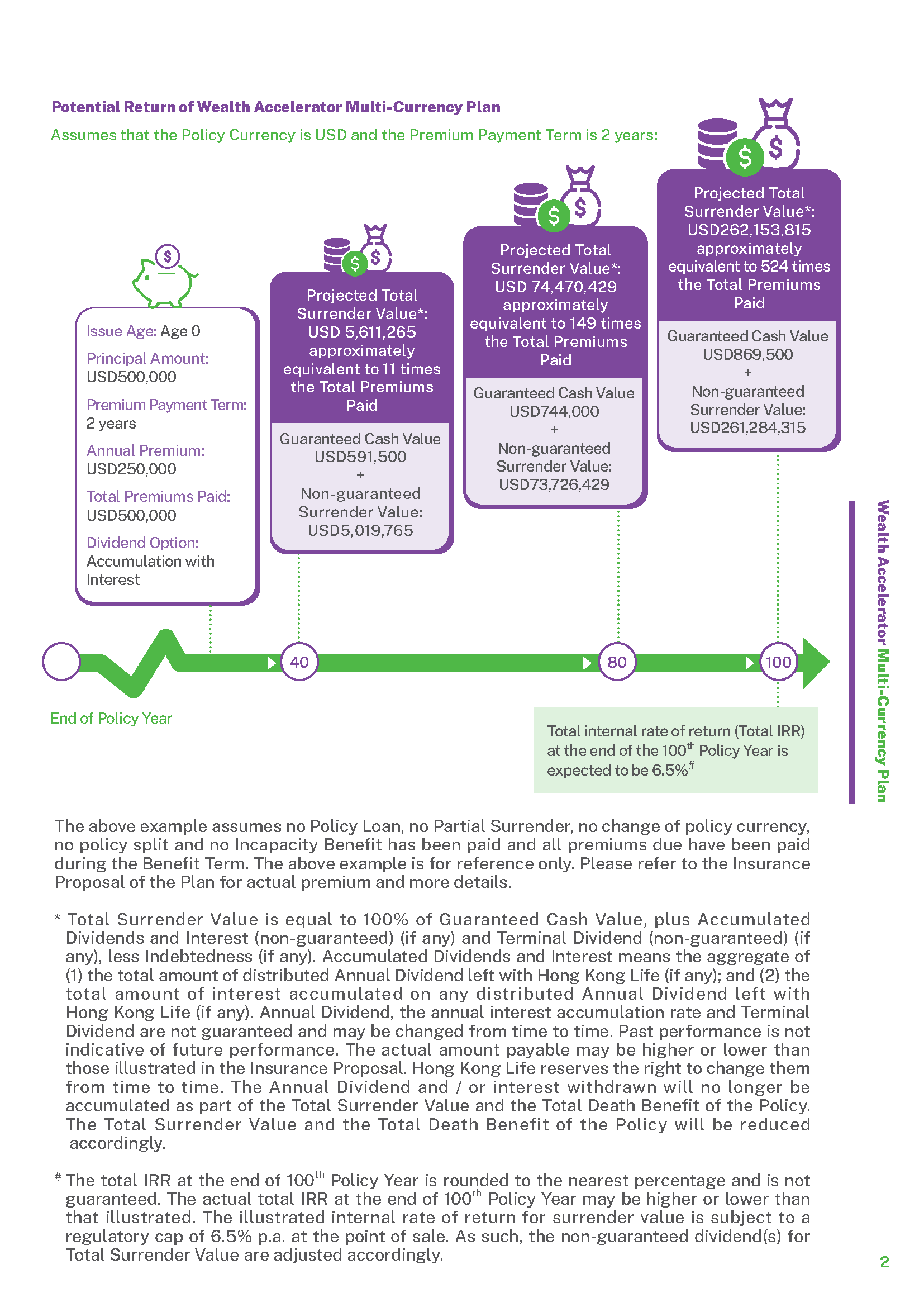

The above example assumes no Policy Loan, no Partial Surrender, no Incapacity Benefit has been paid and all premiums due have been paid during the Benefit Term. The above example is for reference only. Please refer to the Insurance Proposal of the Plan for actual premium and more details. The illustrated internal rate of return for surrender value is subject to a regulatory cap of 6.5% p.a. at the point of sale. As such, the non-guaranteed dividend(s) for Total Surrender Value are adjusted accordingly.

* Total Surrender Value is equal to 100% of Guaranteed Cash Value, plus Accumulated Dividends and Interest (non-guaranteed) (if any) and Terminal Dividend (non-guaranteed) (if any), less Indebtedness (if any). Accumulated Dividends and Interest means the aggregate of (1) the total amount of distributed Annual Dividend left with Hong Kong Life (if any); and (2) the total amount of interest accumulated on any distributed Annual Dividend left with Hong Kong Life (if any). Annual Dividend, the annual interest accumulation rate and Terminal Dividend are not guaranteed and may be changed from time to time. Past performance is not indicative of future performance. The actual amount payable may be higher or lower than those illustrated in the Insurance Proposal. Hong Kong Life reserves the right to change them from time to time. The Annual Dividend and/or interest withdrawn will no longer be accumulated as part of the Total Surrender Value and the Total Death Benefit of the Policy. The Total Surrender Value and the Total Death Benefit of the Policy will be reduced accordingly.

Change of Life Insured Option, Change of Policy Currency Option and Policy Split Option are subject to the terms and conditions, and the then administrative rules as determined by Hong Kong Life from time to time. For detailed terms and conditions, please refer to the policy document issued by Hong Kong Life. For risk from exercising Change of Policy Currency Option, please refer to the important statement of this product leaflet.

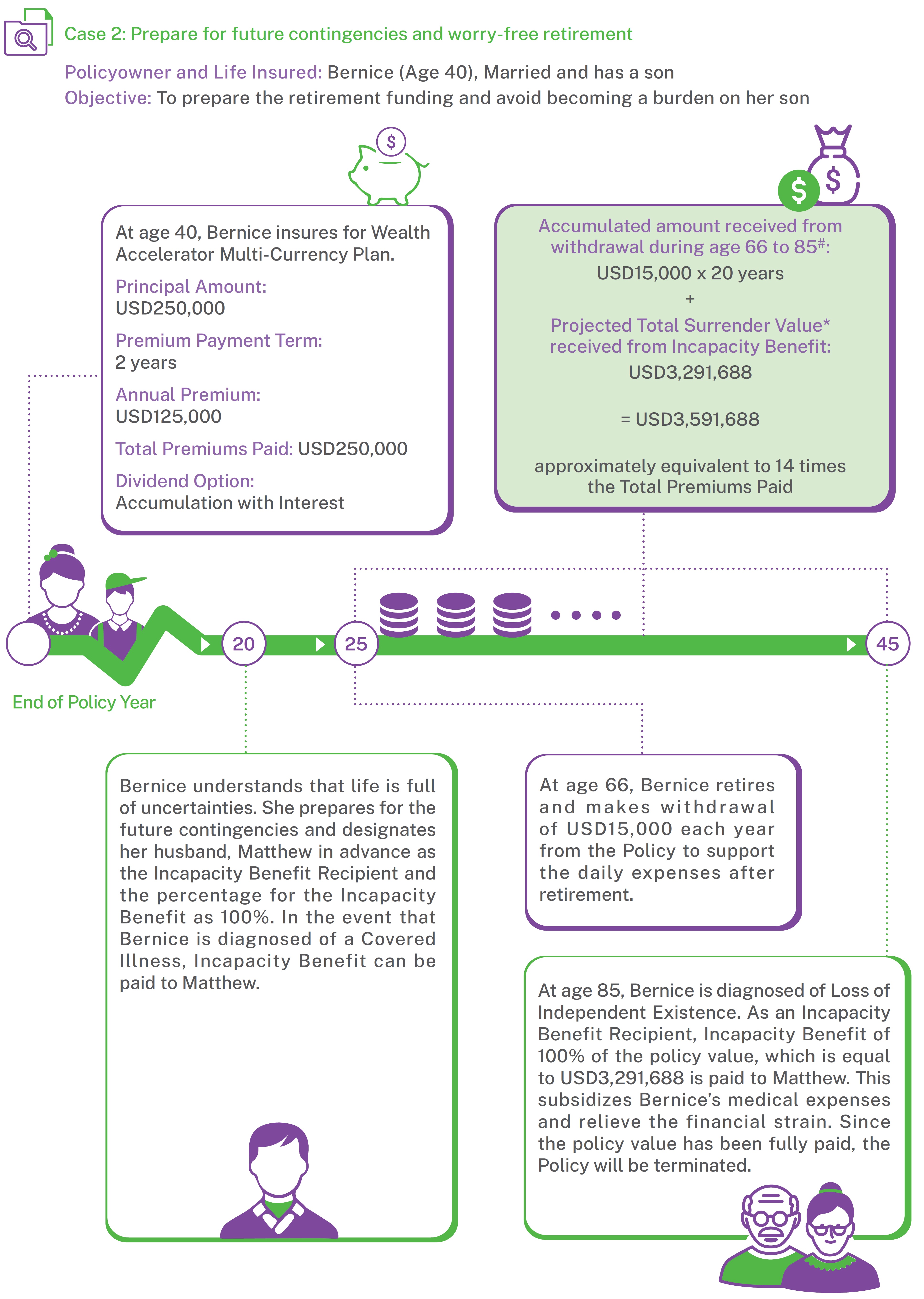

The above example assumes no Policy Loan, no change of policy currency, no policy split and all premiums due have been paid during the Benefit Term. The above example is for reference only. Please refer to the Insurance Proposal of the Plan for actual premium and more details.

# Cash withdrawal will be first deducted from Accumulated Dividends and Interest (non-guaranteed)(if any). If the withdrawal amount exceeds the amount of Accumulated Dividends and Interest (non-guaranteed)(if any), it will be withdrawn from Guaranteed Cash Value and Terminal Dividend (nonguaranteed)(if any) by reducing the Principal Amount of the Policy. Hence, the Guaranteed Cash Value, Accumulated Dividends and Interest (non-guaranteed)(if any) and Terminal Dividend (non-guaranteed)(if any) thereafter, as well as the Total Premiums Paid used for calculating the Total Death Benefit will be adjusted according to the reduced Principal Amount. The actual withdrawal amount and period will be calculated according to the actual non-guaranteed benefits payable and may be different from the above withdrawal amount and period.

* Total Surrender Value is equal to 100% of Guaranteed Cash Value, plus Accumulated Dividends and Interest (non-guaranteed) (if any) and Terminal Dividend (non-guaranteed) (if any), less Indebtedness (if any). Accumulated Dividends and Interest means the aggregate of (1) the total amount of distributed Annual Dividend left with Hong Kong Life (if any); and (2) the total amount of interest accumulated on any distributed Annual Dividend left with Hong Kong Life (if any). Annual Dividend, the annual interest accumulation rate and Terminal Dividend are not guaranteed and may be changed from time to time. Past performance is not indicative of future performance. The actual amount payable may be higher or lower than those illustrated in the Insurance Proposal. Hong Kong Life reserves the right to change them from time to time. The Annual Dividend and/or interest withdrawn will no longer be accumulated as part of the Total Surrender Value and the Total Death Benefit of the Policy. The Total Surrender Value and the Total Death Benefit of the Policy will be reduced accordingly.

Incapacity Benefit is subject to the applicable laws and regulations, terms and conditions, and the then administrative rules as determined by Hong Kong Life from time to time. For detailed terms and conditions, please refer to the policy document issued by Hong Kong Life.

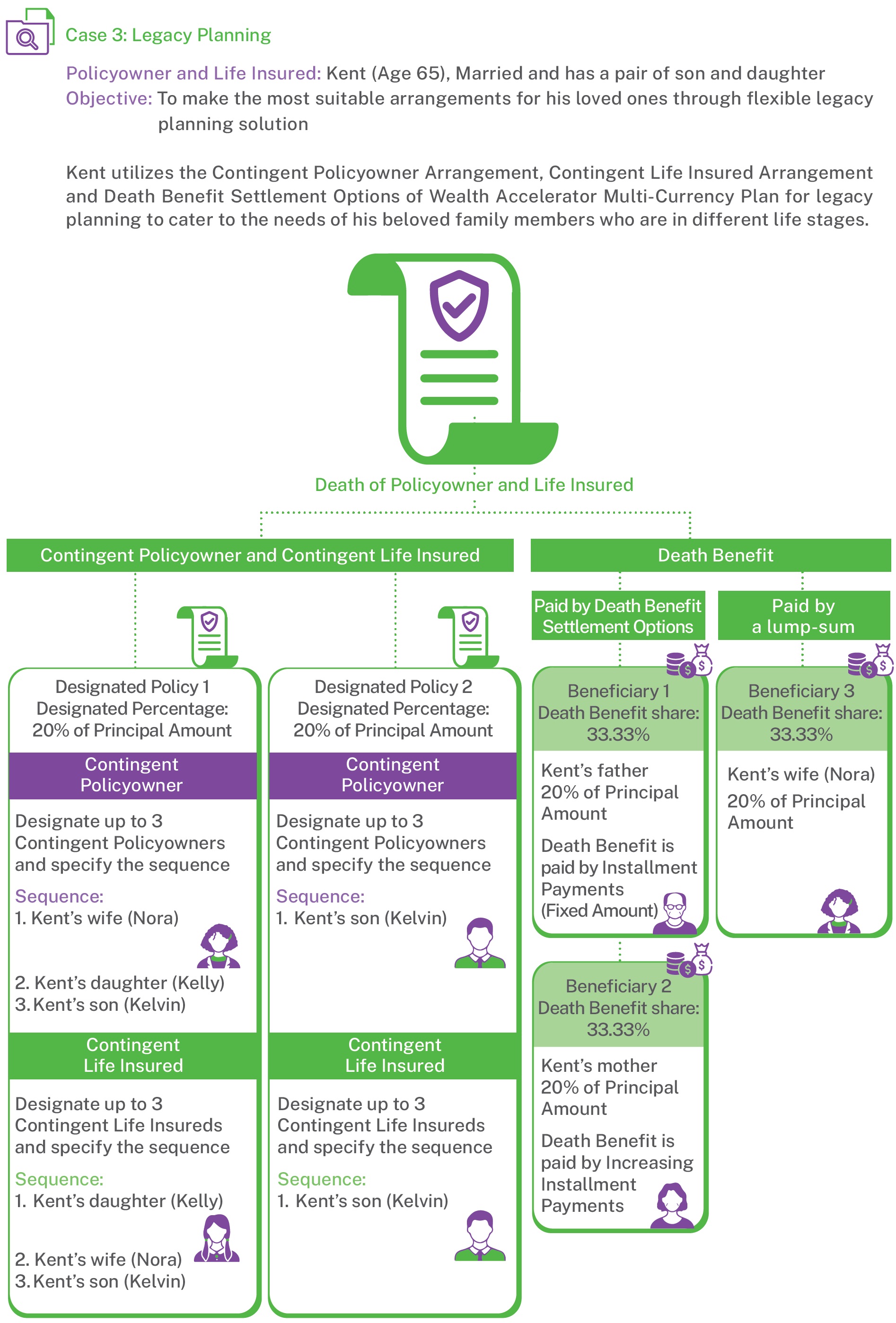

Upon the death of Kent after the 1st Policy Anniversary, according to his designation when he was alive, 20% of the Principal Amount of the Policy will be split to Designated Policy 1. As the first Contingent Life Insured of this Designated Policy, Kent's daughter (Kelly) will become the New Life Insured of Designated Policy 1. At the same time, 20% of the Principal Amount of the Policy will be split to Designated Policy 2. As the first Contingent Life Insured of this Designated Policy, Kent's son (Kelvin) will become the New Life Insured of Designated Policy 2. As Kent is also the Policyowner, upon his death, his wife (Nora), as the first Designated Contingent Policyowner of the Designated Policy 1, will become the new Policyowner of the Designated Policy 1; and Kent's son (Kelvin), as the first Designated Contingent Policyowner of the Designated Policy 2, will become the new Policyowner of the Designated Policy 2. The Death Benefit in respect of the remaining 60% of Principal Amount of the Policy will be paid to Kent's father, mother and his wife, Nora according to the death benefit share (i.e. 33.33% of Death Benefit which is equivalent to 20% of Principal Amount for each) and death benefit payment arrangement specified by Kent.

The above example is for reference only. Designation of Contingent Policyowner, Designation of Contingent Life Insured and Death Benefit Settlement Options are subject to the terms and conditions, and the then administrative rules as determined by Hong Kong Life from time to time. For detailed terms and conditions, please refer to the policy document issued by Hong Kong Life.

- The Policy will be terminated if the Policyowner cannot settle the premium payment before the end of the Grace Period during the Premium Payment Term, subject to the Automatic Premium Loan (Automatic Premium Loan is only applicable to 5/10-year Premium Payment Term), Non-forfeiture Option and other relevant provisions of the Policy. For detailed terms and conditions, please refer to the policy document issued by Hong Kong Life. If the Policy is terminated before the Policy Maturity, the Total Surrender Value (if applicable) received by the Policyowner may be less than the Total Premiums Paid.

- Change of Life Insured is subject to the administrative rules and requirements as determined by Hong Kong Life from time to time. The Principal Amount, Guaranteed Cash Value, Annual Dividend (if any), Terminal Dividend (if any), premium (if any), Total Premiums Paid, Policy Date, Issue Date, Premium Payment Term, Policy Years and Indebtedness (if any) will remain unchanged on the date of endorsement unless the change of Life Insured may trigger consequential adjustment in the Principal Amount and/or other policy value(s). The Maturity Date of the Policy will change based on the Age of the New Life Insured. At the time Hong Kong Life receives the written request, the proposed New Life Insured's age must fulfill the issue age requirement and must not be older than the Initial Life Insured. Also, evidence of insurability including the insurable interest for the proposed New Life Insured shall be submitted. In addition, the New Life Insured and the Previous Life Insured must be alive on the date of endorsement. All Supplementary Benefit(s) (if any) for the Previous Life Insured will be terminated automatically on the date of endorsement and no unearned premium shall be refunded. The relevant Supplementary Benefit(s) can be applied in respect of the New Life Insured subject to the underwriting and administrative rules and requirements as determined by Hong Kong Life from time to time. Any Contingent Policyowner and Contingent Life Insured of the Policy as previously recorded and endorsed by Hong Kong Life will be automatically cancelled and removed once the application for the change of Life Insured is accepted and approved by Hong Kong Life. For detailed terms and conditions, please refer to the policy document issued by Hong Kong Life.

- Annual Dividend, the annual interest accumulation rate and Terminal Dividend are not guaranteed and may be changed from time to time. Past performance is not indicative of future performance. The actual amount payable may be higher or lower than those illustrated in the Insurance Proposal. Hong Kong Life reserves the right to change them from time to time. The Annual Dividend and/or interest withdrawn will no longer be accumulated as part of the Total Surrender Value and the Total Death Benefit of the Policy. The Total Surrender Value and the Total Death Benefit of the Policy will be reduced accordingly.

- If Partial Surrender is exercised in the Policy, the Principal Amount shall be reduced proportionally based on the percentage of Guaranteed Cash Value and Terminal Dividend (if any) being withdrawn for the Partial Surrender. Upon the reduction of Principal Amount, the Guaranteed Cash Value, Annual Dividend (if any), Terminal Dividend (if any), premium (if any) and Total Premiums Paid of the Plan shall be reduced proportionately. Death Benefit, Maturity Benefit, Wealth Succession Bonus (if any) and Incapacity Benefit (if any) shall also be adjusted accordingly. Where applicable an Accidental Death Benefit, Accidental Payor Benefit or Accidental Waiver of Premium Benefit is attached to the Plan, the coverage amount of such relevant benefit(s) shall also be adjusted proportionately. Partial Surrender is subject to the terms and conditions, and the then administrative rules as determined by Hong Kong Life from time to time. For detailed terms and conditions, please refer to the policy document issued by Hong Kong Life.

- Incapacity Benefit is subject to the applicable laws and regulations, administrative rules and requirements as determined by Hong Kong Life from time to time. The Incapacity Benefit Percentage is subject to the minimum amount or any other relevant requirements as determined by Hong Kong Life from time to time. The proposed Incapacity Benefit Recipient must be aged 18 or above at the time of submission and evidence of insurable interest must be submitted. Hong Kong Life reserves the right not to accept any application for the designation of Incapacity Benefit Recipient and to suspend and/or terminate the offering of Incapacity Benefit from time to time. If the Policyowner is diagnosed of a Covered Illness including Apallic Syndrome, Coma, Loss of Independent Existence, Major Head Trauma, Mental Incapacity, Paralysis and Terminal Illness while the Policy is in force, subject to the provisions, conditions and limitations, Hong Kong Life will pay to the Incapacity Benefit Recipient an Incapacity Benefit as follows:

i. If the Incapacity Benefit Percentage is 100%, the Policy will be fully surrendered. The full surrender value which is equal to (i) the Guaranteed Cash Value, plus (ii) Accumulated Dividends and Interest (if any) and (iii) Terminal Dividend (if any), less (iv) Indebtedness (if any) will be payable to the Incapacity Benefit Recipient. Once fully surrendered, the Policy shall terminate.

ii. If the Incapacity Benefit Percentage is less than 100%, the amount of Incapacity Benefit equals to (i) the sum of Guaranteed Cash Value, Accumulated Dividends and Interest (if any) and Terminal Dividend (if any) multiplied by the Incapacity Benefit Percentage, less (ii) Indebtedness (if any). Any Accumulated Dividends and Interest will be withdrawn first for the payment of Incapacity Benefit. If Accumulated Dividends and Interest is not sufficient to cover the amount of Incapacity Benefit, Partial Surrender will be triggered automatically. Part of Guaranteed Cash Value and Terminal Dividend (if any) will be withdrawn. The Principal Amount shall be reduced proportionally based on the percentage of Guaranteed Cash Value and Terminal Dividend (if any) being withdrawn for the automatic Partial Surrender. Upon the reduction of Principal Amount, the Guaranteed Cash Value, Annual Dividend (if any), Terminal Dividend (if any), premium (if any) and Total Premiums Paid of the Plan shall be reduced proportionately. Death Benefit, Maturity Benefit and Wealth Succession Bonus (if any) shall also be adjusted accordingly. Where (if applicable) an Accidental Death Benefit, Accidental Payor Benefit or Accidental Waiver of Premium Benefit is attached to the Plan, the coverage amount of such relevant benefit(s) shall also be adjusted accordingly. Since the Principal Amount of the Plan cannot be less than the required minimum amount as determined by Hong Kong Life after automatic Partial Surrender. The actual amount of Incapacity Benefit payment may be less than the amount payable as mentioned above. Payment made shall constitute a full discharge of Hong Kong Life's obligations in respect of such Incapacity Benefit, and Hong Kong Life shall not be liable to the Policyowner and any other persons (including, if applicable, the estate of the Policyowner and his/her personal representatives, Contingent Policyowner and Beneficiary) in respect of any payment of Incapacity Benefit.

The Incapacity Benefit is payable in the event that the Policyowner is diagnosed of a Covered Illness, including physical or mental incapacity, and therefore extra care should be taken in giving instruction in respect of such Incapacity Benefit. The Policyowner should ensure that he/she has the mental capacity when giving such instructions, otherwise such instructions may be subject to challenge or become void. To better protect the Policyowner's rights, the application of the designation of the Incapacity Benefit Recipient should be signed by the Policyowner in the witness of an independent third party. In case of a dispute, Hong Kong Life reserves the right to withhold the payment of Incapacity Benefit until such dispute is resolved. For definition of Covered Illness, detailed terms and conditions of Incapacity Benefit, please refer to the policy document issued by Hong Kong Life. - Principal Amount is used to calculate Initial Premium, any subsequent premium, benefits and policy values (if any) of the respective Basic Plan and any Supplementary Benefit (if applicable). Any subsequent change of the Principal Amount will result in corresponding change in premium, benefits and policy values (if any) of the respective Basic Plan and any Supplementary Benefit (if applicable). The Principal Amount does not represent the amount of death benefit of the respective Basic Plan and any Supplementary Benefit (if applicable).

- Change of Policy Currency Option is subject to the applicable laws and regulations, administrative rules and requirements as determined by Hong Kong Life from time to time. When applying for the change of policy currency, all of the following conditions must be met:

i. The New Policy Currency shall be a different currency from the current Policy Currency of the Policy at the time of application and the New Policy Currency will not be available for selection if it is demonetized by the issuance country or region at the time of change of policy currency; and

ii. The Policyowner can apply for change of policy currency only 1 time every Policy Year; and

iii. There is no outstanding Indebtedness and all premiums due have been paid under the Policy; and

iv. No claims are currently being processed or have been made under the Policy; and

v. The Principal Amount of the Basic Plan under the New Policy must not less than the minimum requirement as determined by Hong Kong Life from time to time; and

vi. The application for change of policy currency cannot be withdrawn, amended or reverted once made.

Once the application for change of policy currency is accepted and approved by Hong Kong Life, a New Policy denominated in the New Policy Currency will replace the Policy, subject to the following terms and conditions:

i. Any request for the change of policy currency endorsed by Hong Kong Life will take effect on the date of endorsement which will be the Policy Monthiversary following the approval of the change of policy currency or as soon as practicable at a time determined by Hong Kong Life.

ii. There is no cooling-off period for the New Policy.

iii. Policy Date, Issue Date, Premium Payment Term, Maturity Date and Policy Years of the New Policy shall be the same as the Policy upon the effect of the change of policy currency.

iv. Policy values under the Policy, including the Guaranteed Cash Value, Annual Dividend (if any), Terminal Dividend (if any), premium (if any) and Total Premiums Paid shall be converted to the New Policy Currency under the New Policy. Hong Kong Life shall determine and adjust (either increase or decrease) at its sole discretion the current and future policy values, including but not limited to the Principal Amount, Guaranteed Cash Value, Annual Dividend (if any), Terminal Dividend (if any), premium (if any) and Total Premiums Paid for the New Policy, based on factors including but not limited to the prevailing market-based currency exchange rate as determined by Hong Kong Life from time to time, the investment yield and asset values of the existing and new underlying portfolio of assets, and/or the transactions from the existing assets to new assets. Upon the adjustment of the policy values, Death Benefit, Maturity Benefit, Wealth Succession Bonus (if any) and Incapacity Benefit (if any) shall also be adjusted accordingly.

v. Any Death Benefit Settlement Options, Contingent Policyowner, Contingent Life Insured, Beneficiary and Incapacity Benefit Recipient of the Policy as previously recorded and endorsed by Hong Kong Life will be applied to the New Policy unless otherwise specified.

vi. The Policy Currency of any Supplementary Benefit(s) attached to the Policy will be converted to the New Policy Currency, provided that such Supplementary Benefit(s) is offered under the New Policy and is available in the New Policy Currency. Without prejudice to the termination clause of the Supplementary Benefit(s) attached to the Policy, if such Supplementary Benefit(s) is not offered under the New Policy or is not available in the New Policy Currency, or if exercising change of policy currency option that would trigger the new coverage amount of such Supplementary Benefit(s) to be lower than the minimum amount or any other relevant requirements as determined by Hong Kong Life from time to time, such Supplementary Benefit(s) will be terminate automatically on the effective date specified in the of new policy document.

vii. For the avoidance of doubt, if a claim has been made under an Accidental Death Benefit, Accidental Payor Benefit or Accidental Waiver of Premium Benefit (where applicable) of the Policy, the relevant benefit(s) shall not be offered in New Policy denominated in the New Policy Currency.

Upon the application for change of policy currency is accepted and approved by Hong Kong Life, a new set of policy document specifying the date of endorsement, plan features, benefits and policy terms will be issued for the New Policy and the Policy shall automatically terminated. Hong Kong Life reserves the right not to accept any application of change of policy currency and has the absolute discretion to determine the administrative rules and requirements in respect of change of policy currency from time to time. Hong Kong Life reserves the right to suspend and/or terminate the offering of change of policy currency option from time to time. For detailed terms and conditions, please refer to the policy document issued by Hong Kong Life. - Policy Split Option is subject to the rights of any named assignee, any applicable laws and regulations, administrative rules and requirements as determined by Hong Kong Life from time to time. The following conditions should also be met:

i. The Policyowner can apply for policy split only 1 time for every Policy Year; and

ii. There is no outstanding Indebtedness and all premiums due have been paid under the Policy; and

iii. No claims are currently being processed or have been made under the Policy; and

iv. The Principal Amount of the Policy and the Split Policy(ies) after policy split must not less than the minimum amount requirement as determined by Hong Kong Life from time to time; and

v. The application for policy split cannot be withdrawn, amended or reverted once made.

Once the application for policy split is accepted and approved by Hong Kong Life, new Split Policy(ies) and an endorsement of the Policy will be issued to the Policyowner and the policy split will be deemed to be effective as of the date such policy split is recorded during the lifetime of the Life Insured and endorsed by the Hong Kong Life, it is subject to the following conditions and limitations:

i. Any request for the policy split endorsed by Hong Kong Life will take effect on the date of endorsement which will be the Policy Monthiversary following the approval of the policy split or as soon as practicable at a time determined by Hong Kong Life.

ii. There is no cooling-off period for the Split Policy(ies).

iii. Upon acceptance and approval by Hong Kong Life, the Principal Amount of the Policy will be transferred to the Split Policy(ies) in accordance with the designated portion of the policy split as specified by the Policyowner and the Principal Amount of the Policy will be reduced after transfer. Hong Kong Life will determine the respective new Principal Amount of the Policy after split and the Split Policy(ies).

iv. The Policy Currency, Policy Date, Issue Date, Premium Payment Term, Maturity Date and Policy Years of the Split Policy(ies) will be the same as the Policy. All Policy values under the Policy, including the Guaranteed Cash Value, Annual Dividend (if any), Terminal Dividend (if any), premium (if any) and Total Premiums Paid will be reduced and transferred to the Split Policy(ies) in accordance with the new Principal Amount for the Policy and Split Policy(ies) after policy split. The adjustment of policy values in the Policy and the Split Policy(ies) after policy split will become the basis for the calculation of Death Benefit, Maturity Benefit, Wealth Succession Bonus (if any) and Incapacity Benefit (if any) in the Policy and the Split Policy(ies). The maximum amount payable for Wealth Succession Bonus in the Policy and each of the Split Policy(ies) will be adjusted proportionally in accordance to the designated portion of the Principal Amount to be transferred from the Policy to each of the Split Policy(ies).

v. All benefits, terms and conditions of the Policy will apply to the Split Policy(ies) unless otherwise specified. For the avoidance of doubt, if a claim has been made under an Accidental Death Benefit, Accidental Payor Benefit or Accidental Waiver of Premium Benefit (where applicable) of the Policy, the relevant benefit(s) shall not be offered in Split Policy(ies).

vi. Any Death Benefit Settlement Options, Contingent Policyowner, Contingent Life Insured, Beneficiary and Incapacity Benefit Recipient of the Policy as previously recorded and endorsed by Hong Kong Life will be kept under the Policy and applied to Split Policy(ies) unless otherwise specified.

vii. All Supplementary Benefit(s) attached to the Policy will remain in force. Without prejudice to the termination clause of the Supplementary Benefit(s) attached to the Policy, the Supplementary Benefit(s) shall be terminated automatically on the date of endorsement if there is a reduction of coverage amount of Supplementary Benefit(s) induced by the reduction of the Principal Amount of the Policy to be lower than the minimum amount or any other relevant requirements as determined by Hong Kong Life from time to time.Hong Kong Life reserves the right not to accept any application of policy split and has the absolute discretion to determine the administrative rules and requirements in respect of policy split from time to time.

Hong Kong Life reserves the right to suspend and/or terminate the offering of policy split option from time to time. For detailed terms and conditions, please refer to the policy document issued by Hong Kong Life. - Accumulated Dividends and Interest means the aggregate of (1) the total amount of distributed Annual Dividend left with Hong Kong Life (if any); and (2) the total amount of interest accumulated on any distributed Annual Dividend left with Hong Kong Life.

- Wealth Succession Bonus is a one-off payment and is only payable once for the Plan, regardless of the number of time of change of Life Insured while the Plan is in force. For the avoidance of doubt, once a Wealth Succession Bonus is paid for a change of Life Insured, any subsequent change of Life Insured will not be entitled for the Wealth Succession Bonus under the Plan. The Principal Amount for the Plan shall not be affected by any distributed Wealth Succession Bonus. Wealth Succession Bonus is not applicable when the Contingent Life Insured becomes the new Life Insured upon the death of the Life Insured.

- Designation of Contingent Policyowner is subject to the administrative rules and requirements as determined by Hong Kong Life from time to time, and the rights of any named assignee. The evidence of insurability including the existence of insurable interest for the proposed Contingent Policyowner(s) must be submitted. Upon the death of the Policyowner while the Policy is in force, the actual transfer of ownership of the Policy to the Contingent Policyowner shall be approved and becomes effective subject to Hong Kong Life's receipt of satisfactory proof of the Policyowner's death and any documents as requested, the relevant conditions and limitation, and the prevailing administrative rules and requirements of Hong Kong Life. Only one Contingent Policyowner is allowed to become the Policyowner of the Policy. All Supplementary Benefit(s) (if any) for the Policyowner of the Policy will be terminated automatically upon the date of death of the Policyowner and no unearned premium shall be refunded. The relevant Supplementary Benefit(s) can be applied for by the Contingent Policyowner, subject to the underwriting rules and requirements as determined by Hong Kong Life from time to time. Any Incapacity Benefit Recipient of the Policy as previously recorded and endorsed by Hong Kong Life will be automatically cancelled and removed upon the date of death of the Policyowner. For detailed terms and conditions, please refer to relevant form and the policy document issued by Hong Kong Life.

- Designation of Contingent Life Insured is subject to any applicable laws and regulations, administrative rules and requirements as determined by Hong Kong Life from time to time. The proposed Contingent Life Insured(s) must fulfill the issue age requirement and must not be older than the Initial Life Insured at the time Hong Kong Life receives the written request, and evidence of insurability including the existence of insurable interest for the proposed Contingent Life Insured(s) must be submitted. Upon the death of the Life Insured on or after the 1st Policy Anniversary while the Policy is in force, the actual change of Life Insured to the Contingent Life Insured shall be approved and becomes effective subject to Hong Kong Life's receipt of satisfactory proof of the Life Insured's death and any documents as requested, the relevant conditions and limitation, and the prevailing administrative rules and requirements of Hong Kong Life. Only one Contingent Life Insured is allowed to become the Life Insured of the Policy or each of Designated Policies (where applicable). If the Policyowner does not apply to allocate the Principal Amount of the Policy, the Policy shall continue to be in force when the Contingent Life Insured becomes the new Life Insured of the Policy. If the Policyowner apply to allocate the Principal Amount of the Policy to Designated Policy(ies), Designated Policy(ies) shall be issued in accordance with the designated portion as specified by the Policyowner and the Policy shall automatically terminate on the date of endorsement. The Contingent Life Insured(s) shall become the Life Insured of the newly issued Designated Policy(ies). The Policy Currency, Policy Date, Issue Date, Premium Payment Term and Policy Years of the Designated Policy(ies) will be the same as the Policy. The Maturity Date of the Policy or the Maturity Date of the Designated Policy(ies) (where applicable) shall be adjusted based on the Age of the new Life Insured. All policy values under the Designated Policy(ies), including the Guaranteed Cash Value, Annual Dividend (if any), Terminal Dividend (if any), premium (if any) and Total Premiums Paid shall also be adjusted in accordance to the designated portion as specified by the Policyowner. The adjustment of Principal Amount and policy values in the Designated Policy(ies) after exercising the designation of Contingent Life Insured option will become the basis for the calculation of Death Benefit, Maturity Benefit, Wealth Succession Bonus (if any) and Incapacity Benefit (if any) in the Designated Policy(ies). The maximum amount payable for Wealth Succession Bonus in the Designated Policy(ies) will be adjusted accordingly in accordance to the designated portion as specified by the Policyowner. All Supplementary Benefit(s) (if any) of the Policy will be terminated automatically on the date of endorsement of this Policy and no unearned premium shall be refunded. The relevant Supplementary Benefit(s) can be applied for in respect of the new Life Insured in the Policy or the Designated Policy(ies) (where applicable) subject to the underwriting and administrative rules and requirements as determined by Hong Kong Life from time to time. For detailed terms and conditions, please refer to relevant form and the policy document issued by Hong Kong Life.

- Death Benefit Settlement Options are only applicable in the event of the death of the Life Insured after the Premium Payment Term and all premiums due have been paid, and subject to the administrative rules and requirements as determined by Hong Kong Life from time to time. For detailed terms and conditions, please refer to the policy document issued by Hong Kong Life.

- The Accidental Death Benefit is only applicable to the Life Insured who is Hong Kong resident of age 65 or below at the time of Policy application. The indemnity of the Accidental Death Benefit should not exceed an aggregate maximum of HKD400,000 (or its equivalent in a currency other than HKD) in respect of all Hong Kong Life's policies covering the Life Insured for the Accidental Death Benefit. If the Life Insured is covered by more than one policy in Hong Kong Life and at least one of the policies is in Policy Currency other than HKD, the relevant benefit in policy(ies) in other Policy Currencies will be converted to HKD based on the exchange rate as at the date of calculating the aggregate maximum of indemnity.

- The Accidental Waiver of Premium is only applicable to the Life Insured who is Hong Kong resident of age 18 to 59 at the time of Policy application and within the Premium Payment Term of the Basic Plan, and the Life Insured and Policyowner of the Policy must be the same person. In no event shall the premium waived exceed an aggregate maximum of HKD80,000 (or its equivalent in a currency other than HKD) per calendar year in respect of the Policy and all other insurance policies issued by Hong Kong Life from time to time, whether or not still in force, covering the life of the Life Insured for the Accidental Waiver of Premium, and any other Accidental Waiver of Premium and Accidental Payor Benefit. If the Life Insured is covered by more than one policy in Hong Kong Life and at least one of the policies is in Policy Currency other than HKD, the relevant benefit in policy(ies) in other Policy Currencies will be converted to HKD based on the exchange rate as at the date of calculating the aggregate maximum of indemnity.

- The Accidental Payor Benefit is only applicable to the Policyowner who is Hong Kong resident of age 55 or below and the Life Insured is aged 17 or below at the time of Policy application and within the Premium Payment Term of the Basic Plan. In no event shall the premium waived exceed an aggregate maximum of HKD80,000 (or its equivalent in a currency other than HKD) per calendar year in respect of the Policy and all other insurance policies issued by Hong Kong Life from time to time, whether or not still in force, covering the life of the Policyowner for the Accidental Payor Benefit, and any other Accidental Payor Benefit and Accidental Waiver of Premium. If the Policyowner is covered by more than one policy in Hong Kong Life and at least one of the policies is in Policy Currency other than HKD, the relevant benefit in policy(ies) in other Policy Currencies will be converted to HKD based on the exchange rate as at the date of calculating the aggregate maximum of indemnity.

- The Allowance is only payable once either for one time of (i) annual fee of insurance standby trust set up by the Policyowner in a licensed trustee company in Hong Kong or (ii) professional consultation service on Policyowner's tax or legacy planning provided by a legal firm or an accounting firm practicing in Hong Kong or (iii) health check-up received by policyowner from a qualified service provider in Hong Kong. The Allowance is given out no more than HKD5,000 (applicable to the Policy with Principal Amount of HKD500,000 – HKD999,999 / USD62,500 – USD124,999 / RMB450,000 – RMB899,999 / AUD100,000 – AUD199,999 / CAD100,000 – CAD199,999 / EUR62,500 – EUR124,999 / GBP50,000 – GBP99,999 / NZD100,000 – NZD199,999 / SGD100,000 – SGD199,999 while the policy is issued) or HKD8,000 (applicable to the Policy with Principal Amount of HKD1,000,000 / USD125,000 / RMB900,000 / AUD200,000 / CAD200,000 / EUR125,000 / GBP100,000 / NZD200,000 / SGD200,000 or above while the policy is issued) on a reimbursement basis. Insurance Standby Trust Allowance / Tax or Legal Advisory Allowance for Legacy Planning / Health Check-up Allowance is included in the Plan but not part of the coverage. The availability of this item is not guaranteed. The details of this item will be provided along with the policy document. Hong Kong Life reserves the right to cancel or amend the said item at its sole discretion. Hong Kong Life reserves the right of final decision in case of any dispute.

The Accidental Death Benefit shall not cover any claims caused directly or indirectly, wholly or partly, by any one of the following occurrences:

- suicide or self-inflicted injuries while sane or insane;

- war whether declared or undeclared or any act thereof, invasion, civil commotion, riots or any warlike operations;

- service in the armed forces in time of declared or undeclared war or while under orders for warlike operations or restoration of public order;

- violation or attempted violation of the law or resisting arrest or participation in any brawl or affray;

- engaging in or taking part in (a) driving or riding in any kind of race; (b) professional sports; (c) underwater activities involving the use of breathing apparatus; (d) flying or other aerial activity except as a fare-paying passenger in a commercial aircraft;

- accident occurring while or because the Life Insured is affected by alcohol or any drug;

- poison, gas or fumes whether voluntarily or involuntarily taken;

- disease or infection (except infection which occurs through an accidental cut or wound), including infection with any Human Immunodeficiency Virus (HIV) and/or any HIV-related illness including Acquired Immunodeficiency Syndrome (AIDS) and/or any mutations, derivations or variations thereof;

- childbirth, pregnancy, miscarriage or abortion.

The Accidental Waiver of Premium shall not cover any claims caused directly or indirectly, wholly or partly, by any one of the following occurrences:

- self-inflicted injuries while sane or insane;

- war whether declared or undeclared or any act thereof, invasion, civil commotion, riots or any warlike operations;

- service in the armed forces in time of declared or undeclared war or while under orders for warlike operations or restoration of public order;

- violation or attempted violation of the law or resisting arrest or participation in any brawl or affray;

- engaging in or taking part in (a) driving or riding in any kind of race; (b) professional sports; (c) underwater activities involving the use of breathing apparatus; (d) flying or other aerial activity except as a fare-paying passenger in a commercial aircraft;

- childbirth, pregnancy, miscarriage or abortion.

The Accidental Payor Benefit shall not cover any claims caused directly or indirectly, wholly or partly, by any one of the following occurrences:

- self-inflicted injuries while sane or insane

- war whether declared or undeclared or any act thereof, invasion, civil commotion, riots or any warlike operations;

- service in the armed forces in time of declared or undeclared war or while under orders for warlike operations or restoration of public order;

- violation or attempted violation of the law or resisting arrest or participation in any brawl or affray;

- engaging in or taking part in (a) driving or riding in any kind of race; (b) professional sports; (c) underwater activities involving the use of breathing apparatus; (d) flying or other aerial activity except as a fare-paying passenger in a commercial aircraft;

- childbirth, pregnancy, miscarriage or abortion.

- Policyowner may submit a written request in the form prescribed by Hong Kong Life at any time to change or remove an Incapacity Benefit Recipient and the Incapacity Benefit Percentage. Any change or removal of the Incapacity Benefit Recipient and the Incapacity Benefit Percentage must be accepted and approved by Hong Kong Life and shall only take effect on the date of endorsement.

- Any Incapacity Benefit Recipient of the Policy as previously recorded and endorsed by Hong Kong Life shall be automatically cancelled and removed and no Incapacity Benefit will be paid when any of the following occurs (including where the application for the payment of Incapacity Benefit has been made by the Incapacity Benefit Recipient but any of the following occurs before the date of approval of such claim):

a. the Policyowner designates a new Incapacity Benefit Recipient and it is accepted and approved by Hong Kong Life; or

b. the Policyowner is changed; or

c. the Policyowner dies and Hong Kong Life is notified of the same; or

d. the Life Insured dies and Hong Kong Life is notified of the same, subject to the "Designation of Contingent Life Insured" clause of the Plan; or

e. the Incapacity Benefit Recipient dies and Hong Kong Life is notified of the same. - Hong Kong Life reserves the right to remove the Incapacity Benefit Recipient or withhold the payment of Incapacity Benefit at any time without prior notice if the designation or change of Incapacity Benefit Recipient or the payment of Incapacity Benefit by Hong Kong Life conflicts with or appears to be in conflict with any applicable laws, regulations, court orders or its equivalent, or the interest of any other person.

- If (a) a committee or guardian is appointed under the Mental Health Ordinance (Cap. 136 of the Laws of Hong Kong) or a committee or guardian is appointed under similar laws in another jurisdiction; (b) Hong Kong Life is notified of a committee or guardianship order taking effect; (c) there is an enduring power of attorney covering the Policy; (d) Hong Kong Life is notified of an enduring power of attorney covering the Policy; or (e) the Policy has been assigned pursuant to the "Assignment" clause of the General Provisions of the Policy. Hong Kong Life will only make payment to the Incapacity Benefit Recipient under the Incapacity Benefit with the prior written consent of the committee or guardian (as applicable in (a) and (b)); and/or the attorney (as applicable in (c) and (d)); and/or the named assignee (as applicable in (e)), as the case may be.

- In case there is a dispute or in Hong Kong Life's reasonable belief, there may be a dispute between the Incapacity Benefit Recipient and any other person, including but not limited to the Policyowner, Policyowner's guardian or committee, attorney, Contingent Policyowner, Beneficiary(ies) or named assignee, or if Hong Kong Life may incur liability as a result of it making payment of Incapacity Benefit, Hong Kong Life reserves the right to withhold payment until such dispute or matter is resolved to its satisfaction.

- Hong Kong Life shall not be held responsible or liable if Hong Kong Life exercises its right of removal of the Incapacity Benefit Recipient or withholding the payment of Incapacity Benefit under the Incapacity Benefit clause.

For detailed terms and conditions of Incapacity Benefit, please refer to the policy document issued by Hong Kong Life.

-

Basic Plan

Risk

Exchange Rate Risk

You are subject to exchange rate risks for the Policy denominated in currencies other than the local currency. Exchange rates fluctuate from time to time. You may suffer a loss of your benefit values and the subsequent premium payments (if any) may be higher than your initial premium payment as a result of exchange rate fluctuations.

Currency Risk

RMB is currently not freely convertible and conversion of RMB through banks in Hong Kong is subject to the rules, guidelines, regulations and conditions from the banks and/or Relevant Authorities from time to time. The actual conversion arrangement will depend on the restrictions prevailing at the relevant time. As RMB is currently not freely convertible and is subject to exchange controls by the Chinese government, RMB currency conversion is subject to availability and Hong Kong Life may not have sufficient RMB at the relevant time.

Risk from Exercising Change of Policy Currency Option

In case the policy currency is changed under the Change of Policy Currency Option, the adjustments on policy value may be significant (either higher or lower) and the amount of policy value after exercising the Change of Policy Currency Option may be considerably less than the total amount of premiums paid. Any future premiums will be adjusted if the Change of Policy Currency Option is exercised within the Premium Payment Term. The approval of application of Change of Policy Currency Option and the availability of currency at the time of exercising the Change of Policy Currency Option will be subject to the prevailing laws and regulations. Hong Kong Life reserves the right not to accept any application of change of policy currency and has the absolute discretion to determine the administrative rules and requirements in respect of change of policy currency from time to time. Hong Kong Life reserves the right to suspend and/or terminate the offering of Change of Policy Currency Option from time to time.

Please note that the Basic Plan under the New Policy after change of policy currency may or may not be the same as the Basic Plan under the Policy, subject to the eligible Basic Plan offered by Hong Kong Life at its discretion from time to time. Plan features, benefits and policy terms of the Basic Plan under the New Policy may be different from the Basic Plan of the Policy. You shall not purchase this product solely for the Change of Policy Currency Option. Please carefully evaluate the difference between the Basic Plan under the Policy and the latest basic plan available for exchange when you exercise the Change of Policy Currency Option and consider whether the latest basic plan suits your needs.

Liquidity Risk / Long Term Commitment

The Plan is designed to be held until the Maturity / Expiry Date. If you partially surrender or terminate the Policy prior to the Maturity / Expiry Date, a loss of the premium paid may be resulted.

The premium of the Plan should be paid in full for the whole payment term. If you discontinue the payment, the Policy may lapse and a loss of the premium paid may be resulted.

Credit Risk of Issuer

The life insurance product is issued and underwritten by Hong Kong Life. The premium to be paid by you would become part of the assets of Hong Kong Life and that you and your Policy are subject to the credit risk of Hong Kong Life. In the worst case, you may lose all the premium paid and benefit amount.

Market Risk

The amount of dividends (if any) of the Plan depends principally on the factors including investment returns, claim payments, policy persistency rates, operation expenses and tax; while the annual interest accumulation rate principally depends on the factors including investment performance and market conditions. Hence the amount of dividends (if any) and annual interest accumulation rate are not guaranteed and may be changed over time. The actual dividends payable and annual interest accumulation rate may be higher or lower than the expected amount and value at the time when the Policy was issued.

Investment returns include investment income and changes in asset value of the underlying investment. Performance of the investment return is affected by interest earnings and other market risk factors including, but not limited to, interest rate or credit spread movements, credit events, price fluctuations in invested assets, and foreign exchange fluctuations.

Inflation Risk

When reviewing the values shown in the Insurance Proposal, please note that the cost of living in the future is likely to be higher than it is today due to inflation.

Important Policy Provisions

Suicide

If the Initial Life Insured commits suicide, while sane or insane, within one (1) year from the Issue Date or date of any reinstatement, whichever is later, the liability of Hong Kong Life shall be limited to a refund of paid premiums to the Beneficiary without interest less any existing Indebtedness. In the case of reinstatement, such refund of premium shall be calculated from the date of reinstatement.

Upon the change of the Life Insured(s), if the New Life Insured commit suicide, while sane or insane, within one (1) year from the date of endorsement or date of any reinstatement, whichever is the later, the liability of Hong Kong Life shall be limited to (i)(a) a refund of the Total Premiums Paid for the Plan (without interest) or (i)(b) the Guaranteed Cash Value and Terminal Dividend (if any), whichever is greater, plus (ii) Accumulated Dividends and Interest (if any), less (iv) Indebtedness (if any).

Incontestability

The validity of the Policy shall not be contestable except for (i) the non-payment of premiums, (ii) fraud or (iii) misstatement of age and/or sex as specified in the Misstatement of Age and/or Sex provisions, after it has been in force during the lifetime of the Initial Life Insured for two (2) years from the Issue Date or the date of any reinstatement, whichever is later. Premiums paid will not be refunded should the Policy be voided by Hong Kong Life.

Upon the change of the Life Insured, Hong Kong Life shall not contest the validity of the Policy after the change has been in force during the lifetime of the New Life Insured for two (2) years from the date of endorsement or date of any reinstatement, whichever is the latest, except for (i) the non-payment of premiums, (ii) fraud or (iii) misstatement of age and/or sex as specified in the Misstatement of Age and/or Sex provisions. Premiums paid will not be refunded should the Policy be voided by Hong Kong Life.

Automatic Termination

The Plan shall terminate automatically:

- upon the death of the Life Insured (provided that there is no named and surviving Contingent Life Insured who will become the new Life Insured pursuant to the "Designation of Contingent Life Insured" clause of the Plan); or

- if and when the Principal Amount of the Plan is allocated to Designated Policy(ies) pursuant to the "Designation of Contingent Life Insured" clause of the Plan; or

- if and when the Plan matures or is fully surrendered (including the full surrender triggered for the payment of Incapacity Benefit as specified in the Incapacity Benefit clause); or

- (applicable to 2-year Premium Payment Term) if and when a premium remains unpaid at the end of the Grace Period as specified in the General Provisions of the Policy; or

- (applicable to 5/10-year Premium Payment Term) if and when a premium remains unpaid at the end of the Grace Period as specified in the General Provisions of the Policy unless Automatic Premium Loan applies; or

- if and when the Indebtedness of the Policy equals to or exceeds the Guaranteed Cash Value; or

- (applicable to 5/10-year Premium Payment Term) if and when the Guaranteed Cash Value less Indebtedness (if any) is less than the premium required to maintain the Policy up to the next premium due date as specified in the Automatic Premium Loan clause; or

- upon the Change of Policy Currency as specified in Change of Policy Currency Option clause.

Others

Insurance Costs

The Plan is an insurance plan with a savings element. Part of the premium pays for the insurance and related costs (if any).

Potential Fees and Charges

If the premium refund or the payout benefits is not in HKD, USD or RMB, the refund or the payout may only be made in the form of a telegraphic transfer and relevant fees and charges may apply. Such fees and charges will be deducted from the premium refund or the payout benefits by the sending bank and receiving bank. The amount of fees and charges will vary depending on the sending bank and receiving bank designated by the customer. For details of the fees and charges, you should refer to Hong Kong Life and the designated receiving bank.

Cooling-off Period

If you are not satisfied with your Policy, you have a right to cancel it within the cooling-off period and obtain a refund of any premium(s) and levy(ies) paid (in the original payment currency) to Hong Kong Life without any interest. A written notice signed by you should be received directly by Hong Kong Life Insurance Limited at 15/F Cosco Tower, 183 Queen's Road Central, Hong Kong within the cooling-off period (that is, the period of 21 calendar days immediately following either the day of delivery of the Policy or the Cooling-off Notice to you or your nominated representative (whichever is the earlier)). After the expiration of the cooling-off period, if you cancel the Policy before the end of the term, the projected Total Surrender Value (if applicable) may be less than the Total Premiums Paid.

Dividends

Hong Kong Life determines the amount of divisible surplus that will be distributed in the form of dividends. Dividends will be determined and distributed according to the Policy's terms and conditions and in compliance with the relevant legislative and regulatory requirements as well as relevant actuarial standards, whereas Terminal Dividend is available for certain types of policies and payable at the termination of the policies.

The amount of divisible surplus depends principally on the factors including investment returns, claim payments, policy persistency rates, operation expenses and tax. Hence the amount of dividends is not guaranteed and may be changed over time. The actual dividends payable may be higher or lower than the expected amount at the time when the policies were issued. The withdrawal of dividends will decrease the Total Surrender Value and Total Death Benefit of the Policy.

Investment returns include investment income and changes in asset value of the underlying investment. Performance of the investment return is affected by interest earnings and other market risk factors including, but not limited to, interest rate or credit spread movements, credit events, price fluctuations in invested assets, and foreign exchange fluctuations.

Partial Surrender

In case of Partial Surrender, the Guaranteed Cash Value and Terminal Dividend of the Policy will be decreased accordingly. This will also decrease the Principal Amount, Total Surrender Value, Total Death Benefit, Annual Dividend, premium, Total Premiums Paid and other benefits (if applicable) of the Policy.

Policy Loan

After the Plan has acquired a Guaranteed Cash Value and while the Policy is in force, the Policyowner may, upon the sole security and satisfactory assignment of the Policy to Hong Kong Life, apply for a Policy Loan from the Plan. Any loan on the Policy shall bear interest at a rate declared by Hong Kong Life from time to time. Interest on the loan shall accrue and compound daily from the date of loan. The Policy Loan Interest Rate is not guaranteed and will be changed from time to time. The loan and the interest accrued thereon shall constitute Indebtedness against the Policy. Interest shall be due on each Policy Anniversary subsequent to the date of loan. In the event that the Indebtedness of the Policy equals to or exceeds the Guaranteed Cash Value, the Policy will terminate. Any Policy Loan and accrued loan interest may reduce the Total Surrender Value and Total Death Benefit of the Policy.

Non-Protected Deposit

The Plan is not equivalent to, nor should it be treated as a substitute for, time deposit. The Plan is not a protected deposit and is not protected by the Deposit Protection Scheme in Hong Kong.

Dispute on Selling Process and Product

Chong Hing Bank Limited, CMB Wing Lung Bank Limited, OCBC Bank (Hong Kong) Limited and Shanghai Commercial Bank Limited (collectively "Appointed Licensed Insurance Agencies" and each individually "Appointed Licensed Insurance Agency") are the Appointed Licensed Insurance Agencies of Hong Kong Life, and the life insurance product is a product of Hong Kong Life but not the Appointed Licensed Insurance Agencies. In respect of an eligible dispute (as defined in the Terms of Reference for the Financial Dispute Resolution Centre in relation to the Financial Dispute Resolution Scheme) arising between the Appointed Licensed Insurance Agency and the customer out of the selling process or processing of the related transaction, Appointed Licensed Insurance Agency is required to enter into a Financial Dispute Resolution Scheme process with the customer; however any dispute over the contractual terms of the life insurance product should be resolved between Hong Kong Life and the customer directly.

-

Supplementary Benefit

Accidental Death Benefit

Exchange Rate Risk, Currency Risk, Credit Risk of Issuer, Inflation Risk, Cooling-off Period and Dispute on Selling Process and Product in the above Basic Plan section and the below point(s) is/ are applicable to the Accidental Death Benefit:

Important Policy Provisions

1. Automatic Termination

The Accidental Death Benefit shall terminate automatically:

- if and when the Accidental Death Benefit expires; or

- if and when the Basic Plan terminates.

Others

2. Partial Surrender

In case of Partial Surrender, the indemnity of the Accidental Death Benefit (if applicable) will be decreased.

Accidental Waiver of Premium

Exchange Rate Risk, Currency Risk, Credit Risk of Issuer, Inflation Risk, Cooling-off Period and Dispute on Selling Process and Product in the above Basic Plan section and the below point(s) is/ are applicable to the Accidental Waiver of Premium:

Important Policy Provisions

1. Automatic Termination

The Accidental Waiver of Premium shall terminate automatically:

- if and when the Accidental Waiver of Premium expires; or

- if and when the Basic Plan terminates; or

- on the Policy Anniversary on or immediately following the Life Insured's sixtieth (60th) birthday; or

- on the occurrence of any claim under the Accidental Waiver of Premium which Hong Kong Life has admitted as payable; or

- upon a transfer of the ownership of the Policy pursuant to the "Ownership" clause of the Policy to a new Policyowner; or

- upon the death of the Policyowner, the Designation of Contingent Policyowner option of the Policy takes effect and the Contingent Policyowner becomes the new Policyowner.

Accidental Payor Benefit

Exchange Rate Risk, Currency Risk, Credit Risk of Issuer, Inflation Risk, Cooling-off Period and Dispute on Selling Process and Product in the above Basic Plan section and the below point(s) is/ are applicable to the Accidental Payor Benefit:

Important Policy Provisions

Automatic Termination

The Accidental Payor Benefit shall terminate automatically:

- if and when the Accidental Payor Benefit expires; or

- if and when the Basic Plan terminates; or

- on the Policy Anniversary on or immediately following the Policyowner's sixtieth (60th) birthday or the Life Insured's twenty-fifth (25th) birthday (whichever is earlier); or

- on the occurrence of any claim under the Accidental Payor Benefit which Hong Kong has admitted as payable; or

- upon a transfer of the ownership of the Policy pursuant to the "Ownership" clause of the Policy to a new Policyowner; or

- upon the death of the Policyowner, the Designation of Contingent Policyowner option of the Policy takes effect and the Contingent Policyowner becomes the new Policyowner.

The above information is for reference and is applicable within Hong Kong only. Unless otherwise specified, the defined terms used in the above information should have the same meanings as given to them in the policy document. The information of the above information does not contain the full terms of the policy document. For full terms and conditions, please refer to the policy document. If there is any conflict between the above information and the policy document, the latter shall prevail. The copy of the policy document is available upon request. Before applying for the insurance plan, you may refer to the contents and terms of the policy document. You may also seek independent and professional advice before making any decision.