Wealth Up (Premier) Savings Insurance Plan - Client Incentive

Appointed Licensed Insurance Agencies: Chong Hing Bank Limited, OCBC Bank (Hong Kong) Limited and Shanghai Commercial Bank Limited

"Set Sailing Rewards 2026" CLIENT INCENTIVE - Wealth Up (Premier) Savings Insurance Plan CLIENT INCENTIVE DETAILS

First Year Premium Discount and Premium Prepayment Discount for Eligible Life Insurance Plan

Promotion Period: From now till 31 March 2026 (Both Dates Inclusive)

First Year Premium Discount

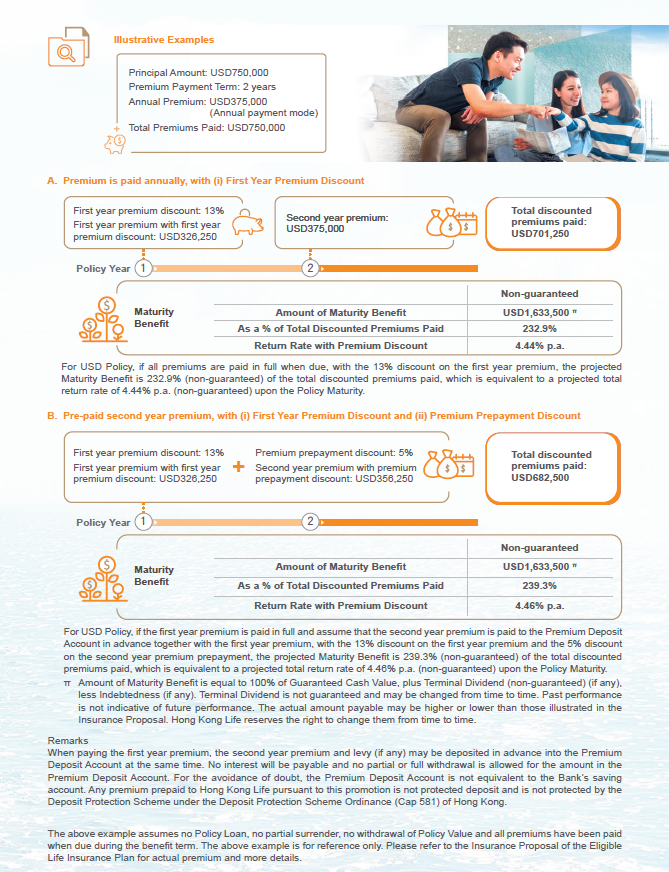

With successful applications submitted within the Promotion Period2 for the Eligible Life Insurance Plan of Hong Kong Life Insurance Limited ("Hong Kong Life") as specified below, subject to the premium requirement and other conditions of the Incentive, clients may enjoy the First Year Premium Discount of Basic Plan11 as specified below.

| Incentive Table (I) | ||||

|---|---|---|---|---|

| Eligible Life Insurance Plan | First Year Premium12 |

First Year Premium Discount of Basic Plan11 | ||

| HKD | USD | RMB | ||

|

100,000 – 249,999 | 12,500 – 31,249 | 90,000 – 224,999 | 7% |

| 250,000 – 1,499,999 | 31,250 – 187,499 | 225,000 – 1,349,999 | 9% | |

| 1,500,000 – 2,999,999 | 187,500 – 374,999 | 1,350,000 – 2,699,999 | 11% | |

| 3,000,000 or above | 375,000 or above | 2,700,000 or above | 13% | |

Premium Prepayment Discount

In addition to the First Year Premium Discount abovementioned, clients will be entitled to the corresponding Premium Prepayment Discount of Basic Plan as specified below in the second policy year, given that the first year premium and the second year premium have been paid in full at the time of application of the Wealth Up (Premier) Savings Insurance Plan, and the policy being successfully issued.

| Incentive Table (II) | |||

|---|---|---|---|

| Eligible Life Insurance Plan | Policy Currency | Premium Prepayment Discount of Basic Plan in Second Policy Year | |

|

HKD/RMB | 4% | |

| USD | 5% | ||

Please refer to relevant product page of the respective insurance plan for the Appointed Licensed Insurance Agency. Please refer to the policy document for the full terms and conditions of the Eligible Life Insurance Plan(s), and the product leaflet of Hong Kong Life's life insurance plans for product information and risk disclosure. Before applying for any life insurance plan, clients should carefully read and understand the contents and terms of the policy document. Clients should also seek independent and professional advice before making any decision.

Terms and Conditions of "Set Sailing Rewards 2026" Client Incentive (Extract and applicable to Wealth Up (Premier) Savings Insurance Plan Client Incentive)

General Terms and Conditions:

- The "Set Sailing Rewards 2026" Client Incentive, provided by Hong Kong Life Insurance Limited ("Hong Kong Life"), consists of Wealth Up (Premier) Savings Insurance Plan Client Incentive "Incentive"). The promotion period of the Incentive is from 2 January 2026 to 31 March 2026 (both dates inclusive)(the "Promotion Period").

- To be eligible for the Incentive, the application signing date and submission date of the application for any of the Eligible Life Insurance Plans must fall within the Promotion Period.

- Unless otherwise stated, the Incentive is applicable to all clients.

- Unless otherwise stated, policies entitled to the Incentive cannot be enjoyed in conjunction with any other incentive(s) offered by Hong Kong Life.

- Hong Kong Life reserves the right to change or terminate the Incentive and amend any terms and conditions of the Incentive at any time without giving prior notice to clients or reason therefor. For the avoidance of doubt, the Incentive applicable to the eligible policy issued prior to such variation, suspension or termination of the Incentive will not be affected.

- Clients should refer to the Product Section of Hong Kong Life website, the policy, proposal, product leaflet and any other relevant documents of Hong Kong Life's life insurance plans for relevant product information, contents, terms and conditions. This promotion describes the details of the Incentive only; it does not cover any coverage, exclusions, risk disclosure, contents, terms and conditions of the Eligible Life Insurance Plan(s). Clients should read, fully understand and accept the coverage, exclusions, risk disclosure, contents, terms and conditions of the policies and proposals before applying for any Eligible Life Insurance Plan(s) inclusive of the Incentive.

- The Incentive and its relevant terms and conditions are applicable within the Hong Kong Special Administrative Region ("Hong Kong") only and governed by the laws of Hong Kong.

- If there is any discrepancy or inconsistency between the English version and the Chinese version of this promotion, the English version shall prevail.

- Hong Kong Life reserves the right of final decision in case of any dispute.

Specific Terms and Conditions of First Year Premium Discount: - Subject to the General Terms and Conditions and the Specific Terms and Conditions herein, clients who fulfill all of the following requirements will be entitled to the corresponding First Year Premium Discount of Basic Plan ("First Year Premium Discount") as shown in the Incentive Table (I): (i) with successful applications submitted within the Promotion Period for any specified Eligible Life Insurance Plans; (ii) the First Year Premium of basic plan being not less than the respective amounts as set out in the Incentive Table (I) (as the case maybe); and (iii) the policy being successfully issued.

- The First Year Premium Discount does not apply to any riders.

- First Year Premium of basic plan is counted per policy.

- If the First Year Premium is not an integer, such figure will be rounded off to the nearest integer for the purpose of calculating the amount of First Year Premium Discount that clients can enjoy.

- The amount of the First Year Premium Discount will be calculated in the currency under which the Eligible Life Insurance Plan is denominated.

- Clients can pay the net premium (i.e. the premium after deducting the premium discount amount) when they submit the applications for the Eligible Life Insurance Plan.

- In case of any changes made by clients in the first policy year, which results in the requirements for the First Year Premium Discount not being fulfilled, Hong Kong Life reserves the right to disqualify such client's entitlement to the First Year Premium Discount and such client agrees to reimburse Hong Kong Life for the amount of the First Year Premium Discount already granted to such client upon request.

- The First Year Premium Discount is not applicable to policies withdrawn during the cooling-off period. In such case, clients would receive a refund of the premium(s) (not including the premium discount amount) and levy(ies) paid (both in the original payment currency) to Hong Kong Life, without any interest.

- The First Year Premium Discount is non-transferable and cannot be redeemed for cash and is not applicable to the premium on renewal of existing policy.

Specific Terms and Conditions of Premium Prepayment Discount: - Subject to the General Terms and Conditions and these Specific Terms and Conditions herein, clients who fulfill all of the following requirements will be entitled to the corresponding Premium Prepayment Discount of Basic Plan ("Premium Prepayment Discount") as shown in the Incentive Table (II) in the second policy year: (i) the application of the Eligible Life Insurance Plan is submitted successfully during the Promotion Period; (ii) the first year premium and the second year premium of the Eligible Life Insurance Plan being paid in full at the time of application; and (iii) the policy being successfully issued.

- The second year premium must be paid together with the initial premium and levy (if any).

- In case of any changes made by clients in any policy year, which results in the requirements for the Premium Prepayment Discount not being fulfilled, Hong Kong Life reserves the right to disqualify such client's entitlement to the Premium Prepayment Discount and such client agrees to reimburse Hong Kong Life for the amount of the Premium Prepayment Discount already granted to such client upon request.

- To be eligible for the Premium Prepayment Discount, when paying the first year premium, the second year premium and levy (if any) must be deposited into the Premium Deposit Account ("PDA") at the same time. No interest will be payable and no partial or full withdrawal is allowed for the amount in the PDA. If there are any changes on the amount of the levy which is collected by the Insurance Authority due to any legal or regulatory changes or any other reasons, Hong Kong Life will refund the excess amount of the prepaid levy or recover any outstanding amount from the policyowner as the case maybe.

- The prepaid premium is subject to the PDA Operation Rules. Please refer to the Operation Rules stipulated in the PDA Application Form for further details.

- For the avoidance of doubt, the PDA is not equivalent to the Bank's saving account. Any premium prepaid to Hong Kong Life pursuant to this promotion is not protected deposit and is not protected by the Deposit Protection Scheme under the Deposit Protection Scheme Ordinance (Cap 581) of Hong Kong.

Exchange Rate Risk

You are subject to exchange rate risks for the Policy denominated in currencies other than the local currency. Exchange rates fluctuate from time to time. You may suffer a loss of your benefit values and the subsequent premium payments (if any) may be higher than your initial premium payment as a result of exchange rate fluctuations.

Currency Risk (Applicable to RMB Policy only)

RMB is currently not freely convertible and conversion of RMB through banks in Hong Kong is subject to the rules, guidelines, regulations and conditions from the banks and/or Relevant Authorities from time to time. The actual conversion arrangement will depend on the restrictions prevailing at the relevant time. As RMB is currently not freely convertible and is subject to exchange controls by the Chinese government, RMB currency conversion is subject to availability and Hong Kong Life may not have sufficient RMB at the relevant time.

Liquidity Risk / Long Term Commitment

The Eligible Life Insurance Plan is designed to be held until the Maturity / Expiry Date. If you partially surrender or terminate the Policy prior to the Maturity / Expiry Date, a loss of the premium paid may be resulted. The premium of the Eligible Life Insurance Plan should be paid in full for the whole payment term. If you discontinue the payment, the Policy may lapse and a loss of the premium paid may be resulted.

Credit Risk of Issuer

The Eligible Life Insurance Plan is issued and underwritten by Hong Kong Life. The premium to be paid by you would become part of the assets of Hong Kong Life and that you and your Policy are subject to the credit risk of Hong Kong Life. In the worst case, you may lose all the premium paid and benefit amount.

Market Risk

The amount of dividends (if any) of the Eligible Life Insurance Plan depends principally on the factors including investment returns, claim payments, policy persistency rates, operation expenses and tax; while the annual interest accumulation rate principally depends on the factors including investment performance and market conditions. Hence the amount of dividends (if any) and annual interest accumulation rate are not guaranteed and may be changed over time. The actual dividends payable and annual interest accumulation rate may be higher or lower than the expected amount and value at the time when the Policy was issued.

Investment returns include investment income and changes in asset value of the underlying investment. Performance of the investment return is affected by interest earnings and other market risk factors including, but not limited to, interest rate or credit spread movements, credit events, price fluctuations in invested assets, and foreign exchange fluctuations.

Inflation Risk

When reviewing the values shown in the Insurance Proposal, please note that the cost of living in the future is likely to be higher than it is today due to inflation.

Non-Protected Deposit

The Eligible Life Insurance Plan is not equivalent to, nor should it be treated as a substitute for, time deposit. The Eligible Life Insurance Plan is not a protected deposit and is not protected by the Deposit Protection Scheme in Hong Kong.

Dispute on Selling Process and Product

Chong Hing Bank Limited, OCBC Bank (Hong Kong) Limited and Shanghai Commercial Bank Limited (collectively "Appointed Licensed Insurance Agencies" and each individually "Appointed Licensed Insurance Agency") are the Appointed Licensed Insurance Agency of Hong Kong Life, and the life insurance product is a product of Hong Kong Life but not the Appointed Licensed Insurance Agency. In respect of an eligible dispute (as defined in the Terms of Reference for the Financial Dispute Resolution Centre in relation to the Financial Dispute Resolution Scheme) arising between the Appointed Licensed Insurance Agency and the customer out of the selling process or processing of the related transaction, Appointed Licensed Insurance Agency is required to enter into a Financial Dispute Resolution Scheme process with the customer; however any dispute over the contractual terms of the life insurance product should be resolved between Hong Kong Life and the customer directly.

For enquiry about the Incentive, please call our Customer Services Hotline at 2290 2882.