The wealth that you have attained is...

Your precious wealth need to be treasured

It's something to pass on to your family, to ensure they live comfortably when one day you're no longer with them.

The wealth that you have attained is...

It's something to pass on to your family, to ensure they live comfortably when one day you're no longer with them.

If misfortune struck, your heartbroken family could face:

Abrupt loss of support for your family

Succession arrangements not according to your wishes

Rifts caused as family members fight over inheritances

Lengthy and costly lawsuits drain away your legacy

You can make a will through a legal firm, stating how your legacy is to be allocated. Your instructions will be carried out by the executor.

Assign a trustee (e.g. a bank) to manage your legacy and allocate to your beneficiaries according to your instructions

Designated beneficiaries and allocation percentages according to your wishes.

Clear policy terms minimize the possibility of lawsuits due to allocation.

Always in control of assets.

With a life insurance plan, your asset value and wealth grows over time.

When you pass away,

would you rather your family...Live without

financial worries?

Or have nothing to

fall back on?

Would you like

your hard-earned legacy to...Become a blessing for

your family?

Or the root cause of

arguments?

50 years oldOwner of an interior design firm

Married with a daughter and a son

(both working)Monthly salary: HK$180,000

Expected retirement age: 65

Details of Mr. Chan's plan: Wealth succession via life insurance plan

approx.

approx.*All currency in Hong Kong Dollar

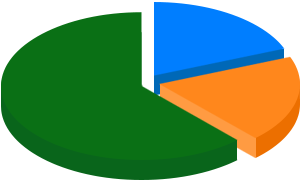

His wish to allocate his wealth

His wish to allocate his wealthThe Plan not only provides Guaranteed Cash Value, Annual Dividend (non-guaranteed) may also be distributed annually in terms of cash starting from the 1st Policy Anniversary. In addition, Terminal Dividend (non-guaranteed) may be payable at or after the end of 3rd Policy Year when the Policy is fully surrendered by the Policyowner or upon the death of the Life Insured, whichever is earlier.

The plan offers a life insurance protection amount of US$800K (HK$6.22 million) to give peace of mind to Mr. Chan's family.

To pass on your wealth and take good care of your loved ones, plan early and let our professional team do an analysis for your financial needs today.

![]() 2290-2882

2290-2882

Issued by Hong Kong Life Insurance Limited