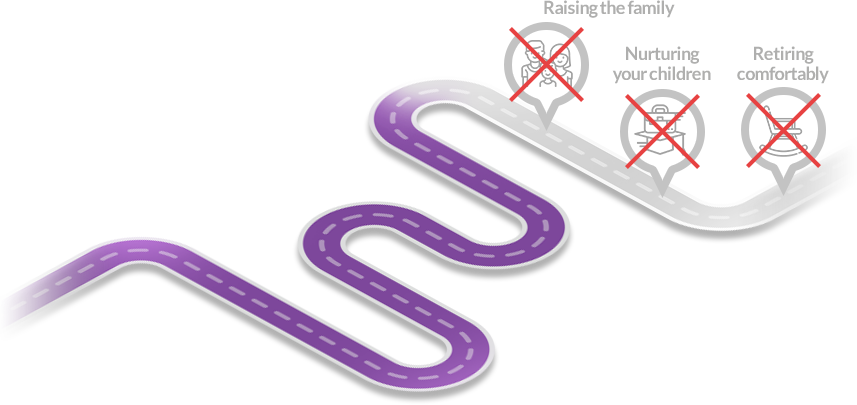

In life’s long winding journey, you work hard for the happiness of your family and loved ones,

now and in the future.

Everyone Longs for a Fulfilling Life...

Accidents Happen Every Day...

deaths

per day4

Were you to encounter an accident, who would look after the future of

your family and loved ones?

Mishaps are beyond our control, indeed.

- Hospital Authority Statistical Report, Department of Health, HKSAR government (2015)

- Hong Kong Police Force, HKSAR government (2018)

- Occupation Safety & Health, Labour Department, HKSAR government (2017)

- HealthyHK, Department of Health, HKSAR government (2017)

Have You Ever Thought About...

If misfortune befell you, not only would your family suffer the loss of their loved one, but also...

Loss of Income

Vanishing of your financial support

Unexpected Expenses

Substantial cash outlays on funeral arrangements

Financial Burden

Difficulties in repaying the mortgage, possibly losing their residence

Distressed Future

Budget disruption in children’s education and retirement support

Case Sharing: Ideal Protection

Andy is covered by

a life insurance plan

benefit of

HK$4 million.

Peter is not covered by

any life insurance plan

HK$100,000

in cash.

Even if accidents occur over the course of your life, life insurance helps fulfil your goal of protecting your family.

The Deepest Love Comes from the Most Caring Protection

A comprehensive protection plan can also provide...

Asset

Appreciation

Provides guaranteed cash value and constant returns

Wealth

Accumulation

A perfect saving tool for your future

How would you provide an ideal protection for the future of your loved ones?

Have You Prepared Sufficient Protection for Your Family’s Future?

If a tragedy were to happen, what they need would be...

Emergency Assistance

A one-off cash compensation to cover their urgent needsSupport for Daily Living

Financial coverage for the family to maintain their everyday needsYou should know...

It has been reported that, on average, each person needs HK$2,540,000 in life insurance protection.

If you have children to care for, that number might rise to HK$6,530,000.

However, most Hong Kong people have life protection of just HK$670, 000 on average.

Think about it – how long your protection for your family would last?

- Ming Po News on 28 Jan 2019

Do You Have Sufficient Coverage?

Fill in the following items to find out your ideal protection amount.

Ideal Life Protection Amount

No one can foresee the unknown, so start preparing to protect your family as early as possible!

- Including all expenses such as living costs, mortgage repayments and children’s tuition fees.

- Including the outstanding mortgage loans on your property, car loans, personal loans, savings earmarked for your children’s education fund and funeral expenses etc.

- Including life protection amount, cash, bank savings, stocks and bonds etc.

Case Sharing

Mr. Cheng

37 years old accountantMarried with a 10 year old sonMonthly salary: HK$75,000

Financial state:- About HK$1 million time deposit

- Mortgaged property with HK$3 million outstanding repayment

- Monthly family expenses of about HK40,000

- Mr. Cheng has a medical insurance plan but no life insurance plan.

- Mr. Cheng is the family’s sole financial support, while his wife is a full-time homemaker.

- A one-time cash compensation to his family if he passes away.

- An amount large enough to pay off the mortgage and yet still be used as an emergency fund.

Mr. Cheng could consider using Hong Kong Life’s life insurance plan to:

- Provide proper protection for his family.

- Grow his wealth steadily.

- This example is not intended to constitute a recommendation or advice. Please do not rely solely on this example to make application decision. Before applying insurance plan, you may also seek independent and professional advice.

Case Sharing

Details of Mr. Cheng's plan: Life insurance plan to protect his family’s future

- This example uses Perfect 10 Whole Life Protector plan for illustration.

- The policy is automatically terminated when it matures or is surrendered.

- The surrender value amounts to the guaranteed cash value plus non-guaranteed accumulated dividend and interest (if any) and non-guaranteed termination dividend (if any), after deducting policy loan (if any). The actual amount received may be higher or lower than the estimated amount

- This example is not intended to constitute a recommendation or advice. Please do not rely solely on this example to make application decision. Before applying insurance plan, you may also seek independent and professional advice.

Mortgage Repayment

In the event of the unfortunate death of Mr. Cheng during the protection period, the plan would pay out a death benefit of HK$6,000,000 to Mrs. Cheng, who could then use it to repay the outstanding HK$3,000,000 mortgage on their residence, giving the family peace of mind.

Coverage of Family Expenses

After the repayment of HK$3,000,000 mortgage loan, the remaining HK$3,000,000 could be used to maintain Mrs. Cheng and their son daily living expense, helping them ride out this difficult period.

Retirement Reserve

The plan not only provides life insurance, but also capital appreciation over the long term. When Mr. Cheng turns 65, it will pay out a surrender value of HK$3,647,718, which is 192% of total premiums paid. This sum can serve as part of Mr. Cheng’s retirement reserve.

Fixed Premium

The plan features a premium payment term of only 10 years, and a fixed premium payment that will not increase as Mr. Cheng ages. This will make it easier for Mr. Cheng to budget for everyday expenses.

Contact Us

Life insurance plan is a lifelong commitment to your loved ones.

Will your plans show them how much you care, even when you can no longer be with them?

Let our professional team do an analysis for your financial needs today.

![]() 2290-2882

2290-2882

- This promotional material contains general information for reference and is applicable within Hong Kong Special Administrative Region only. It is also governed by the laws of Hong Kong.

- The information provided is based on sources which Hong Kong Life believes to be reliable but has not been independently verified. Hong Kong Life makes no responsibilities nor accepts any warranty or guarantee for the accuracy, completeness and timeliness of the information or for any claims and/or losses caused thereby. Any examples given are for the purposes of illustration only.

- This promotional material is not intended to constitute a recommendation or advice to any prospective customer and is not intended as a substitute for professional advice. Please do not rely solely on this promotional material to make application decision. Before applying insurance plan, you may also seek independent and professional advice before making any decision.

- In case of any discrepancies between the Chinese and English version, the English version shall prevail.

Issued by Hong Kong Life Insurance Limited

Replay

Replay