Underwritten by: Hong Kong Life Insurance Limited

Appointed Licensed Insurance Agency: Chong Hing Bank Limited, CMB Wing Lung Bank Limited, OCBC Bank (Hong Kong) Limited and Shanghai Commercial Bank Limited

Manage Your Wealth for a Resplendent Life

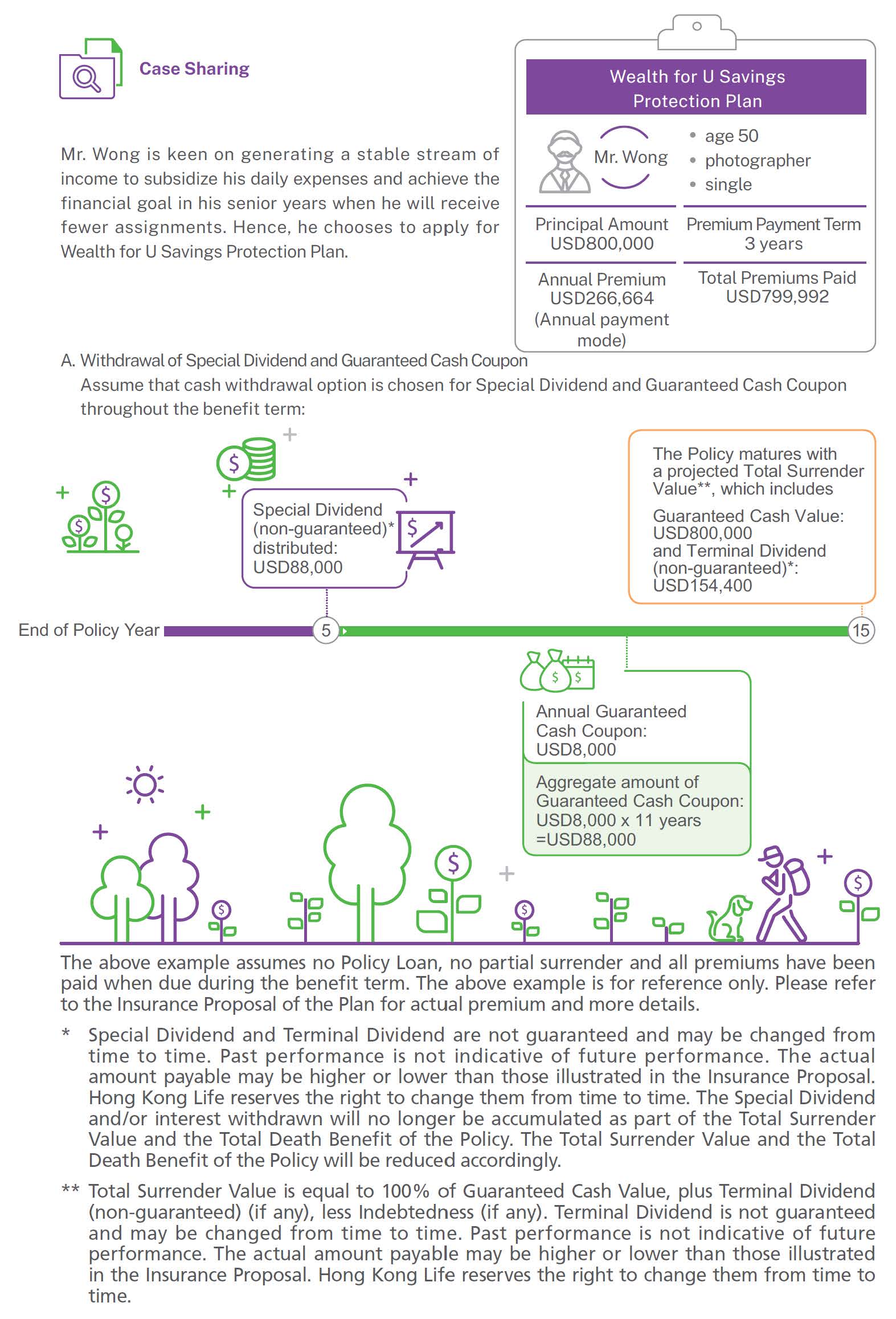

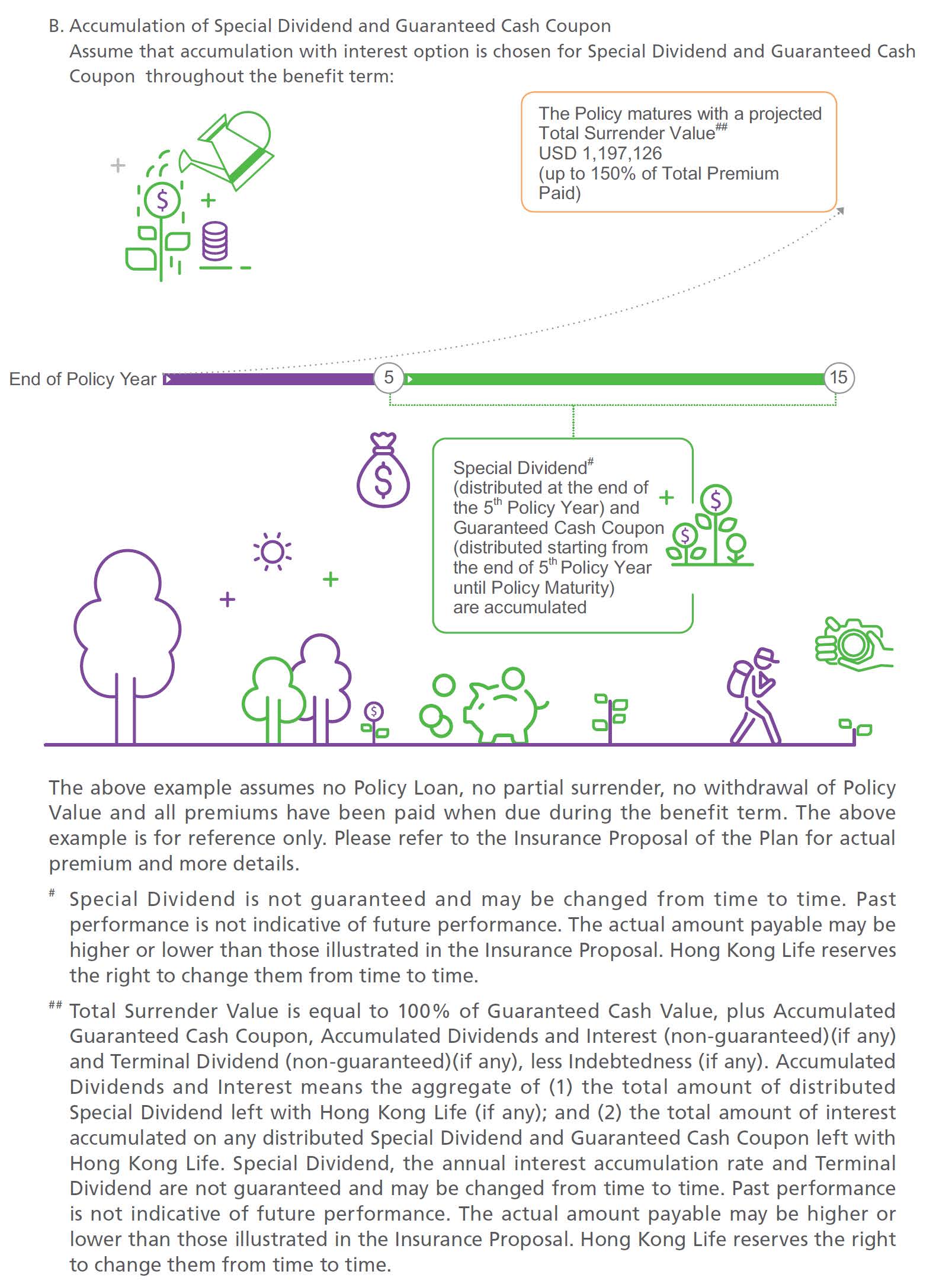

Wealth for U Savings Protection Plan (The "Plan") is a life insurance plan with 15-year benefit term which offers you a flexible financial solution with Premium Payment Term1 as short as 3 years1. The Guaranteed Cash Coupon will be payable regularly starting from the end of 5th Policy Year until the Policy Maturity. The Plan may also provide Special Dividend (non-guaranteed)2 and Terminal Dividend (non-guaranteed)2 to help accumulate your wealth gradually and fulfill your financial goal.

Short Premium Payment Term1 with 15 Years Life Protection

The Premium Payment Term1 of the Plan is 3 years1 only with 15 years life protection.

Guaranteed Cash Coupon

Starting from the end of 5th Policy Year, Guaranteed Cash Coupon which is equal to 1% of the Principal Amount3 will be payable every year until the Policy Maturity. You can choose cash withdrawal or leaving it with the Policy for interest accumulation4,5.

Life Protection for Peace of Mind

If the Life Insured dies while the Plan is in force, the Total Death Benefit will be paid to the Policy Beneficiary.

| Policy Year | Total Death Benefit | |

|---|---|---|

| 1 - 2 | 100% of Net Premiums Paid6 OR 100% of Guaranteed Cash Value as at the date of death of the Life Insured (whichever is greater) |

plus Terminal Dividend (non-guaranteed)2(if any),less Indebtedness (if any). |

| 3 - 15 |

Applicable to the Life Insured with issue age 70 or below:

Applicable to the Life Insured with issue age above 70: |

plus Accumulated Guaranteed Cash Coupon5 (if any), Accumulated Dividends and Interest (non-guaranteed) 2,7(if any) and Terminal Dividend (non-guaranteed)2(if any), less Indebtedness (if any). |

In addition, the Plan provides flexible Death Benefit Settlement Options8. Instead of receiving the Death Benefit in a lump sum payment, Policyowner can designate other settlement options including Installment Payments (Fixed Amount) or Installment Payments (Fixed Period) while the Plan is in force and the Life Insured is alive to settle the Death Benefit to the Policy Beneficiary.

Additional Return

Special Dividend (non-guaranteed)2 may be distributed at the end of 5th Policy Year in terms of cash. You can choose cash withdrawal or leaving it with the Policy for interest accumulation2 to meet your personal needs.

In addition, a Terminal Dividend (non-guaranteed)2 may be payable on or after the end of 2nd Policy Year when the Policy is fully surrendered by the Policyowner, upon the death of the Life Insured or upon Policy Maturity, whichever is the earliest. When the Policy is partially surrendered by the Policyowner, Terminal Dividend (non-guaranteed)2 may be payable on or after the end of 2nd Policy Year. The payable amount is equal to the Terminal Dividend (non-guaranteed)2 attributable to the reduced portion of Principal Amount. Terminal Dividend (non-guaranteed)2 will not accumulate in the Policy.

Fixed Premium for Your Better Planning

The premium will remain unchanged throughout the Premium Payment Term1, allowing you to have a better plan for your future.

Simple Application

The Life Insured will not have to go through any medical examination, up to a certain Principal Amount subject to the prevailing administrative rules as determined by Hong Kong Life.

Flexible Choice of Supplementary Benefits9 to Meet Your Needs

You may enhance your coverage by attaching different Supplementary Benefits9 to the Policy including Waiver of Premium Benefit9 and Payor Benefit9 to fit your personal needs.

| Premium Payment Term1 | 3 Years |

|---|---|

| Issue Age* | Age 0 (15 days after birth) to 75 |

| Policy Currency | HKD / USD |

| Benefit Term | 15 Years |

| Minimum Principal Amount3 | HKD120,000 / USD15,000 |

| Maximum Principal Amount3 |

HKD15,000,000 or USD1,875,000## (Per Life Insured per Plan) |

| Premium Payment Mode | Annual / Semi-annual / Quarterly / Monthly |

* Age means age of the Life Insured at the last birthday

## Subject to underwriting result if the Principal Amount is larger than HKD10,000,000 / USD1,250,000.

- The Policy will be terminated if the Policyowner cannot settle the premium payment before the end of the Grace Period during the Premium Payment Term, subject to the Automatic Premium Loan, Non-forfeiture Option and other relevant provisions of the Policy. For detailed terms and conditions, please refer to the policy document issued by Hong Kong Life. If the Policy is terminated before the Policy Maturity, the Total Surrender Value (if applicable) received by the Policyowner may be less than the Total Premiums Paid.

- Special Dividend, the annual interest accumulation rate and Terminal Dividend are not guaranteed and may be changed from time to time. Past performance is not indicative of future performance. The actual amount payable may be higher or lower than those illustrated in the Insurance Proposal. Hong Kong Life reserves the right to change them from time to time. The Special Dividend and/or interest withdrawn will no longer be accumulated as part of the Total Surrender Value and the Total Death Benefit of the Policy. The Total Surrender Value and the Total Death Benefit of the Policy will be reduced accordingly.

- Principal Amount is used to calculate Initial Premium, any subsequent premium, benefits and policy values (if any) of the respective Basic Plan and any Supplementary Benefit. Any subsequent change of the Principal Amount will result in corresponding change in premium, benefits and policy values (if any) of the respective Basic Plan and any Supplementary Benefit. The Principal Amount does not represent the amount of death benefit of the respective Basic Plan and any Supplementary Benefit.

- The annual interest accumulation rate is not guaranteed and may be changed from time to time. Past performance is not indicative of future performance. The actual amount payable may be higher or lower than those illustrated in the Insurance Proposal. Hong Kong Life reserves the right to change it from time to time.

- The Guaranteed Cash Coupon withdrawn will no longer be accumulated as part of the Total Surrender Value and the Total Death Benefit of the Policy. The Total Surrender Value and the Total Death Benefit of the Policy will be reduced accordingly.

- Net Premiums Paid means the Total Premiums Paid less the aggregate amount of Guaranteed Cash Coupon distributed by Hong Kong Life from the Policy Date up to the date of termination of the Plan. In case of Partial Surrender, the Net Premiums Paid shall be adjusted and reduced proportionally as specified in the Partial Surrender provisions. Total Premiums Paid means the total amount of due and payable premiums from the Policy Date up to the date of termination of the Plan, paid to the Plan and received by Hong Kong Life. Any payment in excess of such amount of due and payable premiums will not be included in the Total Premiums Paid. In case of Partial Surrender, the Total Premiums Paid under the Policy shall be adjusted and reduced proportionally as specified in the Partial Surrender provisions.

- Accumulated Dividends and Interest means the aggregate of (1) the total amount of distributed Special Dividend left with Hong Kong Life (if any); and (2) the total amount of interest accumulated on any distributed Special Dividend and Guaranteed Cash Coupon left with Hong Kong Life.

- Death Benefit Settlement Options are only applicable in the event of the death of the Life Insured after the Premium Payment Term and all premiums due have been paid, and subject to the terms and conditions, and the then administrative rules as determined by Hong Kong Life from time to time. For detailed terms and conditions, please refer to the policy document issued by Hong Kong Life.

- Only applicants who are defined as standard class applicants are accepted. Application for Supplementary Benefits must comply with the issue age requirement of the Supplementary Benefits and are subject to normal underwriting procedures. Supplementary Benefits can be applied together with the Plan or at each Policy Anniversary. Supplementary Benefits will be terminated simultaneously when the Plan is terminated. For details of Supplementary Benefits, please refer to the policy document issued by Hong Kong Life.

-

Basic Plan

Risk

Exchange Rate Risk

You are subject to exchange rate risks for the Policy denominated in currencies other than the local currency. Exchange rates fluctuate from time to time. You may suffer a loss of your benefit values and the subsequent premium payments (if any) may be higher than your initial premium payment as a result of exchange rate fluctuations.

Liquidity Risk / Long Term Commitment

The Plan is designed to be held until the Maturity / Expiry Date. If you partially surrender or terminate the Policy prior to the Maturity / Expiry Date, a loss of the premium paid may be resulted.

The premium of the Plan should be paid in full for the whole payment term. If you discontinue the payment, the Policy may lapse and a loss of the premium paid may be resulted.

Credit Risk of Issuer

The life insurance product is issued and underwritten by Hong Kong Life. The premium to be paid by you would become part of the assets of Hong Kong Life and that you and your Policy are subject to the credit risk of Hong Kong Life. In the worst case, you may lose all the premium paid and benefit amount.

Market Risk

The amount of dividends (if any) of the Plan depends principally on the factors including investment returns, claim payments, policy persistency rates, operation expenses and tax; while the annual interest accumulation rate principally depends on the factors including investment performance and market conditions. Hence the amount of dividends (if any) and annual interest accumulation rate are not guaranteed and may be changed over time. The actual dividends payable and annual interest accumulation rate may be higher or lower than the expected amount and value at the time when the Policy was issued.

Inflation Risk

When reviewing the values shown in the Insurance Proposal, please note that the cost of living in the future is likely to be higher than it is today due to inflation.

Important Policy Provisions

Suicide

If the Life Insured commits suicide, while sane or insane, within one (1) year from the Issue Date or date of any reinstatement, whichever is later, the liability of Hong Kong Life shall be limited to a refund of paid premiums to the Beneficiary without interest less any existing Indebtedness. In the case of reinstatement, such refund of premium shall be calculated from the date of reinstatement.

Incontestability

The validity of the Policy shall not be contestable except for (i) the non-payment of premiums, (ii) fraud or (iii) misstatement of age and/or sex as specified in the Misstatement of Age and/or Sex provisions, after it has been in force during the lifetime of the Life Insured for two (2) years from the Issue Date or the date of any reinstatement, whichever is later. Premiums paid will not be refunded should the Policy be voided by Hong Kong Life.

Automatic Termination

The Plan shall terminate automatically:

- upon the death of the Life Insured; or

- if and when the Plan matures or is fully surrendered; or

- if and when a premium remains unpaid at the end of the Grace Period as specified in the General Provisions of the Policy unless Automatic Premium Loan applies; or

- if and when the Indebtedness of the Policy equals to or exceeds the Guaranteed Cash Value; or

- if and when the Guaranteed Cash Value less Indebtedness (if any) is less than the premium required to maintain the Policy up to the next premium due date as specified in the Automatic Premium Loan provisions.

Others

Insurance Costs

The Plan is an insurance plan with a savings element. Part of the premium pays for the insurance and related costs (if any).

Cooling-off Period

If you are not satisfied with your Policy, you have a right to cancel it within the cooling-off period and obtain a refund of any premium(s) and levy(ies) paid (in the original payment currency) to Hong Kong Life without any interest. A written notice signed by you should be received directly by Hong Kong Life Insurance Limited at 15/F Cosco Tower, 183 Queen's Road Central, Hong Kong within the cooling-off period (that is, the period of 21 calendar days immediately following either the day of delivery of the Policy or the Cooling-off Notice to you or your nominated representative (whichever is the earlier)). After the expiration of the cooling-off period, if you cancel the Policy before the end of the term, the projected Total Surrender Value (if applicable) may be less than the Total Premiums Paid.

Dividends

Hong Kong Life determines the amount of divisible surplus that will be distributed in the form of dividends. Special Dividend will be determined and distributed according to the Policy's terms and conditions and in compliance with the relevant legislative and regulatory requirements as well as relevant actuarial standards, whereas Terminal Dividend is available for certain types of policies and payable at the termination of the policies.

The amount of divisible surplus depends principally on the factors including investment returns, claim payments, policy persistency rates, operation expenses and tax. Hence the amount of dividends is not guaranteed and may be changed over time. The actual dividends payable may be higher or lower than the expected amount at the time when the policies were issued. The withdrawal of dividends will decrease the Total Surrender Value and Total Death Benefit of the Policy.

Withdrawal of Cash Payments

The withdrawal of cash payments (including but not limited to guaranteed cash coupon (if any) and monthly incomes (if any) etc.) will decrease the Total Surrender Value and Total Death Benefit of the Policy.

Policy Loan

After the Plan has acquired a Guaranteed Cash Value and while the Policy is in force, the Policyowner may, upon the sole security and satisfactory assignment of the Policy to Hong Kong Life, apply for a Policy Loan from the Plan. Any loan on the Policy shall bear interest at a rate declared by Hong Kong Life from time to time. Interest on the loan shall accrue and compound daily from the date of loan. The Policy Loan Interest Rate is not guaranteed and will be changed from time to time. The loan and the interest accrued thereon shall constitute Indebtedness against the Policy. Interest shall be due on each Policy Anniversary subsequent to the date of loan. In the event that the Indebtedness of the Policy equals to or exceeds the Guaranteed Cash Value, the Policy will terminate. Any Policy Loan and accrued loan interest may reduce the Total Surrender Value and Total Death Benefit of the Policy.

Non-Protected Deposit

The Plan is not equivalent to, nor should it be treated as a substitute for, time deposit. The Plan is not a protected deposit and is not protected by the Deposit Protection Scheme in Hong Kong.

Dispute on Selling Process and Product

Chong Hing Bank Limited, CMB Wing Lung Bank Limited, OCBC Bank (Hong Kong) Limited and Shanghai Commercial Bank Limited (collectively "Appointed Licensed Insurance Agencies" and each individually "Appointed Licensed Insurance Agency") are the Appointed Licensed Insurance Agency of Hong Kong Life, and the life insurance product is a product of Hong Kong Life but not the Appointed Licensed Insurance Agency. In respect of an eligible dispute (as defined in the Terms of Reference for the Financial Dispute Resolution Centre in relation to the Financial Dispute Resolution Scheme) arising between the Appointed Licensed Insurance Agency and the customer out of the selling process or processing of the related transaction, Appointed Licensed Insurance Agency is required to enter into a Financial Dispute Resolution Scheme process with the customer; however any dispute over the contractual terms of the life insurance product should be resolved between Hong Kong Life and the customer directly.

The above information is for reference and is applicable within Hong Kong only. For terms and conditions, please refer to the policy document. If there is any conflict between the above information and the policy document, the latter shall prevail. The copy of the policy document is available upon request. Before applying for the insurance plan, you may refer to the contents and terms of the policy document. You may also seek independent and professional advice before making any decision.