After 10 years>11%

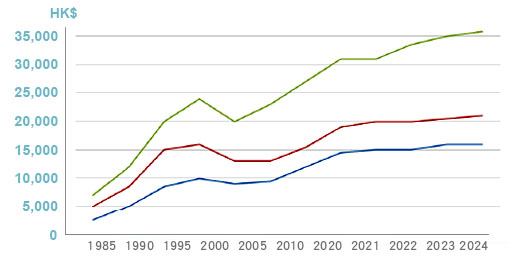

Median salary of people with different education levels in Hong Kong

around $ 295,000

around $ 290,000

around $ 506,000

around $375,000

Some institutes rank high internationally

Child stays close to parents

Save on boarding and flight expenses

Major like engineering and medicine are in high demand

Not enough choices for science, research and innovation subjects

More limited socialisation and network

Improve foreign language

skills

Better chance of enrolling in desired major

Opportunity to foster Western thinking and analytical skills

Nurture self-reliance

Huge tuition, living expenses and flight

Worries about the child living independently

University tuition/year:

HK$97,000 - HK$252,000

Living cost/year:

HK$93,000 - HK$151,000

Total:

HK$190,000 - HK$404,000

University tuition/year:

HK$101,000 - HK$415,000

Living cost/year:

HK$150,000 - HK$224,000

Total:

HK$251,000 - HK$639,000

University tuition/year:

HK$110,000 - HK$247,000

Living cost/year:

HK$115,000

Total:

HK$225,000 - HK$362,000

University tuition/year:

HK$142,000 - HK$399,000

Living cost/year:

HK$54,000 - HK$108,000

Total:

HK$196,000 - HK$507,000

(Tuition for 2025-2026)

Not including accommodation, textbook and miscellaneous costs

In 2023, 48,7005 candidates took the HKDSE, but there were only 15,000 subsidised undergraduate openings available.

That means there are 3.2 candidates competing for every subsidized undergraduate opening.

For local self-funded undergraduate programmes, the costs are even higher

Self-funded undergraduate programmes at non-UGC-funded institutions

(Tuition for 2025-2026)

Suppose the annual inflation rate is only 3% and only

consider inflation factor which means that, an

education costs HK$100,000 today will cost

HK$170,243 in 18 years.

With the Payor Benefit, premiums payable will be waived if the policy owner dies or becomes disabled, ensuring the child's life insurance and education fund remain unaffected.

33 years old, civil servantMarried, with an infant daughter KarenMonthly household income: about HK$80,000

Financial state:Details of Mr. Chow's plan: Using life insurance plan to prepare his daughter, Karen's education fund

Regardless of the presence of named and surviving Contingent Policyowner, if the Policyowner dies due to accident or becomes totally and permanently disabled due to accident and loses his/her working ability before the Policyowner's 60th birthday or the Life Insured's 25th birthday (whichever is earlier) for 6 consecutive months or above, premiums payable of the Plan will be waived upon the death of the Policyowner or within the period of disability.

The Accidental Payor Benefit is only applicable to the Policyowner who is Hong Kong resident of age 55 or below and the Life Insured is aged 17 or below at the time of Policy application and within the Premium Payment Term of the Basic Plan. In no event shall the premium waived exceed an aggregate maximum of HKD80,000/ USD10,000 per calendar year in respect of the Policy and all other insurance policies issued by Hong Kong Life from time to time, whether or not still in force, covering the life of the Policyowner for the Accidental Payor Benefit, and any other Accidental Payor Benefit and Accidental Waiver of Premium.

The Policyowner may make a one-off or regular withdrawal from the cash value of the Policy (including the Guaranteed Cash Value (if any), Accumulated Dividends and Interest (non-guaranteed)(if any) and Terminal Dividend (non-guaranteed) (if any)) according to his/ her needs in order to fulfilling the dreams like children’s education and fruitful retirement, etc. However, the future cash value of the Policy will be reduced accordingly.

After the Policy has acquired a Guaranteed Cash Value, the Policyowner can opt for Partial Surrender to withdraw the Guaranteed Cash Value and Terminal Dividend (non-guaranteed) (if any) attributable to the reduced portion of Principal Amount of the Policy.

After the plan is in force for 2 year, the plan may distribute annual dividend, Mr. Chow can choose cash withdrawal or leaving it with the policy for interest accumulation#. This can prepare for unforeseen circumstances, for examples: tuition or living expenses increase due to inflation.

# Annual Dividend and the annual interest accumulation rate are not guaranteed and may be changed from time to time. Past performance is not indicative of future performance. The actual amount received may be higher or lower than the estimated amount. Hong Kong Life reserves the right to change them from time to time. The Annual Dividend and/or interest withdrawn will no longer be accumulated as part of the Total Surrender Value and the Total Death Benefit of the Policy. The Total Surrender Value and the Total Death Benefit of the Policy will be reduced accordingly.

If Mr Chow’s daughter elects to study at a local university instead of overseas and, he chooses to leave dividend with the policy for accumulation, when his daughter is 20 years old, a projected Total Surrender Value is about Hk$4.75 million, which could be used as down payment to buy a home or start a business, laying a great foundation for his daughter.

Plan ahead and let our professional team do an analysis of your financial needs today. Plan early so you can prepare sufficient reserves to provide your child with a quality education and a glorious future.

![]() 2290-2882

2290-2882

Issued by Hong Kong Life Insurance Limited