Underwritten by: Hong Kong Life Insurance Limited

Appointed Licensed Insurance Agency: Chong Hing Bank Limited, CMB Wing Lung Bank Limited, OCBC Bank (Hong Kong) Limited and Shanghai Commercial Bank Limited

Supreme Medical Protection for Your Precious Health

Basic Information

| Type of the Certified Plan | Flexi Plan |

|---|---|

| Name of the Certified Plan | Health Supreme Medical Plan |

|

Certification Number |

F00039-01-000-02 (Health Supreme Medical Plan I) F00039-01-001-02 (Health Supreme Medical Plan I - Premier) F00039-02-000-02 (Health Supreme Medical Plan II) F00039-02-001-02 (Health Supreme Medical Plan II - Premier) F00039-03-000-02 (Health Supreme Medical Plan III) F00039-03-001-02 (Health Supreme Medical Plan III - Premier) |

| Provider Registration No. | 00037 (Registration Effective Date: 31 May 2019) |

The below information does not contain the full terms of the policy document. For full terms and conditions, please refer to the policy document.

With the soaring medical expense, if suddenly encounter an unexpected illness, do you and your family have adequate medical coverage?

If unfortunately your loved one is diagnosed from illness, can you afford to choose a better medical service in order to have a cozier environment for his/ her recovery?

Health Supreme Medical Plan (The "Plan") is a Certified Plan under the Hong Kong Government's Voluntary Health Insurance Scheme ("VHIS") and complies with the requirements of the scheme in product design. The premiums paid for the Plan is eligible for the tax deduction under the Inland Revenue Ordinance (Cap.112). Moreover, the Plan provides several choices of benefit classes which can fulfill your personal needs and offers you and your family a comprehensive medical insurance, renewal is guaranteed up to the Age of 100 years of the Insured Person.

Reimbursement for Lifelong Medical Protection and Flexible Choices of Different Benefit Classes

The Plan is a medical plan of reimbursement for incurred medical expenses. If during the period while the Plan is in force, the Insured Person, as a result of a Disability and upon the recommendation of a Registered Medical Practitioner for covered medical treatments, the Plan will reimburse the Reasonable and Customary1 Eligible Expenses2 to help you to relieve the sudden financial burden. Moreover, the Plan offers 3 different choices of benefit classes and supplementary major medical benefit, i.e. totally 6 benefit choices that you can flexibly choose the best option to suit your financial budget and medical needs.

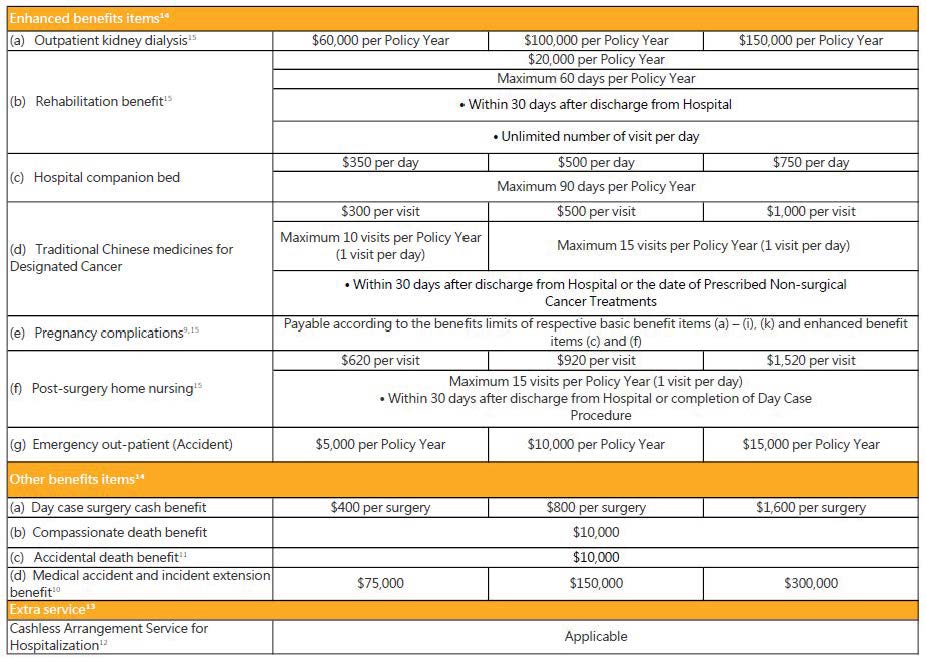

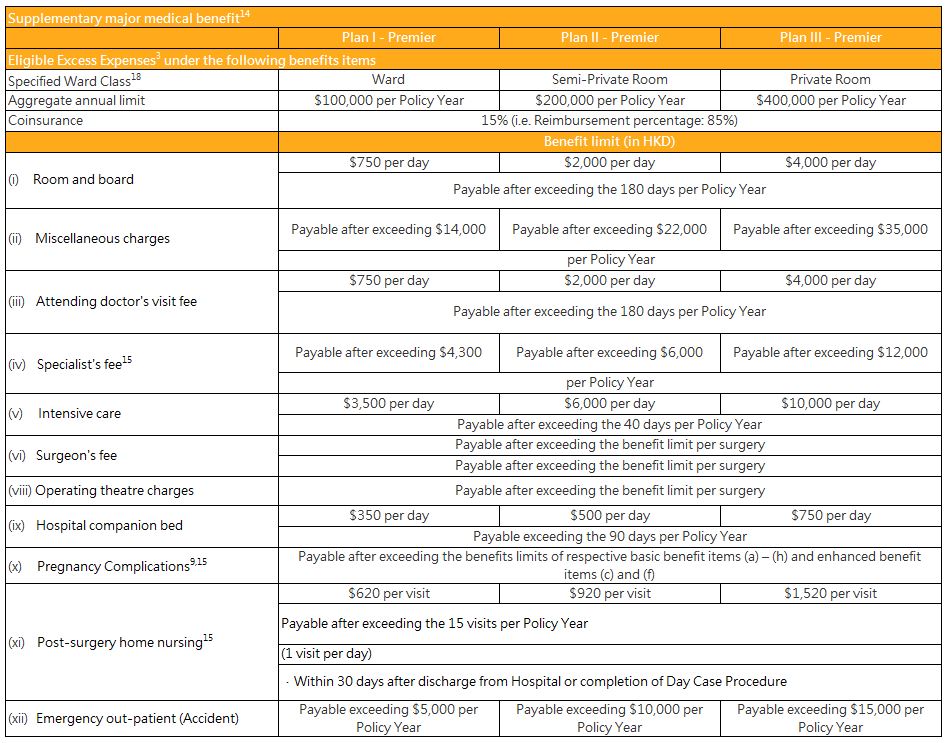

Supplementary Major Medical Benefit to Enhance Your Protection

You can opt for a supplementary major medical benefit to enjoy comprehensive protection. If the Eligible Expenses2 or other expenses are in excess of the respective benefit limits, the Policy Holder will receive 85% of the Eligible Excess Expenses3, subject to the Specified Ward Class and aggregate annual limit for supplementary major medical benefit.

Guaranteed Renewal for Peace of Mind

Regardless of the Insured Person's health conditions or claim records, the Policy Holder is guaranteed to renew4 the Plan every year up to the Age of 100 years of the Insured Person. Upon Renewal, even if the Insured Person's health conditions change, his / her premium rate or applicable additional rate of Premium Loading will not be adjusted and no Case-based Exclusion(s) will be imposed on the Insured Person, allowing you to enjoy total peace of mind.

Tax Deduction5

Policy Holder can apply for tax deduction on the premiums paid for the Plan for himself/ herself and his/ her dependants. The maximum annual tax deduction amount is HKD8,000 per Insured Person. There is no cap on the number of VHIS policies and dependants that are eligible for tax deduction.

No Lifetime Benefit Limit with Worldwide Coverage

All benefits described in the Plan do not have the lifetime benefit limit. Except for the psychiatric treatment, all benefits described in the Plan shall be applicable worldwide.

Up to 16% No Claim Discount for Staying Healthy

In order to reward for your health, a no claim discount will be offered to you. If no claim was incurred after 2 consecutive Policy Years, no claim discount equals to 10% of premium will be applied to reduce the premium upon the renewal. The no claim discount will be increased to 16% of premium if no claim was incurred after 5 consecutive Policy Years. The no claim discount will be reset to 0% in the next Policy Year once a claim is made and will restart to operate. Please refer to the following for the details of no claim discount:

| Claims Free Years | No claim discount |

|---|---|

| 2 consecutive Policy Years | 10% |

| 5 consecutive Policy Years | 16% |

Extended Coverage to Safeguard Your Health

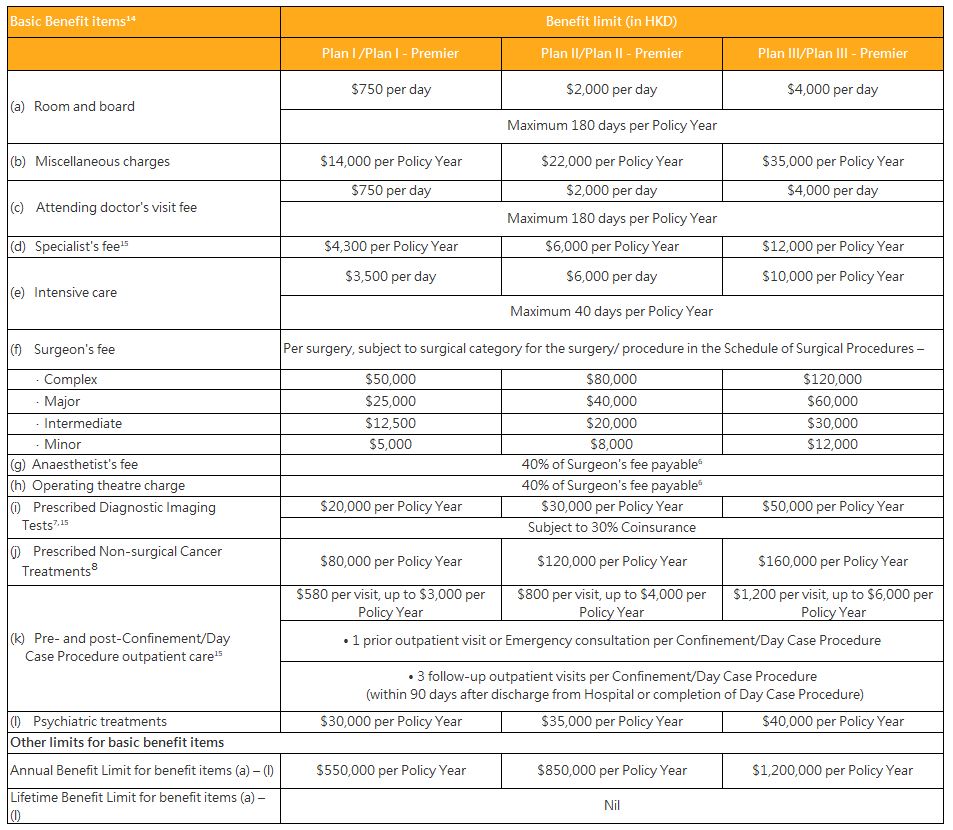

Apart from the coverage for major medical treatment such as room and board, miscellaneous charges, attending doctor's visit fee, Specialist's fee, intensive care and Surgeon's fee etc., the Plan also includes Anaesthetist's fee and operating theatre charges. Each benefit limit of the 2 items is up to 40% of Surgeon's fee6, which is relatively higher than most of the same type of plans.

Moreover, the Plan also includes Treatment of Congenital Condition(s), Day Case Procedures, Prescribed Diagnostic Imaging Test7, Prescribed Non-surgical Cancer Treatments8 and Psychiatric Treatments for a wider range of protection.

The Plan also covers Unknown Pre-existing Condition(s). The Eligible Expenses2 arising from Pre-existing Condition(s) that the Policy Holder and/or Insured Person was not aware and would not reasonably have been aware of at the time of application, shall be payable by the Plan subject to the following waiting period and reimbursement arrangement:

| Policy Year | Reimbursement Arrangement (% of reimbursement) |

|---|---|

| 1st Policy Year | No coverage |

| 2nd Policy Year | 25% |

| 3rd Policy Year | 50% |

| 4th Policy Year onwards | 100% |

Various Benefits to Best Protect Against Disability

We understand that you may want to build a more comprehensive safety net for safeguarding your health. Therefore, the Plan offers various benefits to provide with gracious care:

- Rehabilitation benefit

This benefit is payable for the Eligible Expenses2 charged by the Rehabilitation Centre for Stay in the Rehabilitation Centre and for rehabilitation treatment provided to the Insured Person during such Stay after discharge from the Hospital. - Traditional Chinese medicines for Designated Cancer

Notwithstanding of the General Exclusions of the Plan, this benefit is payable for the expenses charged by a Registered Chinese Medicine Practitioner for treatment provided to the Insured Person after discharge from Hospital or the date of Prescribed Non-surgical Cancer Treatments, provided that such traditional Chinese medicine treatment is directly related to and as a result of the condition arising from Designated Cancer (including any and all complications therefrom) necessitating such Confinement or Prescribed Non-surgical Cancer Treatments. - Pregnancy complications9

Notwithstanding of the General Exclusions of the Plan, this benefit is payable for the Eligible Expenses2 charged for the Insured Person's Confinement and Medically Necessary surgical procedure in a Hospital due to the covered pregnancy complications. - Day case surgery cash benefit

This benefit is payable for Day Case Procedure performed by a Registered Medical Practitioner or Surgeon on the Insured Person. - Medical accident and incident extension benefit10

This benefit is payable if the Insured Person unfortunately dies due to negligence of Registered Medical Practitioner during medical procedure or treatment in a Hospital.

Life Protection

If the Insured Person dies while the Plan is in force, a compassionate death benefit will be paid to the Policy Holder. Besides, if the death of the Insured Person is caused by Accident, the Policy Holder will be paid an additional accidental death benefit11.

Extra Service for Your Strongest Support

- Cashless Arrangement Service for Hospitalization12,13

If the Insured Person receives in-patient treatment in the private hospital in Hong Kong, by completing simple registration and approval procedures before hospitalization to ensure you understand and are fully informed of the terms and coverage, the eligible medical expenses incurred during the hospital stay will be settled on the behalf of you when discharge. This helps alleviate your burden to deal with medical expenses.

- "Reasonable and Customary" shall mean, in relation to a charge for Medical Service, such level which does not exceed the general range of charges being charged by the relevant service providers in the locality where the charge is incurred for similar treatment, services or supplies to individuals with similar conditions, e.g. of the same sex and similar Age, for a similar Disability, as reasonably determined by Hong Kong Life in utmost good faith. The Reasonable and Customary charges shall not in any event exceed the actual charges incurred. In determining whether a charge is Reasonable and Customary, Hong Kong Life shall make reference to the followings (if applicable) - (a) treatment or service fee statistics and surveys in the insurance or medical industry; [b] internal or industry claim statistics; [c] gazette published by the Government; and/or [d] other pertinent source of reference in the locality where the treatments, services or supplies are provided.

- "Eligible Expenses" shall mean expenses incurred for Medical Services rendered with respect to a Disability. "Medical Services" shall mean Medically Necessary services, including, as the context requires, Confinement, treatments, procedures, tests, examinations or other related services for the investigation or treatment of a Disability. For the definition of "Medically Necessary", please refer to the Terms and Conditions of the Plan.

- "Eligible Excess Expense" shall mean the specified portions of Eligible Expenses or other expenses as stated in supplement major medical benefit for Enhanced Benefits.

- The Policy Holder can renew the Policy every year up to the Age of 100 years of the Insured Person. Renewal premium is not guaranteed and Hong Kong Life reserves the right to adjust the Standard Premium according to the prevailing Standard Premium schedule adopted by Hong Kong Life on an overall Portfolio basis. For the avoidance of doubt, if the Premium Loading is set as a percentage of the Standard Premium [i.e. rate of Premium Loading], the amount of Premium Loading payable shall be automatically adjusted according to the change in Standard Premium.

- Whether tax deduction is allowable for the qualifying premiums paid under VHIS policy [not including levy] are subject to the Inland Revenue Ordinance and the circumstances of the Policy Holder [as taxpayer] and the Insured Person[s] [as specified dependent[s]]. Please refer to the website of the Inland Revenue Department ["IRD"] [www.ird.gov.hk] or contact the IRD directly for any tax related enquiries. You may also seek independent and professional advice from your tax and accounting advisors.

- The percentage here applies to the Surgeon's fee actually payable or the benefit limit for the Surgeon's fee according to the surgical categorisation, whichever is the lower.

- Tests covered here only include computed tomography ["CT" scan], magnetic resonance imaging ["MRI" scan], positron emission tomography ["PET" scan], PET-CT combined and PET-MRI combined.

- Treatments covered here only include radiotherapy, chemotherapy, targeted therapy, immunotherapy and hormonal therapy.

- The date of diagnosis of such covered pregnancy complications must be more than 12 consecutive months after the Policy Effective Date of the Plan. The covered pregnancy complications are only limited to ectopic pregnancy, molar pregnancy, disseminated intravascular coagulopathy, pre-eclampsia, miscarriage, threatened abortion, medically prescribed induced abortion, foetal death, postpartum hemorrhage requiring hysterectomy, eclampsia, amniotic fluid embolism, and pulmonary embolism of pregnancy.

- The medical accident and incident extension benefit [if applicable] is payable in addition to the compassionate death benefit.

- The accidental death benefit [if applicable] is payable in addition to the compassionate death benefit.

- The Cashless Arrangement Service for Hospitalization is an administrative arrangement for hospitalization expenses. The service is only applicable to private hospitals in Hong Kong and pre-approval should be obtained. However, success approval of Cashless Arrangement Service for Hospitalization is not an admission of claim eligibility by Hong Kong Life. The actual reimbursement entitlement is subject to the terms and conditions of the Policy, medical information finally received by Hong Kong Life and the eligible medical expenses incurred. Hong Kong Life reserves the rights to recover any shortfall from the Policy Holder in the event of any non-eligible expenses that are not covered under the Policy. For details of pre-approval procedure, please visit the company website of Hong Kong Life.

- Cashless Arrangement Service for Hospitalization is provided by third party service providers. Such service is not part of the product features. The availability of this service is not guaranteed. The details of the service will be provided along with the policy document or please refer to the company website of Hong Kong Life. Hong Kong Life reserves the right to cancel or amend the said service at its sole discretion. In addition, Hong Kong Life will not be responsible for any services or opinions provided by the third party service provider. Hong Kong Life reserves the right of final decision in case of any dispute.

- Unless otherwise specified, Eligible Expenses incurred in respect of the same item shall not be recoverable under more than one benefit item in the table above.

- Hong Kong Life shall have the right to ask for proof of recommendation e.g. written referral or testifying statement on the claim form by the attending doctor or Registered Medical Practitioner.

- "Coinsurance" shall mean a percentage of Eligible Expenses the Policy Holder must contribute after paying the Deductible [if any] in a Policy Year. For the avoidance of doubt, Coinsurance does not refer to any amount that the Policy Holder is required to pay if the actual expenses exceed the benefit limits under the Terms and Benefits of the Plan.

- Emergency out-patient [Accident] shall be payable for the Eligible Expenses charged by a Hospital for Emergency Treatment of an Injury in the outpatient unit or emergency treatment room of the Hospital which is provided to the Insured Person within 24 hours of an Accident causing the Insured Person such Injury.

- Hospitals offer various accommodation options with different facilities, and the categorisation used by the Hospitals may be different from the definition as stated on Terms and Benefits of the policy as follows: Under Specified Ward Class, Ward shall mean a room with more than two patient beds in a Hospital; Semi-Private Room shall mean a single-bedded or two-bedded room, or a room with maximum double occupancy with a shared bath/shower room; Private Room shall mean a standard single occupancy room with adjoining bathroom, but excluding any room of upper class with its own kitchen, dining or sitting room(s) or otherwise. If Policy Holder / Insured Person is unsure of whether a particular accommodation option meets the above definitions, please contact Hong Kong Life before confinement.

| Premium Payment Term | 1 Year [Renewable up to the Age of 100 years of the Insured Person] |

|---|---|

| Issue Age* | 0 to 80 years |

| Policy Currency | HKD |

| Benefit Term | 1 Year [Renewable up to the Age of 100 years of the Insured Person] |

| Geographical Area of Cover | Worldwide [except for psychiatric treatments] |

| Covered ward class | No restriction [except for supplementary major medical benefit] |

| Premium Payment Mode | Annual/ Semi-annual/ Quarterly/ Monthly |

Room Class Adjustment of Supplementary Major Medical Benefit

In any case if the Insured Person is Confined in Hospital in a room of class higher than Specified Ward Class as specified in the Benefit Schedule and Policy Schedule voluntarily, on any days of a Confinement, any Eligible Excess Expenses incurred during such days of Confinement shall be reduced by multiplying an appropriate adjustment factor ["Room Class Adjustment" as stated below].

| Room Class Adjustment | Specified Ward Class corresponding to chosen plan level as stated in the Benefit Schedule and Policy Schedule of the Plan | |||

|---|---|---|---|---|

| Ward | Semi-Private Room | Private Room | ||

| Ward class on the day of the Confinement | Ward | N/A | N/A | N/A |

| Semi-Private Room | 50% | N/A | N/A | |

| Private Room | 25% | 50% | N/A | |

| Any room with amenities upgraded beyond a Private Room | 25% | 25% | 50% | |

However, Room Class Adjustment shall not be applied under the following circumstances:

[i] unavailability of accommodation at the Specified Ward Class due to ward or room shortage for Emergency Treatment;

[ii] isolation reasons that require a specific class of accommodation; or

[iii] other reasons not involving personal preference of the Policy Holder and/or the Insured Person.

This benefit shall be payable according to the following formula, subject to the aggregate annual limit for supplementary major medical benefit as stated in the Benefit Schedule:

| [ | Eligible Excess Expenses | x | [1 - Coinsurance for supplementary major medical benefit] | x |

Room Class Adjustment [if applicable] |

] |

Under the Terms and Benefits of the Plan, Hong Kong Life shall not pay any benefits in relation to or arising from the following expenses-

- Expenses incurred for treatments, procedures, medications, tests or services which are not Medically Necessary.

- Expenses incurred for the whole or part of the Confinement solely for the purpose of diagnostic procedures or allied health services, including but not limited to physiotherapy, occupational therapy and speech therapy, unless such procedure or service is recommended by a Registered Medical Practitioner for Medically Necessary investigation or treatment of a Disability which cannot be effectively performed in a setting for providing Medical Services to a Day Patient.

- Expenses arising from Human Immunodeficiency Virus ("HIV") and its related Disability, which is contracted or occurs before the Policy Effective Date. Irrespective of whether it is known or unknown to the Policy Holder or Insured Person at the time of submission of Application, including any updates of and changes to such requisite information [if so requested by Hong Kong Life under Section 8 of Part 1 at the Terms and Conditions of the Plan] such Disability shall be generally excluded from any coverage of the Terms and Benefits of the Plan if it exists before the Policy Effective Date. If evidence of proof as to the time at which such Disability is first contracted or occurs is not available, manifestation of such Disability within the first five [5] years after the Policy Effective Date shall be presumed to be contracted or occur before the Policy Effective Date, while manifestation after such five [5] years shall be presumed to be contracted or occur after the Policy Effective Date.

However, the exclusion under this Section 3 shall not apply where HIV and its related Disability is caused by sexual assault, medical assistance, organ transplant, blood transfusions or blood donation, or infection at birth, and in such cases the other terms of the Terms and Benefits of the Plan shall apply.

- Expenses incurred for Medical Services as a result of Disability arising from or consequential upon the dependence, overdose or influence of drugs, alcohol, narcotics or similar drugs or agents, self-inflicted injuries or attempted suicide, illegal activity, or venereal and sexually transmitted disease or its sequelae [except for HIV and its related Disability, where this Section 3 of General Exclusions applies].

-

Any charges in respect of services for –

[a]

beautification or cosmetic purposes, unless necessitated by Injury caused by an Accident and the Insured Person receives the Medical Services within ninety [90] days of the Accident; or

[b]

correcting visual acuity or refractive errors that can be corrected by fitting of spectacles or contact lens, including but not limited to eye refractive therapy, LASIK and any related tests, procedures and services.

- Expenses incurred for prophylactic treatment or preventive care, including but not limited to general check-ups, routine tests, screening procedures for asymptomatic conditions, screening or surveillance procedures based on the health history of the Insured Person and/or his family members, Hair Mineral Analysis [HMA], immunisation or health supplements. For the avoidance of doubt, this Section 6 does not apply to –

[a]

treatments, monitoring, investigation or procedures with the purpose of avoiding complications arising from any other Medical Services provided;

[b]

removal of pre-malignant conditions; and

[c]

treatment for prevention of recurrence or complication of a previous Disability.

- Expenses incurred for dental treatment and oral and maxillofacial procedures performed by a dentist except for Emergency Treatment and surgery during Confinement arising from an Accident. Follow-up dental treatment or oral surgery after discharge from Hospital shall not be covered.

- Expenses incurred for Medical Services and counselling services relating to maternity conditions and its complications, including but not limited to diagnostic tests for pregnancy or resulting childbirth, abortion or miscarriage; birth control or reversal of birth control; sterilisation or sex reassignment of either sex; infertility including in-vitro fertilisation or any other artificial method of inducing pregnancy; or sexual dysfunction including but not limited to impotence, erectile dysfunction or premature ejaculation, regardless of cause.

- Expenses incurred for the purchase of durable medical equipment or appliances including but not limited to wheelchairs, beds and furniture, airway pressure machines and masks, portable oxygen and oxygen therapy devices, dialysis machines, exercise equipment, spectacles, hearing aids, special braces, walking aids, over-the-counter drugs, air purifiers or conditioners and heat appliances for home use. For the avoidance of doubt, this exclusion shall not apply to rental of medical equipment or appliances during Confinement or on the day of the Day Case Procedure.

- Expenses incurred for traditional Chinese medicine treatment, including but not limited to herbal treatment, bone-setting, acupuncture, acupressure and tui na, and other forms of alternative treatment including but not limited to hypnotism, qigong, massage therapy, aromatherapy, naturopathy, hydropathy, homeotherapy and other similar treatments.

- Expenses incurred for experimental or unproven medical technology or procedure in accordance with the common standard, or not approved by the recognised authority, in the locality where the treatment, procedure, test or service is received.

- Expenses incurred for Medical Services provided as a result of Congenital Condition[s] which have manifested or been diagnosed before the Insured Person attained the Age of eight [8] years.

- Eligible Expenses which have been reimbursed under any law, or medical program or insurance policy provided by any government, company or other third party.

- Expenses incurred for treatment for Disability arising from war [declared or undeclared], civil war, invasion, acts of foreign enemies, hostilities, rebellion, revolution, insurrection, or military or usurped power.

The above General Exclusions is for reference only. For details and full exclusions, please refer to the Terms and Conditions of the Plan.

-

Basic Plan

Tax deduction under the VHIS

The issuance of this plan does not necessarily mean you are eligible for any tax deduction for the premiums you have paid for this plan. Please refer to the website of the Inland Revenue Department ["IRD"] or contact the IRD directly for any tax related enquiries. You may also seek independent and professional advice from your tax and accounting advisors.

Product Features Revision

Hong Kong Life reserves the right to revise the Terms and Benefits upon renewal by giving a 30 days advance notice to the Policy Holder. As long as Hong Kong Life maintains the registration as a VHIS provider, Hong Kong Life guarantees the Terms and Benefits will not be less favourable than the latest version of the Standard Plan Terms and Benefits published by the Government at the time of renewal.

Exchange Rate Risk

You are subject to exchange rate risks for the Policy denominated in currencies other than the local currency. Exchange rates fluctuate from time to time. You may suffer a loss of your benefit values and the subsequent premium payments [if any] may be higher than your initial premium payment as a result of exchange rate fluctuations.

Cooling-off Period

If you are not satisfied with your Policy, you have a right to cancel it within the cooling-off period and obtain a refund of any premium[s] and levy[ies] paid [in the original payment currency] to Hong Kong Life without any interest. A written notice signed by you should be received directly by Hong Kong Life Insurance Limited at 15/F Cosco Tower, 183 Queen's Road Central, Hong Kong within the cooling-off period [that is, the period of 21 calendar days immediately following either the day of delivery of the Policy or the Cooling-off Notice to you or your nominated representative [whichever is the earlier]]. After the expiration of the cooling-off period, if you cancel the Policy before the end of the term, the projected Total Surrender Value [if applicable] may be less than the Total Premiums Paid.

Cancellation

After the cooling-off period, the Policy Holder can request cancellation of the Terms and Benefits of the Plan by giving thirty [30] days prior written notice to Hong Kong Life, provided that there has been no benefit payment under the Terms and Benefits of the Plan during the relevant Policy Year.

The cancellation right under this Section shall also apply after the Terms and Benefits of the Plan have been Renewed upon expiry of its first [or subsequent] Policy Year.

Premium Adjustment

Hong Kong Life has the right to review and adjust the Plan's premium rates for particular risk classes upon renewal, but not for any individual customer. Hong Kong Life may adjust premium rates because of several factors, such as Hong Kong Life's claims and persistency experience, expenses directly related to and indirect expenses allocated to the Plan, medical price inflation, projected future medical costs and any applicable changes in benefit.

Credit Risk of Issuer

The life insurance product is issued and underwritten by Hong Kong Life. The premium to be paid by you would become part of the assets of Hong Kong Life and that you and your Policy are subject to the credit risk of Hong Kong Life. In the worst case, you may lose all the premium paid and benefit amount.

Inflation Risk

When reviewing the values shown in the Insurance Proposal, please note that future medical costs/ the cost of living in the future is likely to be higher than it is today due to inflation.

Misrepresentation or Fraud

Hong Kong Life has the right to declare the Policy void as from the Policy Effective Date and notify the Policy Holder that no cover shall be provided for the Insured Person in case of any of the following events –

[a]

any material fact relating to the health related information of the Insured Person which may impact the risk assessment by Hong Kong Life is incorrectly stated in, or omitted from, the Application or any statement or declaration made for or by the Insured Person in the Application or in any subsequent information or document submitted to Hong Kong Life for the purpose of the application, including any updates of and changes to such requisite information [if so requested by Hong Kong Life]. The circumstances that a fact shall be considered "material" include, but not limited to, the situation where the disclosure of such fact as required by Hong Kong Life would have affected the underwriting decision of Hong Kong Life, such that Hong Kong Life would have imposed Premium Loading, included Case-based Exclusion[s], or rejected the application. For the avoidance of doubt, this paragraph [a] shall not apply to non-health related information of the Insured Person, which shall be governed by the Terms and Conditions of the Plan; or

[b]

any Application or claim submitted is fraudulent or where a fraudulent representation is made.

The burden of proving [a] and [b] shall rest with Hong Kong Life. Hong Kong Life shall have the duty to make all necessary inquiries on all facts which are material to Hong Kong Life for underwriting purpose as provided in the Terms and Conditions of the Plan.

In the event of [a], Hong Kong Life shall have -

[i]

the right to demand refund of the benefits previously paid; and

[ii]

the obligation to refund the premium received,

in each case for the current Policy Year and the previous Policy Years in which the Policy was in force, subject to a reasonable administration charge payable to Hong Kong Life.

In the event of [b], Hong Kong Life shall have –

[iii]

the right to demand refund of the benefits previously paid; and

[iv]

the right not to refund the premium received.

For details, please refer to the Terms and Conditions of the Plan.

Termination of Policy

The Policy shall be automatically terminated on the earliest of the followings –

[a]

where the Policy is terminated due to non-payment of premiums after the grace period as specified in the Terms and Conditions of the Plan;

[b]

the day immediately following the death of the Insured Person; or

[c]

Hong Kong Life has ceased to have the requisite authorisation under the Insurance Ordinance to write or continue to write the Policy;

Immediately following the termination of the Policy, insurance coverage under the Policy shall cease to be in force. No premium paid for the current Policy Year and previous Policy Years shall be refunded, unless specified otherwise.

The Policy shall also be terminated if the Policy Holder decides to cancel the Policy or not to renew the Policy in accordance with the Terms and Conditions of the Plan, as the case may be, by giving the requisite written notice to Hong Kong Life.

For details, please refer to the Terms and Conditions of the Plan.

Insurance Costs

Part of the premium pays for the insurance and related costs (if any).

Dispute Resolution

If any dispute, controversy or disagreement arises out of the Policy, including matters relating to the validity, invalidity, breach or termination of the Policy, Hong Kong Life and Policy Holder shall use their endeavours to resolve it amicably, failing which, the matter may [but is not obliged to] be referred to any form of alternative dispute resolution, including but not limited to mediation or arbitration, as may be agreed between Hong Kong Life and the Policy Holder, before it is referred to a Hong Kong court.

Each party shall bear its own costs of using services under alternative dispute resolution.

Dispute on Selling Process and Product

Chong Hing Bank Limited, CMB Wing Lung Bank Limited, OCBC Bank (Hong Kong) Limited and Shanghai Commercial Bank Limited [collectively "Appointed Licensed Insurance Agencies" and each individually "Appointed Licensed Insurance Agency"] are the Appointed Licensed Insurance Agencies of Hong Kong Life, and the life insurance product is a product of Hong Kong Life but not the Appointed Licensed Insurance Agencies. In respect of an eligible dispute [as defined in the Terms of Reference for the Financial Dispute Resolution Centre in relation to the Financial Dispute Resolution Scheme] arising between the Appointed Licensed Insurance Agency and the customer out of the selling process or processing of the related transaction, Appointed Licensed Insurance Agency is required to enter into a Financial Dispute Resolution Scheme process with the customer; however any dispute over the contractual terms of the life insurance product should be resolved between Hong Kong Life and the customer directly.

- What is underwriting?

This is the process by which an insurance company determines whether it can accept an application for insurance, and if so, on what basis so that the proper premium is charged. - How do insurance companies assess risk?

The risk factors to be considered during the underwriting process are grouped into three major buckets: your health history and current condition, your lifestyle [such as occupation, place[s] of residency*, smoke and drink habits, etc.] and your family history [such as any genetic disease etc.]. - What kind of the underwriting decision will be offered after review the medical application?

According to the risk factors, the medical insurance application will be accepted either with standard premium, offer with premium loading and/or offer with case-based exclusion, postponed or declined. - Under what circumstances will the insurance company re-underwrite the policy?

Insurance company has the right to re-underwrite the policy at the time of renewal of policy if the policyholder/insured person[s] requests to:

[a] Switch to another insurance plan which provides upgrade or addition of benefits;

[b] Remove the case-based exclusion[s] or reduce premium loading which was/were previously applied;

[c] Change the Place[s] of Residence*

[d] Change the occupation. - What is material fact[s] and how it impacts the underwriting decision?

A "material" fact is one which would influence underwriting decision on accepting the risks, and the terms and conditions that should apply [such as premium loading and/or case-based exclusion etc.]. If a customer fails to disclose [or misrepresents] a material fact and this induces the insurer to accept the proposed risk, the legal remedy is to "avoid" the policy. This means the insurer is entitled to treat the policy as though it never existed. Unless fraud is involved, the insurer will normally return the premium and will not pay out on any claim made under the policy. - What is eligibility of policy holder?

Policy Holder should be age 18 or above, and Insured Person should be the Policy Holder or Policy Holder's spouse or child#. We only accept one Policy Holder per policy.

* Place[s] of Residence shall mean the jurisdiction[s] in which a person legally has the right of abode. A change in the Place[s] of Residence refers to the situation where a person has been granted the right of abode of additional jurisdiction[s], or has ceased to have the right of abode of existing jurisdiction[s]. For the avoidance of doubt, a jurisdiction in which a person legally has the right or permission of access only but without the right of abode, such as for the purpose of study, work or vacation, shall not be treated as a Place of Residence.

# Child should be age 17 or below or full time student of age 18 to 25.

The above information is for reference and is applicable within Hong Kong only. The above information does not contain the full terms of the policy document. For full terms and conditions, please refer to the policy document. If there is any conflict between the above information and the policy document, the latter shall prevail. The copy of the policy document is available upon request. Before applying for the insurance plan, you may refer to the contents and terms of the policy document. You may also seek independent and professional advice before making any decision.